Introduction

In the world of trading, risk management is paramount. One of the most common ways to mitigate risk is by using stop-loss orders. But can we use stop-loss orders in option trading? In this article, we will delve into this topic, exploring the benefits and drawbacks of utilizing stop-loss orders in options trading.

Image: tradingforexcoid.blogspot.com

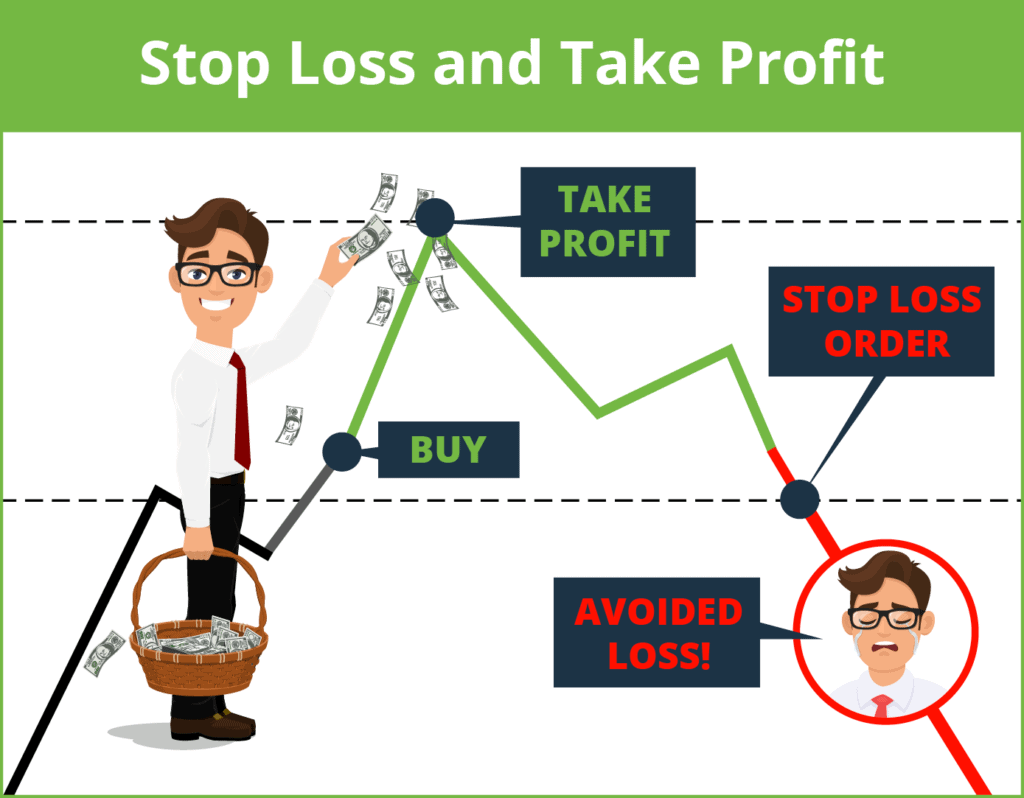

Understanding Stop-Loss Orders

A stop-loss order is a conditional order that is placed with a broker to sell an asset when it reaches a specified price. This order is designed to protect traders from incurring losses beyond a predetermined level.

Stop losses can be classified into two main categories:

- Trailing stop orders: The stop-loss price moves dynamically, typically a fixed percentage or dollar amount below the current market price.

- Fixed stop orders: The stop-loss price remains static, regardless of market fluctuations.

Can Stop-Loss Orders Be Used in Option Trading?

The answer to this question is yes, we can use stop-loss orders in option trading. However, it is important to note a few key points:

- Stop-loss orders are not guaranteed to prevent losses: Market volatility can sometimes cause the asset price to fluctuate quickly, leading to a price gap where the stop-loss order cannot be executed.

- Stop-loss orders can limit potential profits: If the option price rises rapidly, a stop-loss order may sell the option prematurely, limiting the potential profit.

When to Use Stop-Loss Orders in Option Trading

There are certain situations where using stop-loss orders in option trading can be beneficial:

- To protect profits: If an option position has gained significantly, a stop-loss order can be placed to ensure the trader locks in a certain level of profit.

- To manage risk: In highly volatile markets, a stop-loss order can protect traders from incurring substantial losses.

Image: www.fxstreet.com

Tips and Expert Advice

Here are some tips and expert advice from experienced traders:

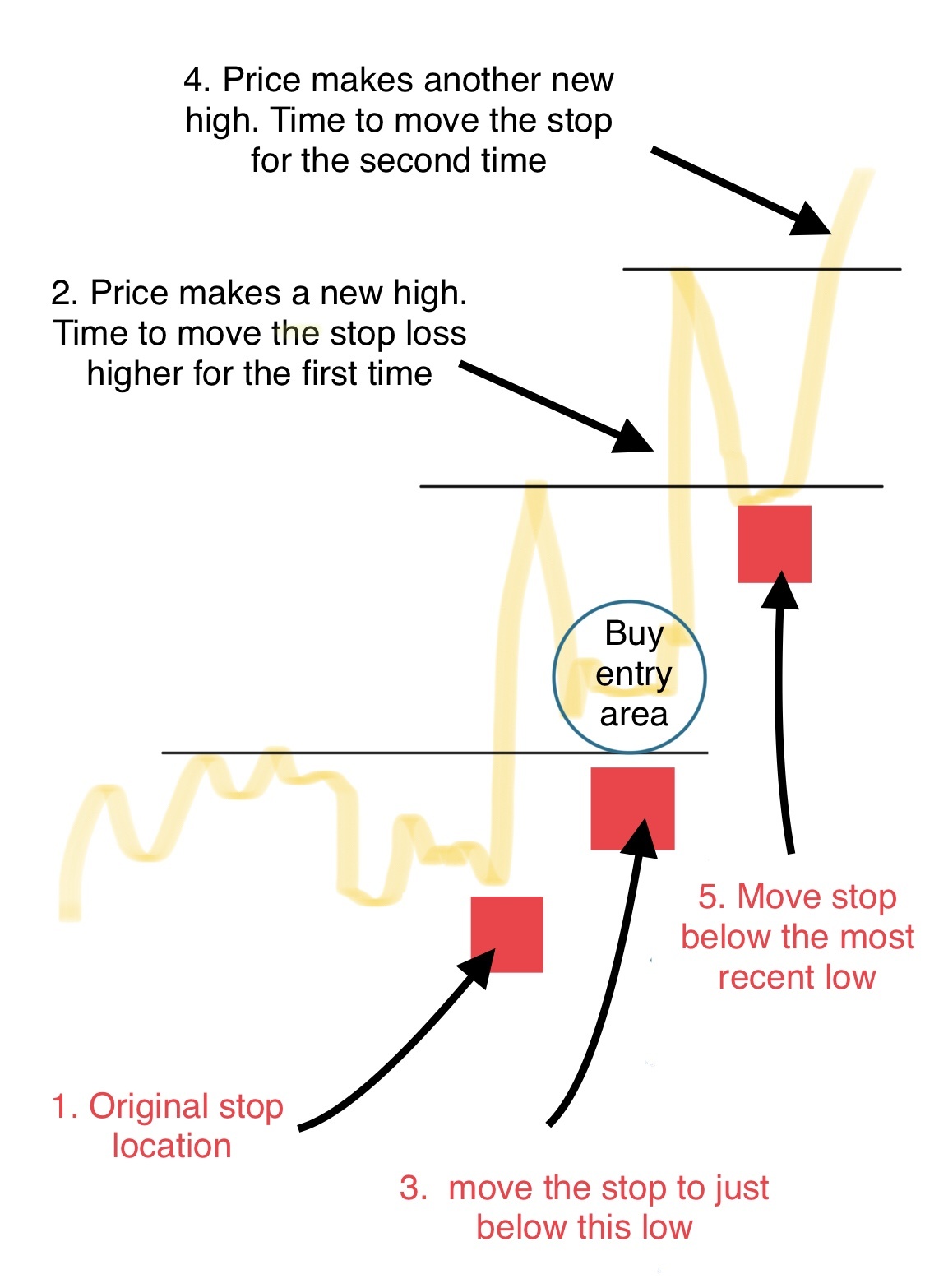

- Choose the right stop-loss type: Depending on the trading strategy and risk tolerance, traders can opt for either trailing or fixed stop-loss orders.

- Place orders at appropriate levels: The stop-loss level should not be too tight or too loose. Too tight a stop-loss may result in whipsaws, while too loose a stop-loss may fail to protect from substantial losses.

- Monitor orders regularly: Market conditions can change rapidly, so it is crucial to monitor open positions and adjust stop-loss orders as necessary.

Conclusion

Stop-loss orders can be utilized as a risk-management tool in option trading, but their usage should be carefully considered. By understanding the potential benefits and limitations, as well as following the tips outlined above, traders can optimize their risk-reward profile.

Are you interested in learning more about options trading? Consider signing up for our free webinar where we delve into the fundamentals of options and provide practical trading strategies.

Can We Use Stop Loss In Option Trading

Frequently Asked Questions

Q: What are the potential risks of using stop-loss orders in option trading?

A: Stop-loss orders may not execute immediately, leading to price gaps and increased losses. They can also prematurely sell options, limiting potential profits if the market turns favorable.

Q: When is it advisable to use stop-loss orders in option trading?

A: Stop-loss orders can be beneficial to lock in profits and manage risk in volatile markets.