Introduction:

Image: timonandmati.com

Options, tradable financial instruments that offer the right but not the obligation to buy or sell an underlying asset at a predetermined price on or before a specified date, are an essential part of any savvy trader’s arsenal. Mastering the intricate world of option trading requires a deep understanding of various order types, each tailored to execute specific strategies effectively.

Understanding Order Types:

An order type refers to precise instructions given to a broker outlining how a particular option trade should be executed. These instructions encompass factors such as the time frame, price, and quantity of the contract. Choosing the appropriate order type is crucial to align with your trading objectives, whether it’s hedging against potential losses, pursuing speculative opportunities, or implementing complex trading strategies.

1. Market Order

Definition: A market order instructs the broker to execute the trade immediately at the best available price in the market.

Usage: This order type is suitable for traders seeking swift execution, particularly in volatile markets. It’s ideal when the price of the option is less significant than the speed of execution.

Advantages:

- Ensures rapid execution.

- No risk of the trade not getting filled.

Disadvantages:

- Potential for slippage, resulting in a less favorable price than expected.

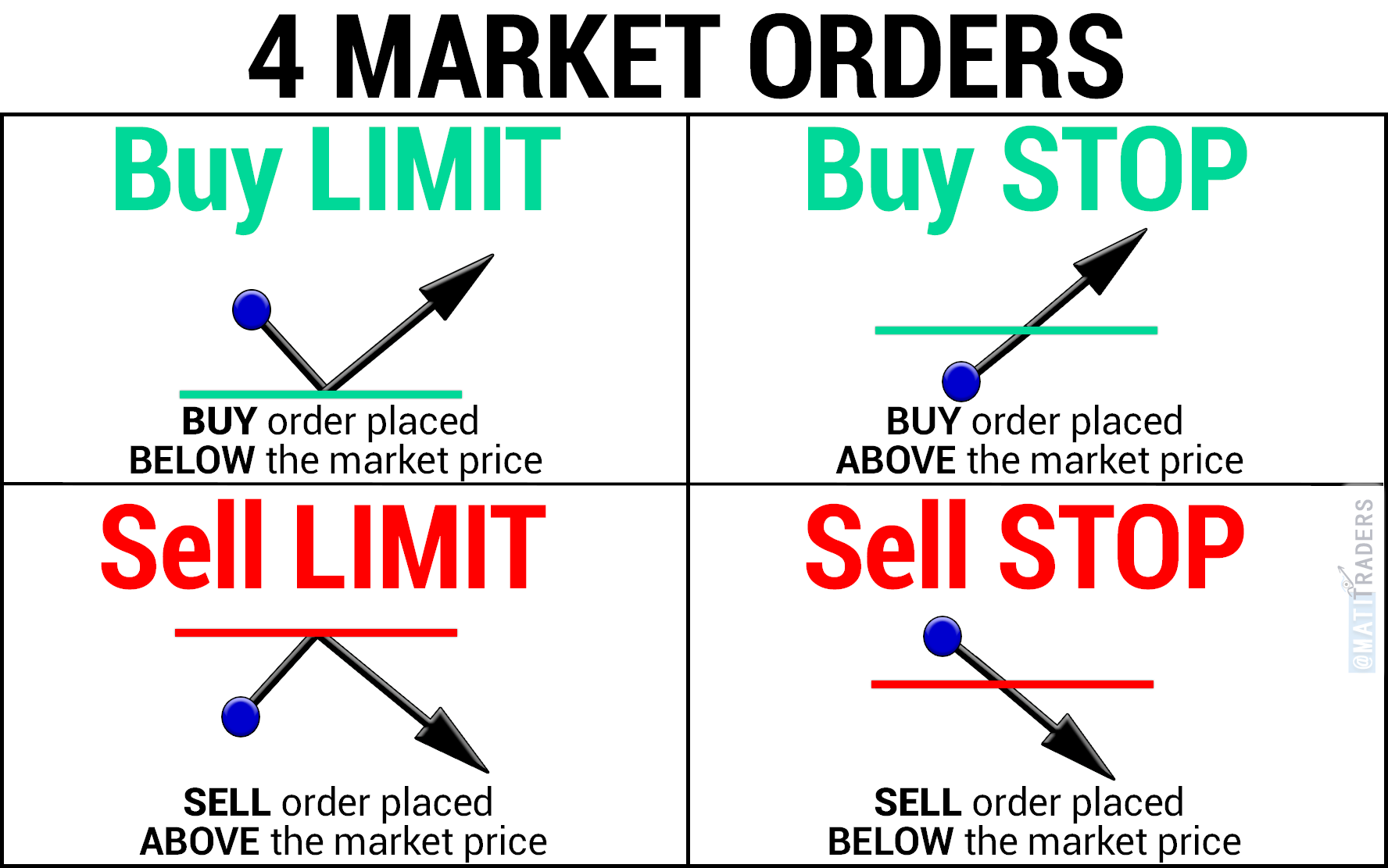

2. Limit Order

Definition: A limit order specifies a maximum price at which a trader is willing to buy or a minimum price at which they’re willing to sell an option contract.

Usage: This order type provides greater control over execution price than a market order. It allows traders to enter or exit positions at a specific price or better.

Advantages:

- Offers price protection.

- Prevents unfavorable executions.

Disadvantages:

- May not get filled immediately, especially in thin markets.

3. Stop Order

Definition: A stop order is a conditional order that becomes active only when the underlying asset reaches a predetermined price level.

Usage: Stop orders are primarily used to limit potential losses or capture potential profits at specific price points.

Types of Stop Orders:

- Stop Loss Order: Executes a sell order when the underlying asset drops to a predefined price, minimizing potential losses.

- Stop-Limit Order: Combines a stop order with a limit order, ensuring the trade is executed only within a specified price range.

Advantages:

- Protects against adverse price movements.

- Automates risk management.

Disadvantages:

- Potential for the trade not getting filled if the market moves too quickly.

Image: tradesmartonline.in

4. Stop-Market Order

Definition: A stop-market order is similar to a stop order, but instead of a limit price, it executes a market order once the specified price level is triggered.

Usage: This order type combines the price protection of a stop order with the immediate execution of a market order.

Advantages:

- Ensures rapid execution after the trigger price is hit.

- Protects against large drawdowns.

Disadvantages:

- Potential for slippage, as with market orders.

5. One-Cancels-the-Other (OCO) Order

Definition: An OCO order consists of two linked orders, typically a stop-loss order and a take-profit order. If one order is executed, the other is automatically canceled.

Usage: OCO orders allow traders to simultaneously set up a protective stop-loss order and a profit-taking target.

Advantages:

- Streamlines order management.

- Ensures risk and reward management.

Disadvantages:

- May limit flexibility, as both orders must be placed at the same time.

Order Typr For Option Trading

Image: www.adigitalblogger.com

Conclusion:

Understanding and selecting the appropriate order type is pivotal for successful option trading. Each order type serves a specific purpose, catering to diverse trading strategies. By mastering the nuances of market orders, limit orders, stop orders, stop-market orders, and OCO orders, traders can execute their trades with precision and maximize their potential for profitability while effectively managing risk.