Introduction:

Image: www.sensefinancial.com

In the realm of retirement planning, solo 401(k) plans offer unparalleled flexibility and investment opportunities. Enter solo 401(k) option trading – a powerful tool that empowers individuals to maximize their retirement savings through sophisticated financial strategies. This comprehensive guide delves into the world of solo 401(k) option trading, unraveling its intricacies and equipping you with the knowledge to navigate this dynamic investment arena.

Understanding Solo 401(k) and Option Trading:

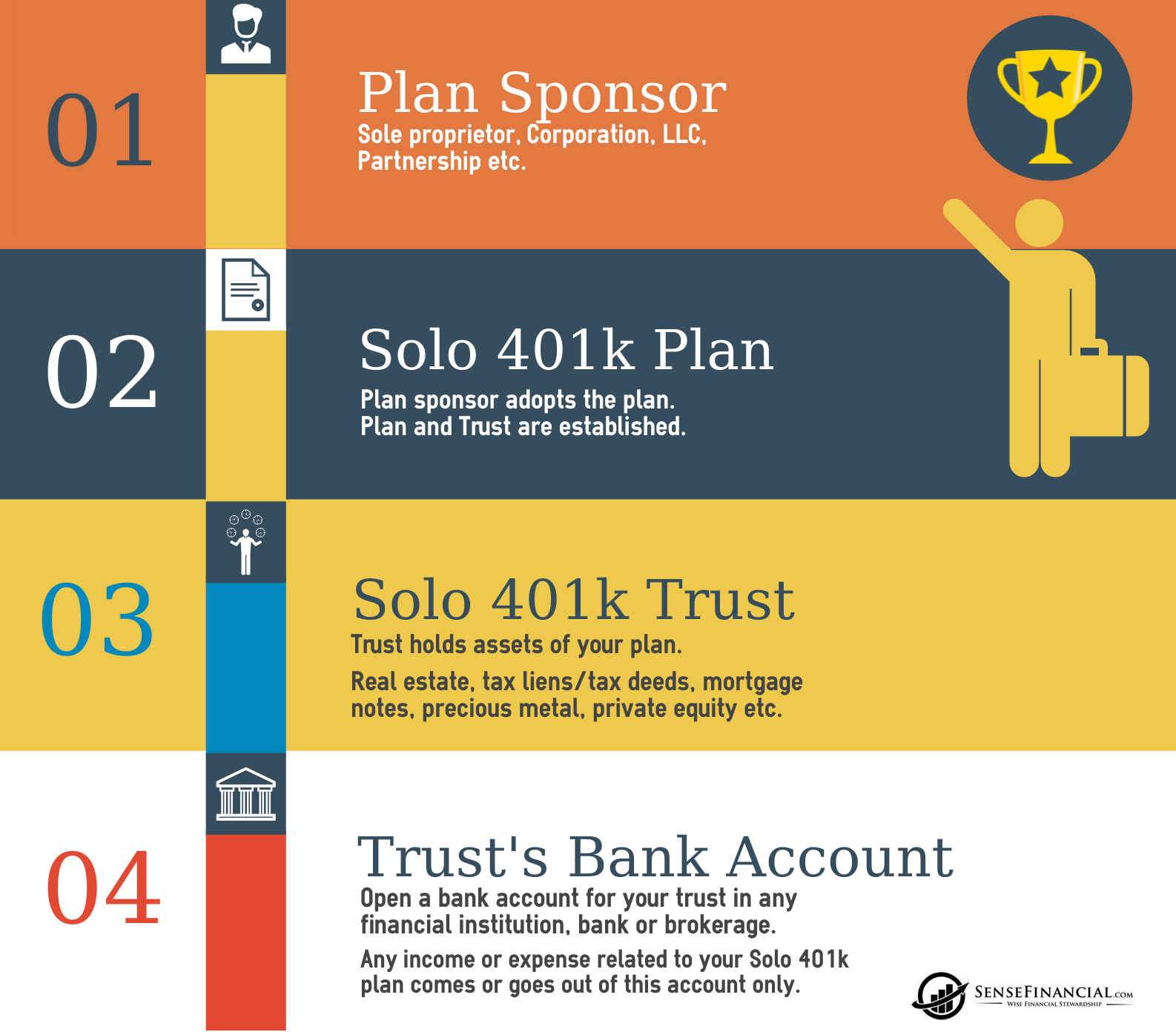

A solo 401(k) is a tax-advantaged retirement plan designed specifically for self-employed individuals and business owners with no employees. It combines the benefits of both traditional 401(k) and individual retirement account (IRA) plans, providing greater flexibility and higher contribution limits.

Option trading, on the other hand, involves the buying and selling of contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset (such as stocks or bonds) at a specific price and date. Options provide investors with leverage and the ability to generate both income and capital gains.

Merging Solo 401(k) and Option Trading:

Solo 401(k) plans allow for a wide range of investment options, including stocks, bonds, mutual funds, and – you guessed it – options. This creates a unique opportunity for investors to harness the benefits of option trading within the tax-advantaged framework of a solo 401(k).

By leveraging options strategies, solo 401(k) participants can enhance their returns, reduce risk, and tailor their retirement portfolios to meet specific goals. For instance, using options can generate additional income through selling covered calls, or provide downside protection by buying puts.

Benefits of Solo 401(k) Option Trading:

1. Tax-Advantaged Growth:

Solo 401(k) plans offer tax-deferred growth on investments, meaning that any earnings accumulate without being subject to current income taxes. This allows for significant long-term wealth accumulation.

2. Enhanced Risk Management:

Options provide investors with tools to manage risk in their solo 401(k) portfolios. By using appropriate strategies, such as protective collars or spreads, investors can mitigate market fluctuations and protect their investments.

3. Income Generation:

Certain option strategies, such as selling covered calls, can generate additional income within the solo 401(k) plan. This can supplement other sources of retirement income, providing increased financial flexibility.

4. Portfolio Customization:

Solo 401(k) option trading allows investors to tailor their retirement portfolios to meet their specific risk tolerance, investment goals, and time horizon. By combining stocks, bonds, and options, investors can create a diversified portfolio that meets their unique needs.

Considerations:

While solo 401(k) option trading offers numerous benefits, it is crucial to be mindful of certain considerations:**

1. Knowledge and Experience:

Option trading requires a high level of knowledge and experience in financial markets. Investors should approach option trading with caution and consult with a qualified financial advisor if necessary.

2. Volatility and Risk:

Options are volatile instruments, and their value can fluctuate significantly. Investors should carefully consider the risks associated with option trading and understand that losses are possible.

3. Tax Implications:

Option trading within a solo 401(k) plan may trigger certain tax events, such as ordinary income treatment on premiums or capital gains on profits. Investors should consult with a tax professional to understand the tax implications of their trading activity.

Conclusion:

Solo 401(k) option trading can be a powerful tool for self-employed individuals and business owners to enhance their retirement savings and achieve financial goals. However, it is crucial to approach option trading with knowledge, experience, and careful consideration of the associated risks and tax implications. By leveraging this guide as a starting point, investors can embark on their solo 401(k) option trading journey with confidence and a path to potential financial success. Remember to consult with qualified financial and tax professionals to ensure your investment decisions align with your financial plan and retirement objectives.

Image: www.sensefinancial.com

Solo 401k Option Trading

Image: www.sensefinancial.com