Introduction

In the realm of financial markets, options trading offers investors a powerful tool for managing risk and potentially generating profits. But navigating the intricacies of options trading can be daunting, especially when it comes to understanding the different types of orders. This comprehensive guide will delve into the world of options orders, providing you with a thorough understanding of their function, types, and how to use them effectively in your trading strategies.

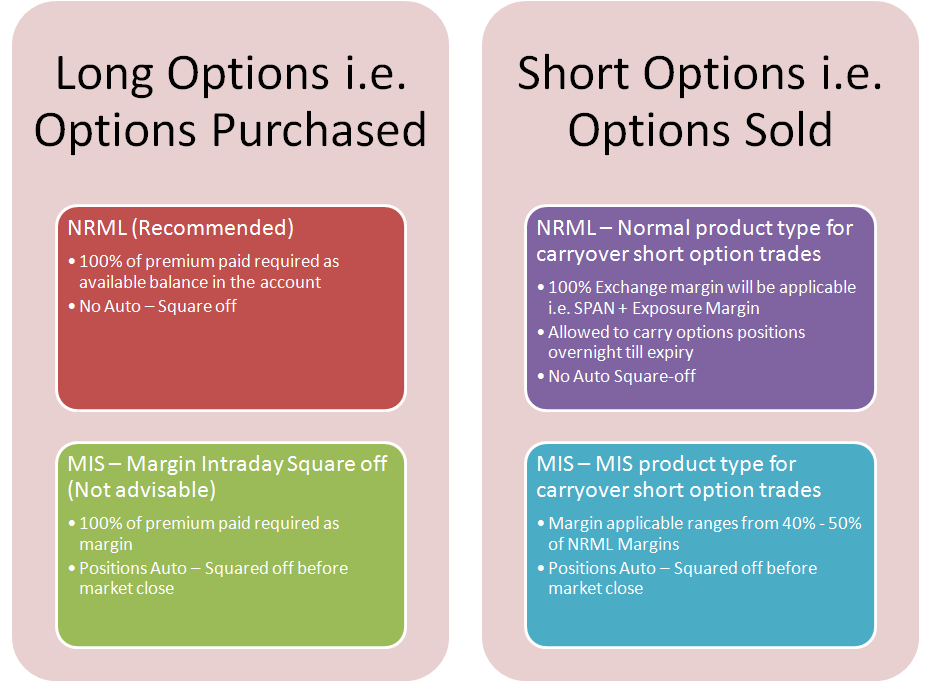

Image: yufyfiqec.web.fc2.com

Defining an Order in Options Trading

An order in options trading represents an instruction given to a broker or exchange to execute a specific transaction involving options contracts. Options are financial contracts that grant the holder the right, but not the obligation, to buy (call options) or sell (put options) an underlying asset at a predetermined price (strike price) before a specified date (expiration date). An order specifies the parameters of the trade, including the type of option, the underlying asset, the strike price, the expiration date, and the quantity of contracts to be bought or sold.

Types of Options Orders

The wide array of options orders available allows traders to tailor their trading strategies to their specific risk appetite and investment objectives. Here are some of the most common types of options orders:

1. Market Orders

Market orders are the simplest type of options order, instructing the broker to execute the trade at the current prevailing market price. These orders are typically used when traders want to enter or exit a position quickly, without specifying a specific price.

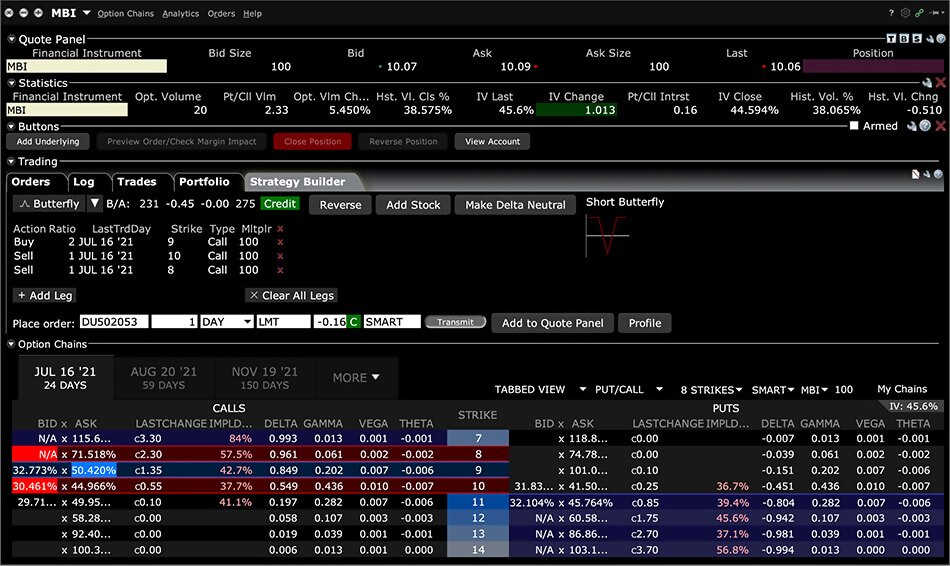

Image: www.interactivebrokers.com

2. Limit Orders

Limit orders allow traders to specify the maximum price they are willing to pay for a call option or the minimum price they want to receive for a put option. The order will only be executed if the market price moves to or beyond the specified limit price.

3. Stop Orders

Stop orders are used to trigger a trade when the underlying asset’s price reaches a certain level. The order will then become a market order and will be executed at the prevailing market price. Stop orders can be used to protect against losses or to enter or exit a position at a specific price.

4. Stop-Limit Orders

Stop-limit orders combine features of stop orders and limit orders. They allow traders to specify a trigger price (stop price) and a limit price. The order will become a market order if the stop price is reached, but the trade will only be executed at or above (for call options) or at or below (for put options) the specified limit price.

5. Conditional Orders

Conditional orders allow traders to combine multiple orders into a single instruction. For example, a “one-cancels-the-other” (OCO) order places two orders, such as a buy order and a sell order, with the condition that if one order is executed, the other order is automatically canceled.

6. Spread Orders

Spread orders involve buying and selling multiple options contracts with different strike prices and/or expiration dates. By combining options in this way, traders can create customized strategies that enable them to manage risk and potentially enhance returns.

Understanding Option Order Parameters

When placing an options order, traders must consider several key parameters:

1. Type of Option:

Determine whether you want to buy a call option or a put option, depending on whether you anticipate the underlying asset’s price to rise or fall.

2. Underlying Asset

Specify the underlying asset to which the option contract relates, such as a stock, index, or commodity.

3. Strike Price

Select the strike price that aligns with your investment strategy. This is the price at which you can exercise the option to buy (call option) or sell (put option) the underlying asset.

4. Expiration Date

Determine the date by which the option contract must be exercised or it will expire worthless.

5. Quantity

Indicate the quantity of options contracts you want to buy or sell. This represents the number of units of the underlying asset covered by the option contracts.

What Is An Order In Options Trading

Image: www.stockamj.com

Conclusion

Orders are the lifeblood of options trading, enabling traders to execute strategic trades and manage risk. By understanding the different types of options orders and their parameters, traders can refine their trading strategies, enhance their decision-making, and pave the way for potential success in the complex world of options trading.