In the ever-evolving landscape of financial markets, options trading presents an avenue for potentially lucrative returns. However, to harness its full potential, meticulous analysis is essential. Enter the options trading spreadsheet in Excel, a powerful tool that empowers traders with in-depth insights and precise calculations.

Image: fadinafeesah.blogspot.com

Unveiling the Power of Options Trading Spreadsheets

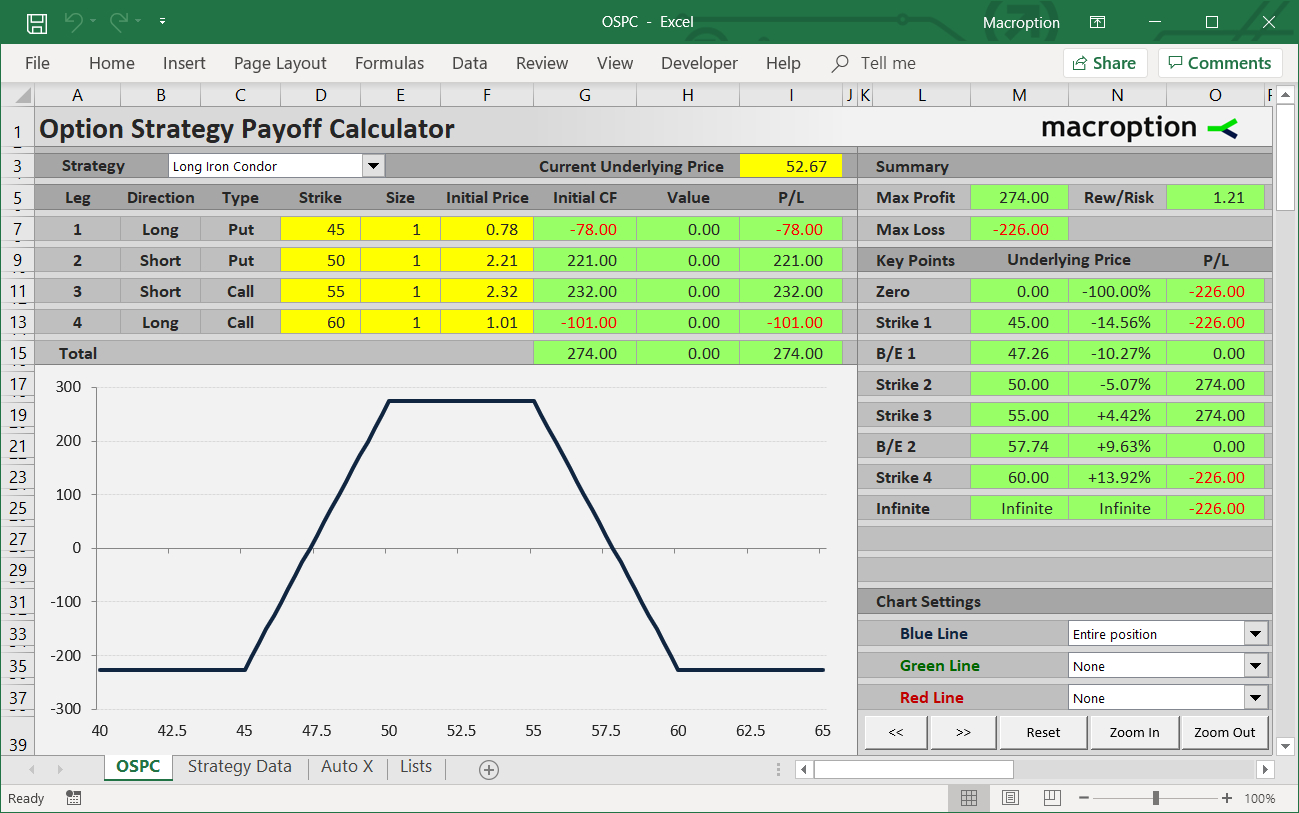

An options trading spreadsheet in Excel is a versatile tool that allows you to create and customize spreadsheets tailored to your specific trading strategies. These spreadsheets automate complex calculations, providing you with a clear understanding of risk and reward profiles. By leveraging formulas and functions, traders can quickly evaluate the impact of various factors on option positions.

Laying the Foundation for Success

To effectively utilize an options trading spreadsheet, understanding the underlying concepts of options trading is paramount. Options contracts grant the holder the right, but not the obligation, to buy or sell an underlying asset at a specified strike price on or before a predetermined expiration date. By correctly predicting the direction of the underlying asset’s price, traders can make strategic moves that enhance their chances of profitability.

Excel’s Toolset for Options Trading

Excel offers a comprehensive array of functions and formulas specifically designed for options trading analysis. The “OPTIONPRICE” function, for instance, calculates the theoretical value of an option based on the Black-Scholes model. Traders can also employ the “STANDARDIZE” function to convert option prices to a standard format, facilitating comparisons between different contracts.

Image: db-excel.com

Expert Insights: Unlocking the Potential

Renowned options trading expert, Mark Sebastian, emphasizes the importance of scenario analysis in options trading. By creating multiple scenarios in an Excel spreadsheet, traders can visualize potential outcomes under varying market conditions. “Scenario analysis allows you to assess the potential impact of different events, such as changes in volatility or underlying asset price,” Sebastian explains.

Actionable Tips for Enhanced Performance

- Customize Your Spreadsheet: Tailor your spreadsheet to your specific trading strategies, including parameters like strike price, expiration date, and volatility.

- Monitor Key Metrics: Track crucial metrics like Greeks (Delta, Gamma, Theta, Vega) to gain insights into the sensitivity and risk profile of your options positions.

- Manage Risk Effectively: Use the “Risk Manager” add-in for Excel to calculate position risk, analyze potential losses, and implement risk management strategies.

Options Trading Spreadsheet Excel

Image: db-excel.com

Conclusion: Empowering Traders with Excel’s Capabilities

An options trading spreadsheet in Excel is an invaluable asset for traders seeking to enhance their decision-making and maximize their returns. By incorporating expert insights and employing actionable tips, traders can harness the power of Excel and elevate their options trading endeavors. Whether you’re a seasoned trader or a novice seeking to navigate the complexities of the options market, an Excel-based options trading spreadsheet empowers you with the tools and knowledge to make informed and potentially profitable trades.