Investing can be a daunting venture, but with the right knowledge, it can become an empowering tool. Have you ever considered solo 401k options trading? It’s a less explored path, yet holds tremendous potential for those seeking savvy retirement strategies. In this article, we’ll delve into the world of solo 401k options trading, uncovering its ins and outs and exploring its transformative power.

Image: hackyourwealth.com

Unveiling Solo 401k Options Trading

A solo 401k is a retirement savings plan designed for self-employed individuals and small business owners. It offers significant tax benefits and substantial contribution limits. However, unlike traditional 401k plans, a solo 401k allows for a broader range of investment options, including stocks, bonds, and mutual funds – and yes, you guessed it, options.

Options trading involves buying or selling contracts that give you the right, but not the obligation, to buy or sell an underlying asset, such as a stock, at a predetermined price and date. By incorporating options into your solo 401k, you gain access to a wider spectrum of investment strategies that can potentially enhance your retirement savings.

The Allure of Options Trading

Why consider solo 401k options trading? Let’s discover its captivating advantages:

- Magnifying Returns: Options can offer substantial leverage, allowing you to amplify your potential returns.

- Mitigating Losses: Buying a put option can provide protection against market downturns, safeguarding your investments.

- Boosting Income: Selling options can generate regular income, supplementing your retirement earnings.

- Tax Advantages: Profits gained through options trading are sheltered within your solo 401k, reducing tax liabilities.

Furthermore, with a solo 401k, you have the freedom to invest in options without being subject to the constraints imposed on IRAs.

Mastering the Art of Solo 401k Options Trading

Options trading may seem intricate, but with meticulous planning and a touch of strategy, you can harness its power. Here are some expert tips to guide you along the way:

- Educate Yourself: Immerse yourself in the world of options trading through books, online resources, and courses.

- Start Small: Begin with minimal investments until you grasp the complexities and intricacies of options trading.

- Diversify Your Strategy: Blend various option strategies, such as buying calls, selling puts, etc., to spread your risk and enhance returns.

- Protect Your Profits: Use stop-loss orders to automatically sell your options at a predetermined price, minimizing potential losses.

Remember, options trading carries inherent risks. Approach it with a measured mindset, understanding both its potential gains and pitfalls.

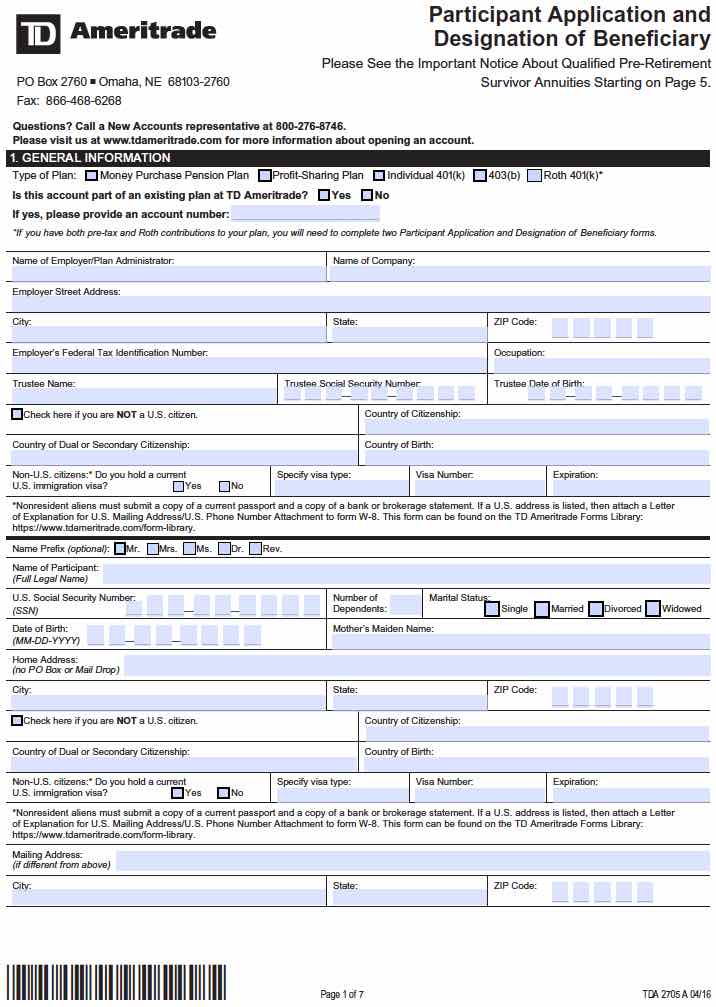

Image: www.mysolo401k.net

Frequently Asked Questions

To shed light on common queries, here’s a comprehensive FAQ section:

- Q: Is options trading suitable for beginners?

A: While options trading offers great potential, it’s not recommended for novice investors. It demands a solid understanding of market dynamics and risk management. - Q: Can solo 401k funds be used for any type of options trade?

A: No, solo 401k funds can only be invested in qualified options approved by the plan’s custodian. - Q: What are the tax implications of options trading in a solo 401k?

A: Profits from options trading within a solo 401k are tax-deferred until retirement age. However, early withdrawals may incur a 10% penalty tax.

Solo 401k Options Trading

Image: www.mysolo401k.net

Conclusion

Solo 401k options trading unfolds a world of possibilities for retirement investment. By embracing options trading, you empower yourself to explore a wider range of strategies, potentially increasing your returns and reducing risk. However, remember that options trading requires a thorough understanding of the subject matter and a balanced approach. So, are you ready to embark on this thrilling journey of solo 401k options trading? Remember, the path to financial success begins with education and prudent decision-making.