The world of options trading can be a daunting and intricate landscape, but understanding the importance of stop loss orders can significantly enhance your trading strategies. These safeguards act as your financial seatbelts, protecting you from excessive losses while navigating the volatile markets. Options, being more complex than stocks and futures, warrant a profound understanding of stop losses to mitigate risks and optimize gains.

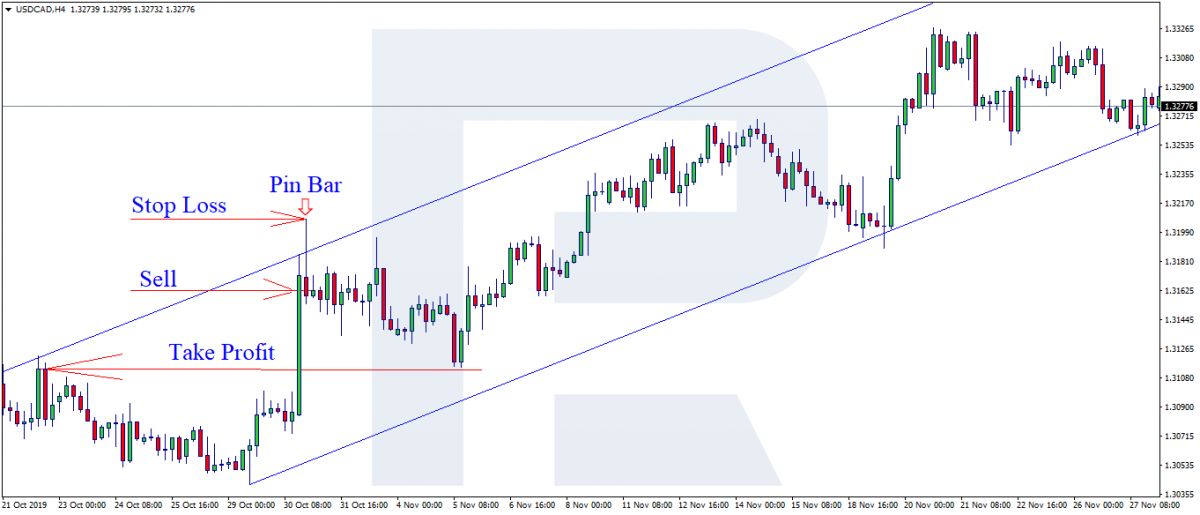

Image: blog.roboforex.com

Options, with their dynamic price fluctuations, present a unique challenge in managing risk. Stop loss orders, in this context, offer a crucial tool to limit your potential losses. When executed correctly, they act as a safety net, preventing further financial erosion beyond a predefined threshold and safeguarding your capital.

Understanding the Types of Stop Loss Orders

The world of stop losses extends beyond a single, rigid concept. Options trading offers a choice between two primary types of stop loss orders:

1. Market Stop Loss

Simplicity and swiftness define market stop loss orders. Upon execution, they instantly close your position at the prevailing market price, regardless of its favorability. While their expediency can be advantageous, they also leave room for potential slippage during rapid market movements. Market stop loss orders are suitable for scenarios where immediate exit is your top priority.

2. Stop Limit Order

Stop limit orders combine the precision of a limit order with the protective nature of a stop loss. With these orders, your position will only close if the market price touches or exceeds a predetermined price level. This controlled approach reduces the impact of market volatility and prevents hasty exits. Stop limit orders are ideal for strategic exits where you seek a specific price point to close your position.

Image: www.signalskyline.com

Choosing the Right Stop Loss Level

Establishing an optimal stop loss level is a delicate balancing act, requiring a careful assessment of multiple factors:

• Volatility: Ensure your stop loss is placed at a distance from the current market price that accounts for the underlying asset’s volatility. Higher volatility warrants wider stop distances.

• Risk Tolerance: Your risk tolerance plays a crucial role in determining the stop loss level. Lower tolerance levels necessitate tighter stops closer to the current price.

• Market Conditions: Understanding the prevailing market dynamics is essential. Bullish markets typically allow for wider stop distances, while bearish conditions may call for tighter stops to mitigate losses.

Executing Stop Loss Orders on Options

Options exchanges offer specific mechanisms for executing stop loss orders. These include entering the order through the trading platform, submitting it via your broker, or using automated trading tools that continuously monitor market movements. Selecting the method that aligns with your trading style and comfort level is crucial.

• Trading Platform: Most trading platforms provide user-friendly interfaces for setting up stop loss orders. Simply select the desired option type, enter the necessary parameters, and submit the order.

• Broker Submission: Contacting your broker directly to place a stop loss order is another option. While this method may be less convenient, it’s suitable for complex orders or scenarios where personalized guidance is desired.

• Automated Trading: Sophisticated traders may employ automated trading tools that integrate directly with the trading platform. These tools enable pre-defined entries and exits, including stop loss orders, based on specific market conditions.

The Benefits of Using Stop Loss Orders

The advantages of incorporating stop loss orders into your options trading strategy are undeniable:

1. Risk Management and Protection

Stop loss orders act as a safety shield, limiting potential losses. By predetermining an acceptable level of loss, you safeguard your account balance from catastrophic plunges.

2. Automated and Objective Exits

Stop loss orders remove the emotional component from trading. They execute automatically when market conditions trigger the pre-defined threshold, preventing rash decisions.

3. Improved Performance

Effective use of stop loss orders can contribute to overall trading performance. By protecting against excessive losses and enabling strategic exits, you enhance your chances of long-term success.

How To Use Stop Loss In Option Trading

Tips for Effective Stop Loss Usage

Maximizing the effectiveness of stop loss orders requires careful consideration:

• Set Realistic Levels: Avoid setting stop loss levels too tight or too wide. Excessive tightness increases the chances of premature exits, while overly wide stops negate their protective purpose.

• Review and Adjust: Market conditions are