Options trading has become increasingly accessible for retail investors seeking to manage risk and enhance their returns. One trading strategy gaining momentum is the side-by-side trading of options, attracting traders with its potential to align with SEC regulations.

Image: www.valuetrend.ca

Understanding SEC Side-by-Side Trading of Options

Side-by-side trading involves simultaneously buying and selling identical options contracts with different expiration dates or strike prices. This strategy is designed to reduce risk by diversifying the option trades while maintaining the same or similar payoff.

Benefits of Side-by-Side Trading

- Reduced risk: By trading side-by-side, traders reduce the risk of a single trade going against them, as a favorable outcome in one trade can offset a loss in another.

- Improved returns: Side-by-side trading can potentially enhance returns by taking advantage of various market conditions, such as volatility or time decay.

- Regulation-compliant: SEC regulations explicitly allow for side-by-side trading, making it a viable option for traders looking to comply with regulatory guidelines.

Latest Trends and Developments

Side-by-side trading continues to gain traction among options traders, with increasing discussions on forums and social media platforms. Technology advancements have also emerged, offering automated platforms that facilitate side-by-side trading. These platforms automate trade execution, enhancing efficiency and accuracy.

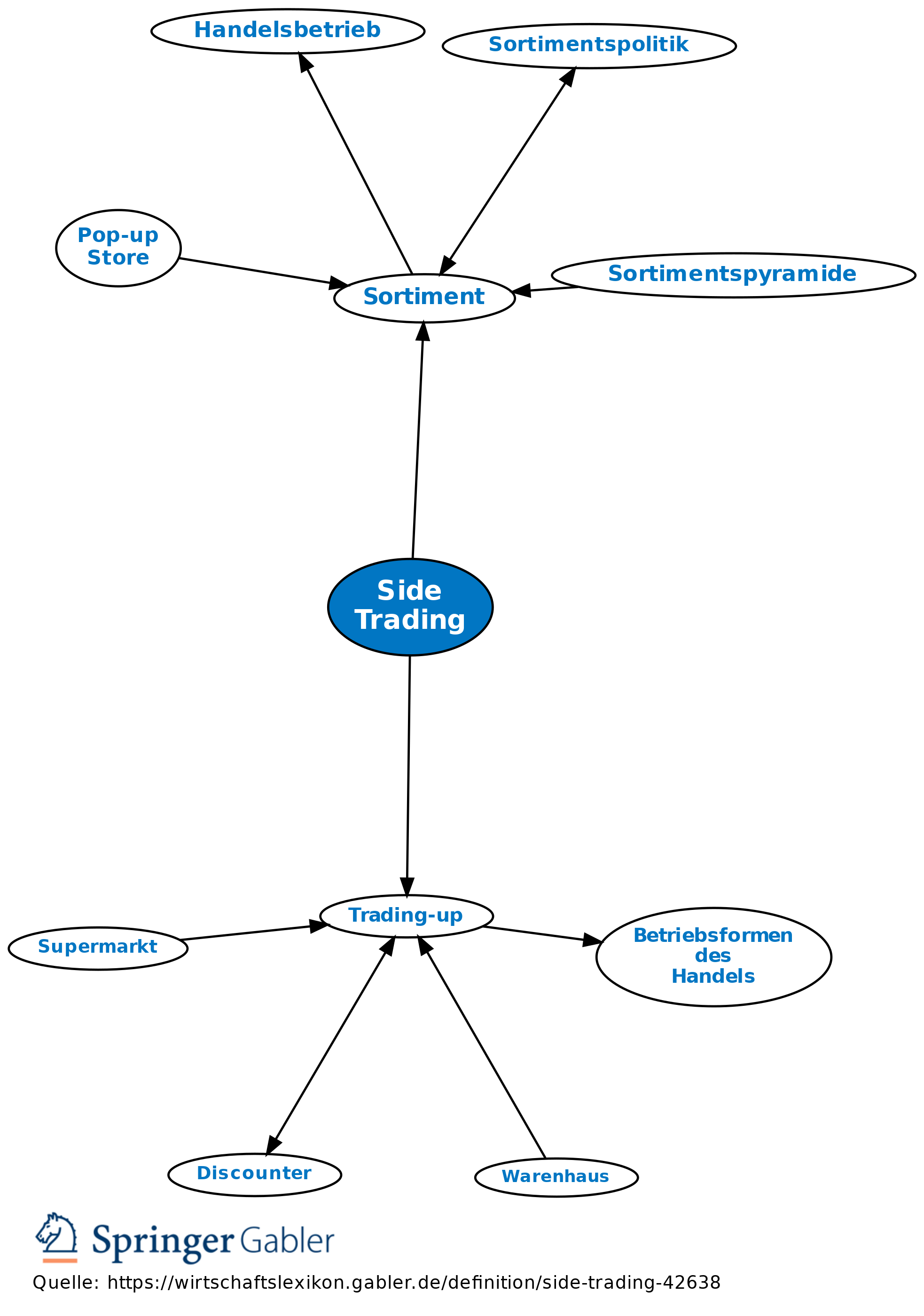

Image: wirtschaftslexikon.gabler.de

Expert Tips for Side-by-Side Trading

Implementing a successful side-by-side trading strategy requires careful planning and execution.

Selecting Contracts

- Choose options with different expiration dates or strike prices to increase the probability of a favorable outcome in one trade.

- Consider the underlying asset’s volatility and the market outlook to make informed decisions.

Managing Risk

- Use stop-loss orders to limit potential losses in case the trades move against you.

- Monitor the positions closely and adjust the trades as market conditions change.

Frequently Asked Questions

Q: What are the risks involved in side-by-side trading?

A: While side-by-side trading reduces risk compared to single trades, it is still subject to market fluctuations and trading losses.

Q: Is side-by-side trading a suitable strategy for all traders?

A: Side-by-side trading can be a good option for experienced options traders who understand risk management and the dynamics of options trading.

Sec Side By Side Trading Of Options

Image: wirtschaftslexikon.gabler.de

Conclusion

SEC side-by-side trading of options provides a viable and regulation-compliant strategy for options traders seeking to manage risk and potentially enhance returns. By following proven tips and expert advice, traders can navigate the complexities of side-by-side trading and maximize their chances of success.

Would you like to explore the topic of SEC side-by-side trading of options further? Connect with me to discuss your queries and exchange knowledge.