As an avid option trader, I’ve always relied on spreadsheets to streamline my strategies and enhance my decision-making. Recently, I stumbled upon an ingenious option trading spreadsheet that revolutionized my approach.

Image: jsmithmoore.com

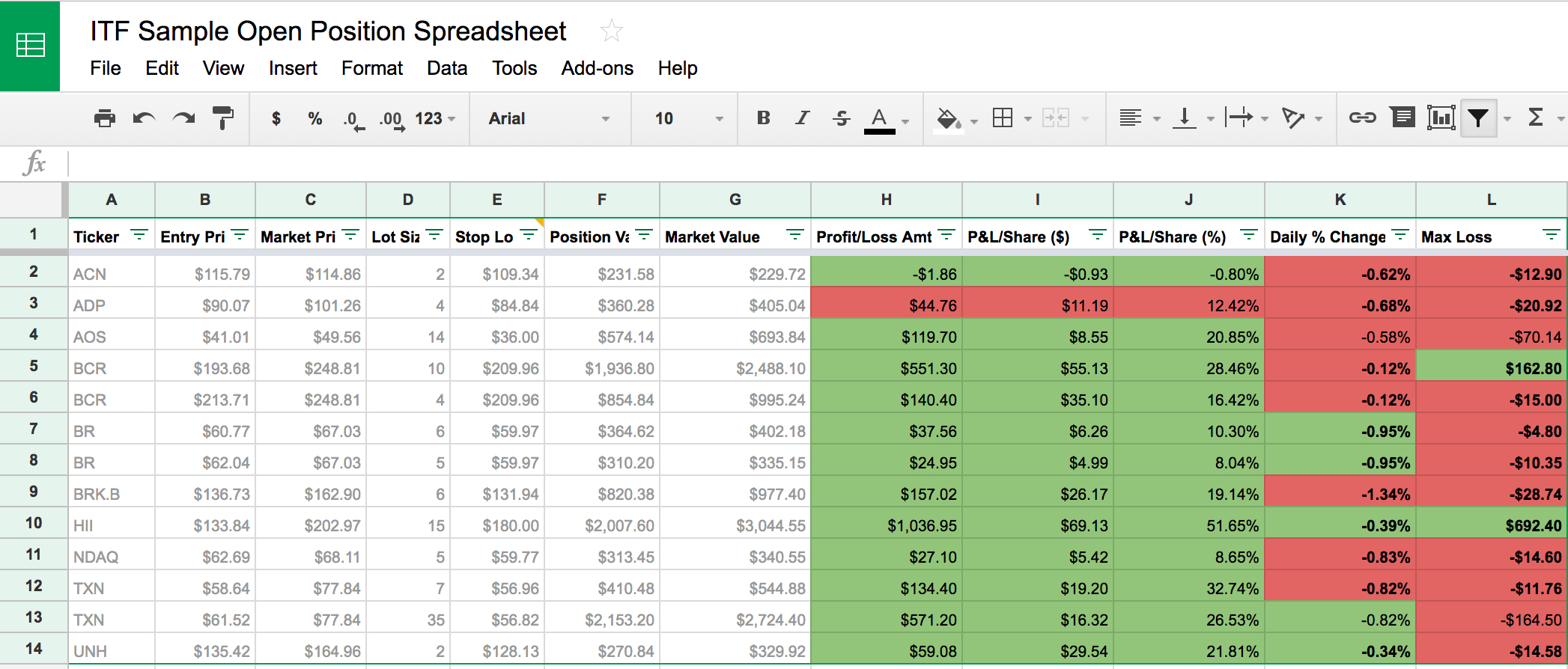

This spreadsheet, meticulously crafted by a team of finance experts, encompassed a wealth of features that met every need of an options trader. It provided real-time data, advanced calculations, and comprehensive analytics, enabling me to make informed trades with unparalleled precision.

**Understanding Option Trading Spreadsheets**

Option trading spreadsheets are sophisticated tools that simplify the complex calculations and data management involved in options trading. They integrate a range of functions, including Greeks analysis, position tracking, historical data tracking, and strategy simulation.

By incorporating real-time data feeds, these spreadsheets provide up-to-date market information, ensuring that traders base their decisions on the most current conditions. The advanced calculations, such as implied volatility and option pricing models, empower traders to assess risk and potential rewards with accuracy.

**Comprehensive Analytics**

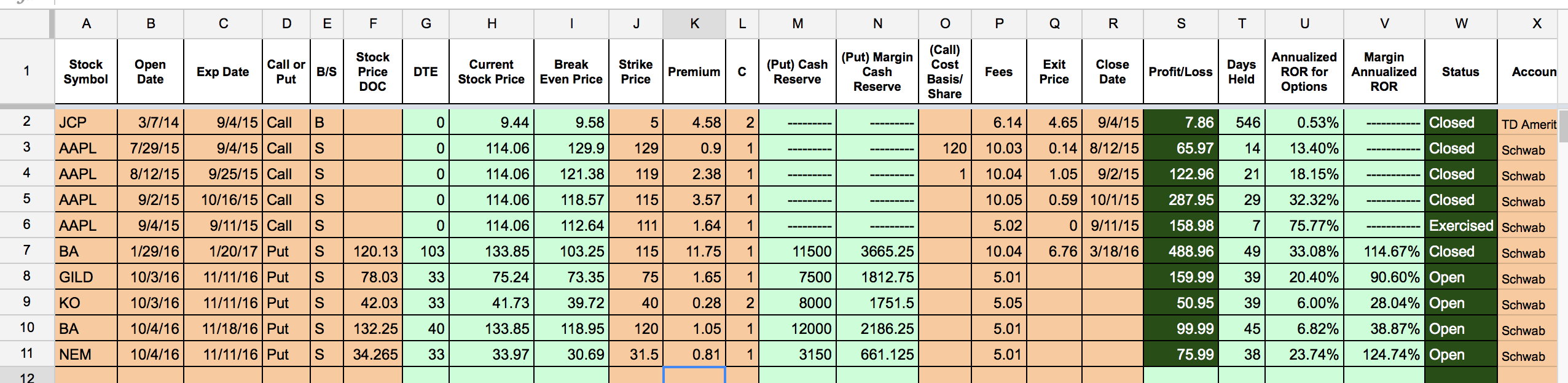

One of the standout features of a well-designed option trading spreadsheet is its comprehensive analytics capability. It offers detailed breakdowns of portfolio performance, enabling traders to track profit and loss, monitor theta decay, and identify potential trading opportunities.

Furthermore, the spreadsheet incorporates advanced graphical representations, including charts and graphs, making it easy for traders to visualize market trends and identify price patterns. This visual representation streamlines data analysis and aids in timely decision-making.

**Enhanced Risk Management**

Option trading involves inherent risks that must be carefully managed. A comprehensive spreadsheet empowers traders with robust risk management tools. It performs scenario analysis, quantifying potential losses under different market conditions.

The spreadsheet also calculates key risk metrics, such as delta and vega, providing insights into the sensitivity of option positions to changes in underlying asset prices and implied volatility. These metrics enable traders to monitor and adjust their strategies proactively.

Image: db-excel.com

**Tips and Expert Advice for Using Option Trading Spreadsheets**

While option trading spreadsheets can greatly enhance your strategies, utilizing them effectively requires an understanding of the underlying concepts and trading principles. Here are some tips to optimize your spreadsheet usage:

Familiarize Yourself with the Features:

Take time to explore the spreadsheet’s functionality. Understand the different tabs, buttons, and menus. Familiarizing yourself with the tools will enable you to leverage its full potential.

Customize to Suit Your Trading Style:

Spreadsheets can be customized according to your specific trading preferences. Tailor the spreadsheet to complement your strategy and incorporate preferred technical indicators or calculations.

**FAQs on Option Trading Spreadsheets**

Q: Can I use a spreadsheet even if I’m a beginner in options trading?

A: While spreadsheets can assist beginners in understanding options concepts, it’s crucial to acquire foundational knowledge and experience before employing complex trading tools.

Q: Are there any limitations to using spreadsheets?

A: Spreadsheets may have limitations in terms of processing speed, data storage capacity, and integration with trading platforms. Consider these factors when selecting a spreadsheet or combining it with other tools.

Option Trading Spreadsheet

**Conclusion**

In the ever-evolving landscape of option trading, a well-crafted spreadsheet can empower you with the tools to maximize your potential. Leverage its features to gain real-time insights, conduct thorough analysis, and implement effective risk management strategies.

Ready to enhance your trading journey?

Explore the world of option trading spreadsheets today and unleash the trading prowess that lies within.