Unlock the Power of Excel Options Trading Spreadsheets: A Journey to Profitability

Image: www.trademetria.com

In the dynamic world of finance, options trading presents a sophisticated yet rewarding avenue for investors seeking potential returns. While understanding the underlying concepts can be daunting, leveraging the power of an Excel options trading spreadsheet can significantly enhance your trading strategy. This comprehensive guide will delve into the intricacies of Excel options trading spreadsheets, empowering you with the knowledge and confidence to navigate this complex realm.

What is an Excel Options Trading Spreadsheet?

An Excel options trading spreadsheet is a powerful tool that allows you to analyze, track, and manage your options trading activities. It provides real-time data, advanced calculations, and customizable features that enable you to make informed decisions and optimize your trading performance.

The Importance of Excel Options Trading Spreadsheets

-

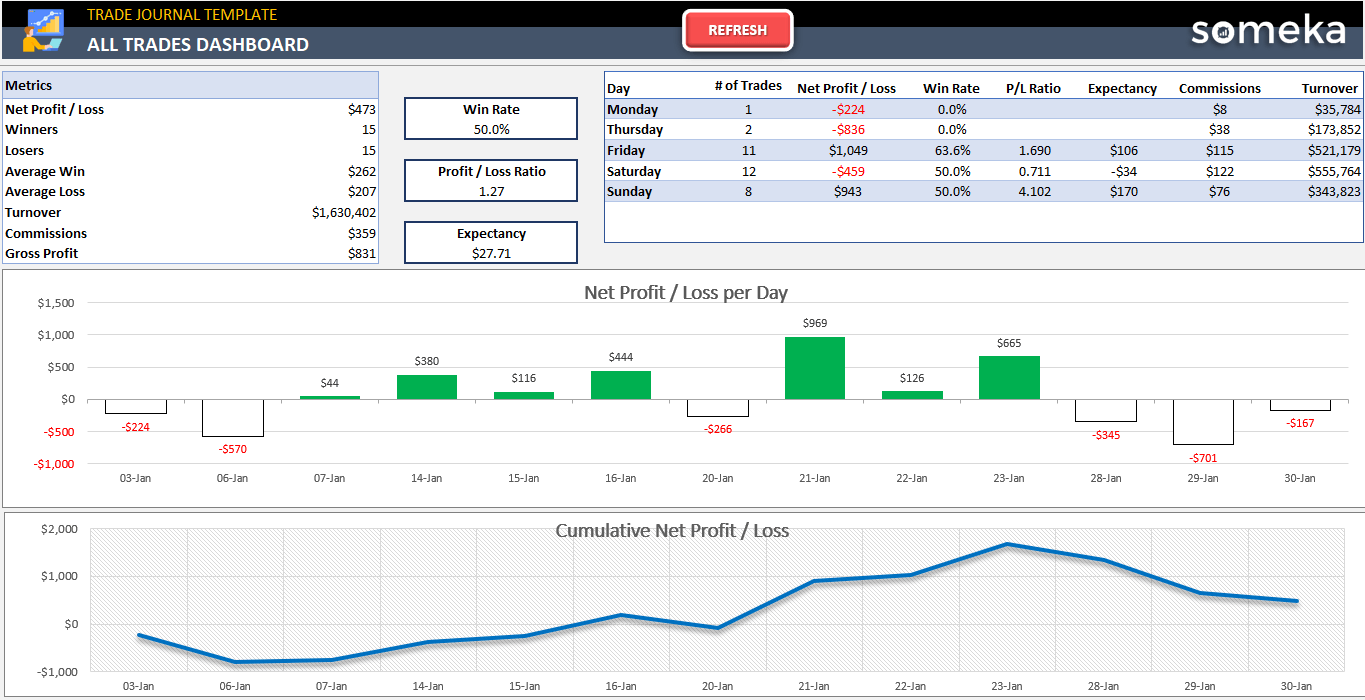

Detailed Analysis: The spreadsheet allows you to calculate essential metrics, such as option premiums, Greeks (delta, gamma, theta, rho, and vega), break-even points, and profit/loss estimates. This comprehensive analysis empowers you to evaluate potential trades and make data-driven decisions.

-

Real-Time Tracking: Integrate your spreadsheet with market data feeds to monitor real-time price movements and market conditions. This real-time tracking allows you to adapt your strategy to changes in the market and seize timely opportunities.

-

Historical Data Management: The spreadsheet provides a record of your historical trades, including entry and exit prices, profit/loss, and Greeks. This valuable data enables you to analyze trading patterns, identify areas for improvement, and refine your trading approach.

-

Scenario Planning: Customize your spreadsheet with multiple scenarios to analyze hypothetical outcomes under different market conditions. This flexibility allows you to test various strategies and make informed decisions even before executing a trade.

Expert Insights and Strategy Optimization

Harness the wisdom of experienced options traders by incorporating their insights into your spreadsheet. Access pre-built templates, expert-developed formulas, and automated tools that streamline analysis and enhance your trading decisions.

Leveraging Excel Options Trading Spreadsheets

-

Start with the Basics: Begin by creating a simple spreadsheet that calculates option premiums and underlying stock prices. As you progress, gradually incorporate more advanced formulas such as Greeks and probability distributions.

-

Customize to Your Strategies: Tailor your spreadsheet to align with your specific trading strategies. Whether you focus on single-leg options or complex multi-leg combinations, customize your spreadsheet to suit your needs.

-

Seek Expert Guidance: Engage with experienced options traders or consult online resources to enhance your knowledge and understanding of Excel options trading spreadsheets.

Conclusion

By harnessing the power of Excel options trading spreadsheets, you unlock a world of opportunities to enhance your financial decision-making. Embrace their analytical capabilities, real-time tracking, historical data management, and comprehensive insights to navigate the options trading landscape with confidence. Remember, continuous learning and a commitment to understanding the complexities of these tools will empower you on your path to trading success.

Image: warsoption.com

Excel Options Trading Spreadsheet

Image: www.someka.net