In the realm of options trading, successfully navigating the volatile market landscape requires a multifaceted approach that encompasses both strategic planning and prudent risk management. One indispensable tool for mitigating risk is the stop loss order, an ingenious mechanism that empowers traders to proactively define their tolerance for losses.

Image: www.fool.com

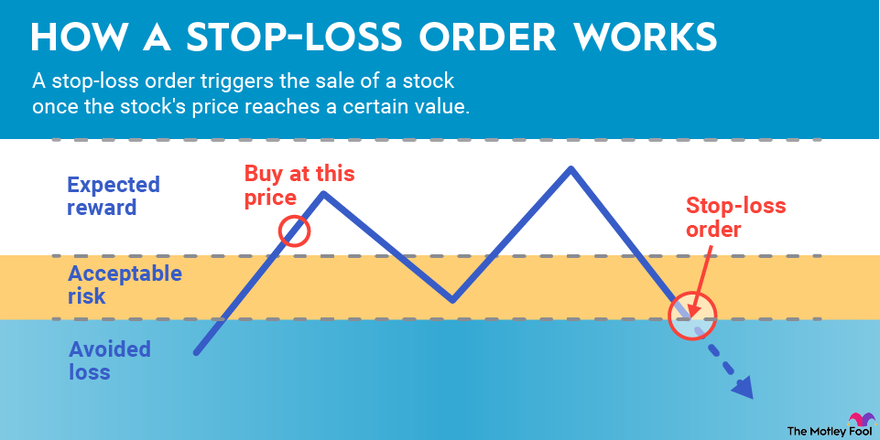

Stop loss orders function as automated safeguards, designed to trigger an immediate sale or purchase of an option when it reaches a predetermined price threshold. This dynamic feature allows traders to limit their potential losses, ensuring they do not exceed an acceptable threshold.

Understanding Stop Loss Orders

Types of Stop Loss Orders

Traders have the flexibility to employ two primary types of stop loss orders:

- Stop Market Orders: Execute the sale or purchase of an option at the current market price as soon as the specified trigger price is reached.

- Stop Limit Orders: Execute the sale or purchase of an option only if the market price reaches or crosses a predetermined limit price, mitigating the risk of execution at unfavorable prices during periods of high volatility.

Placement Considerations

Effectively utilizing stop loss orders requires strategic placement. Several factors should be meticulously considered when determining the appropriate trigger price:

- Volatility: Determine the historical volatility of the underlying asset to gauge potential price fluctuations and set stop loss orders accordingly.

- Risk Tolerance: Assess your individual risk appetite and establish stop loss orders that align with your tolerance for potential losses.

- Trade Strategy: Consider the specific trade strategy employed and adjust stop loss orders to complement the overall trading approach.

Image: www.projectfinance.com

Benefits of Stop Loss Orders

The judicious use of stop loss orders offers a myriad of benefits for options traders:

- Risk Mitigation: Mitigate the potential for catastrophic losses by limiting downside exposure.

- Emotional Trading Avoidance: Remove emotional biases from trading decisions, ensuring disciplined execution.

- Time Management: Automate the risk management process, freeing up time for strategic analysis and trade execution.

- Capital Preservation: Safeguard trading capital, enabling the pursuit of long-term profitability.

Tips and Expert Advice

Seasoned traders and industry experts recommend employing stop loss orders judiciously to enhance their trading performance:

- Tailor to Strategy: Align stop loss orders with your specific trading strategy for optimized risk management.

- Monitor Regularly: Continuously monitor market conditions and adjust stop loss orders as needed to reflect prevailing volatility and price trends.

Frequently Asked Questions (FAQs)

Q: What are the key benefits of using stop loss orders in options trading?

A: Stop loss orders mitigate risk, prevent emotional trading, and aid in capital preservation.

Q: Can stop loss orders guarantee against losses?

A: No, they do not guarantee zero losses but significantly reduce their potential severity.

Q: How often should I adjust stop loss orders?

A: Regular adjustments are recommended to align with changing market conditions and price trends.

Stop Loss For Options Trading

https://youtube.com/watch?v=7_ugVwf7upg

Conclusion

Stop loss orders are indispensable tools in the arsenal of options traders, empowering them to manage risk and safeguard capital in the face of market volatility. By strategically placing and adjusting stop loss orders in accordance with their individual risk tolerance and trading strategy, traders can mitigate downside exposure and position themselves for long-term success. Embrace the benefits of stop loss orders and take a proactive approach to risk management, enhancing your chances of navigating the ever-evolving options market with prudence and precision.

Would you like to delve deeper into the world of stop loss orders for options trading? Share your questions or insights in the comments section below, and let’s engage in a collaborative discussion.