Embark on a Journey of Informed Trading and Precise Execution

In the fast-paced world of finance, options trading presents an avenue for seasoned investors and novices alike to navigate market volatility and capitalize on potential profit opportunities. While the intricacies of options trading may seem daunting at first, harnessing the power of a dedicated Excel spreadsheet can transform this complex endeavor into an accessible and empowering pursuit.

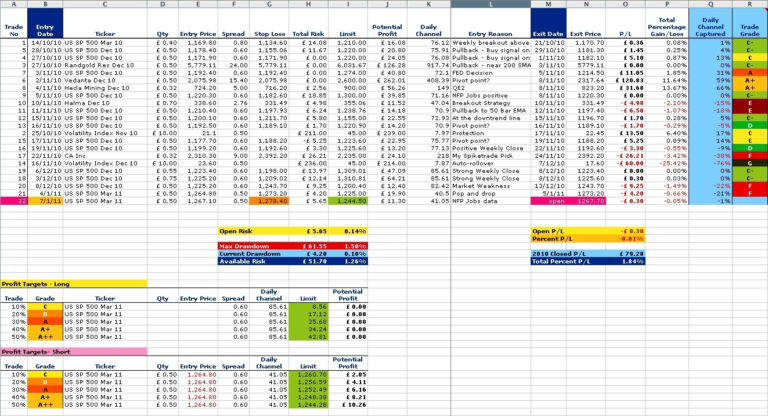

Image: db-excel.com

Options Trading Deconstructed: Unraveling the Basics

Options trading, in essence, revolves around the concept of contracts that grant the buyer the right, not the obligation, to buy or sell an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). These contracts empower investors with the flexibility to speculate on future price movements of underlying securities, ranging from stocks and indices to commodities and currencies.

Unlike traditional stock trading, options trading doesn’t involve ownership of the underlying asset. Instead, options contracts serve as a separate financial instrument, offering investors a multitude of trading strategies to pursue their investment goals.

Excel Spreadsheet: Your Ultimate Options Trading Arsenal

An Excel spreadsheet tailored specifically for options trading equips investors with an invaluable toolset to simplify complex calculations, execute precise decisions, and manage risk effectively. This versatile tool enables you to:

- Calculate Greeks (measures of option sensitivity): Delta, Gamma, Vega, and Theta

- Perform historical and implied volatility analysis

- Optimize trading strategies using scenarios and simulations

- Track and manage open positions

Empowering Traders of All Skill Levels

Regardless of your experience level in options trading, a comprehensive Excel spreadsheet empowers you with unparalleled insights and control. Seasoned traders can leverage the spreadsheet to refine their existing strategies and explore advanced trading techniques. For beginners, it serves as a comprehensive educational resource, guiding them through the intricacies of options trading in a structured and accessible manner.

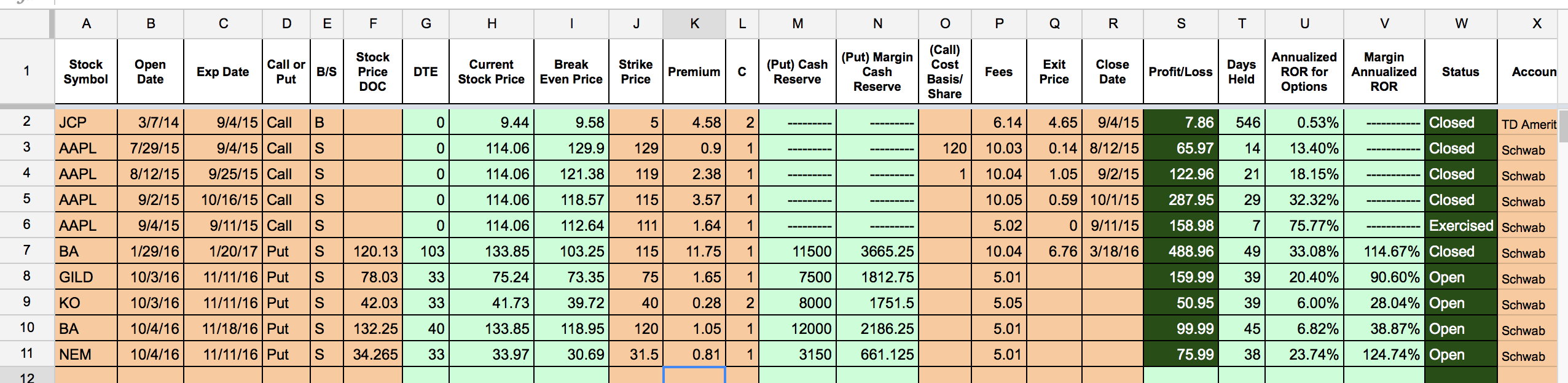

Image: db-excel.com

Expert Insights to Guide Your Trading Decisions

Harness the wisdom of industry experts by incorporating their insights into your Excelspreadsheet. Integrate formulas and analytical tools developed by experienced traders to enhance your understanding of market dynamics and inform your trading decisions.

Actionable Tips to Maximize Your Profits

- Master the Greeks: Gain a thorough understanding of the Greeks to gauge the sensitivity of your option positions to changes in underlying asset price, volatility, time, and interest rates.

- Conduct Implied Volatility Analysis: Analyze the market’s expectations for future volatility to determine optimal strike prices and expiration dates.

- Simulate Trading Scenarios: Test different trading strategies and assumptions using the spreadsheet’s scenario analysis capabilities to mitigate risk and identify potential profit opportunities.

- Manage Risk Effectively: Use the spreadsheet to calculate position sizes, margin requirements, and potential profit/lossscenarios to ensure responsible and informed trading.

Options Trading Excel Spreadsheet Download

Image: db-excel.com

Conclusion: Empowering Traders through Knowledge and Tools

Embracing an Excel spreadsheet designed for options trading equips investors with a comprehensive toolkit to navigate the complexities of this dynamic financial landscape. Armed with expert insights, actionable tips, and the ability to perform sophisticated calculations, traders of all skill levels can unlock the full potential of options trading. By leveraging the power of Excel, investors empower themselves to make informed decisions, optimize their strategies, and maximize their profit potential in the ever-evolving world of finance.