In the realm of financial markets, options trading stands as a powerful instrument with the potential to amplify gains and mitigate risks. To harness this power, many traders turn to Microsoft Excel, a versatile spreadsheet application that empowers users with a robust toolkit for financial analysis, charting, and option pricing calculations. In this exhaustive guide, we dive deep into the world of option trading using Excel, unearthing its potential and equipping you with the knowledge to maximize your trading performance.

Image: findandbrowsedistinctiveproperty.blogspot.com

Navigating the Labyrinth of Options

Options, financial instruments with the right but not the obligation to buy (call) or sell (put) an underlying asset at a predetermined price on or before a specified date, represent a dynamic and complex domain. Yet, armed with the appropriate knowledge and tools, traders can master the art of options trading, reaping its benefits and navigating its intricacies.

Excel: Your Financial Fortress

Microsoft Excel’s capabilities extend far beyond simple spreadsheets, transforming it into a financial powerhouse. Its vast array of formulas, functions, and charting tools empowers traders with advanced analytical capabilities, precise option pricing calculations, and real-time market data integration. By harnessing the versatility and adaptability of Excel, traders gain a competitive edge in the options arena.

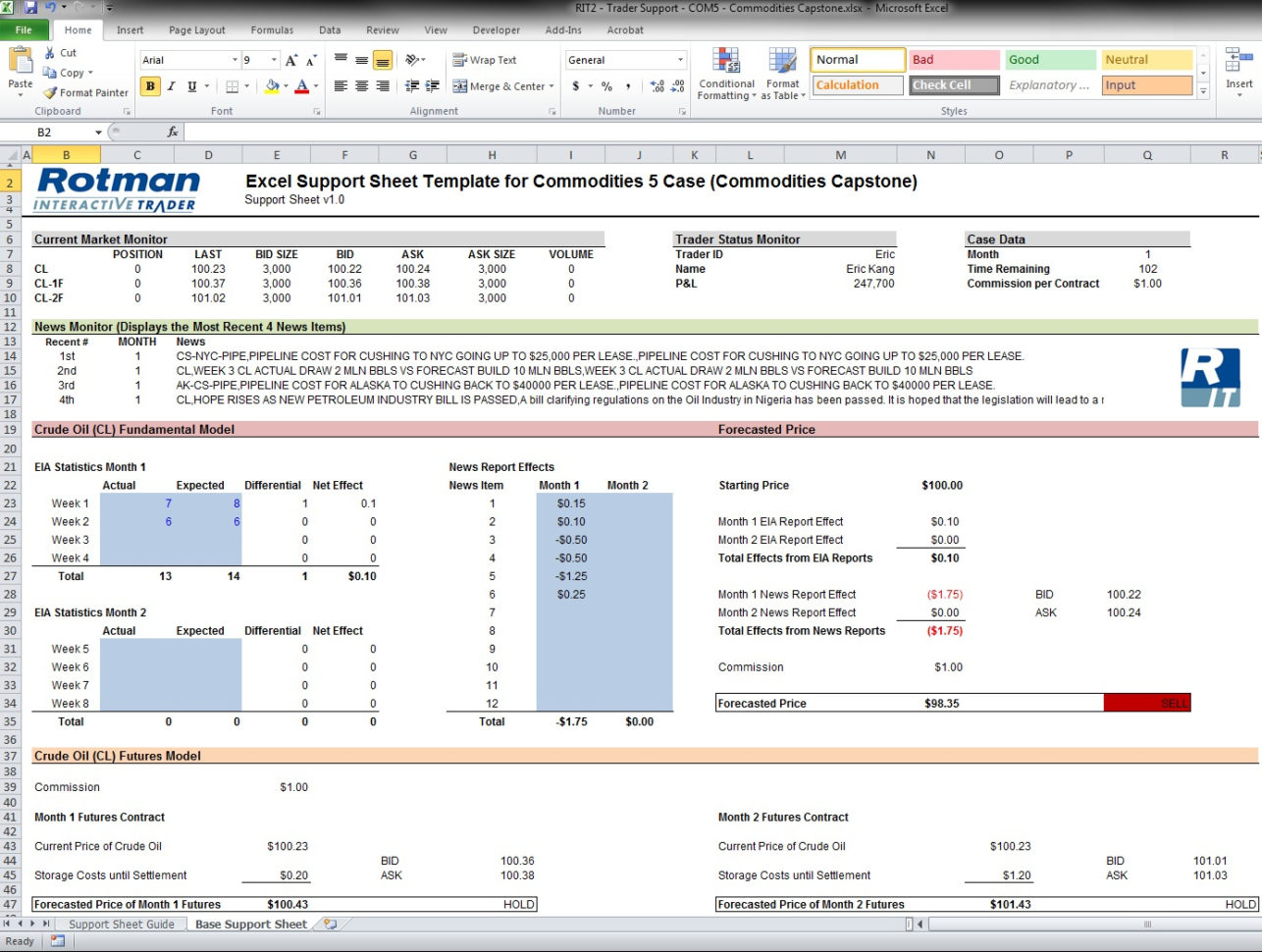

Deftly Navigating the Option Pricing Landscape

The heart of option trading lies in accurately determining the fair value of these contracts, a task made effortless with Excel’s inherent prowess. The venerable Black-Scholes model, embedded within Excel’s arsenal, provides a robust framework for pricing both call and put options, considering vital parameters such as underlying asset price, strike price, time to expiration, risk-free interest rate, and volatility. With Excel as your steadfast companion, you’ll master the intricacies of option pricing, unlocking the gateway to informed trading decisions.

Image: db-excel.com

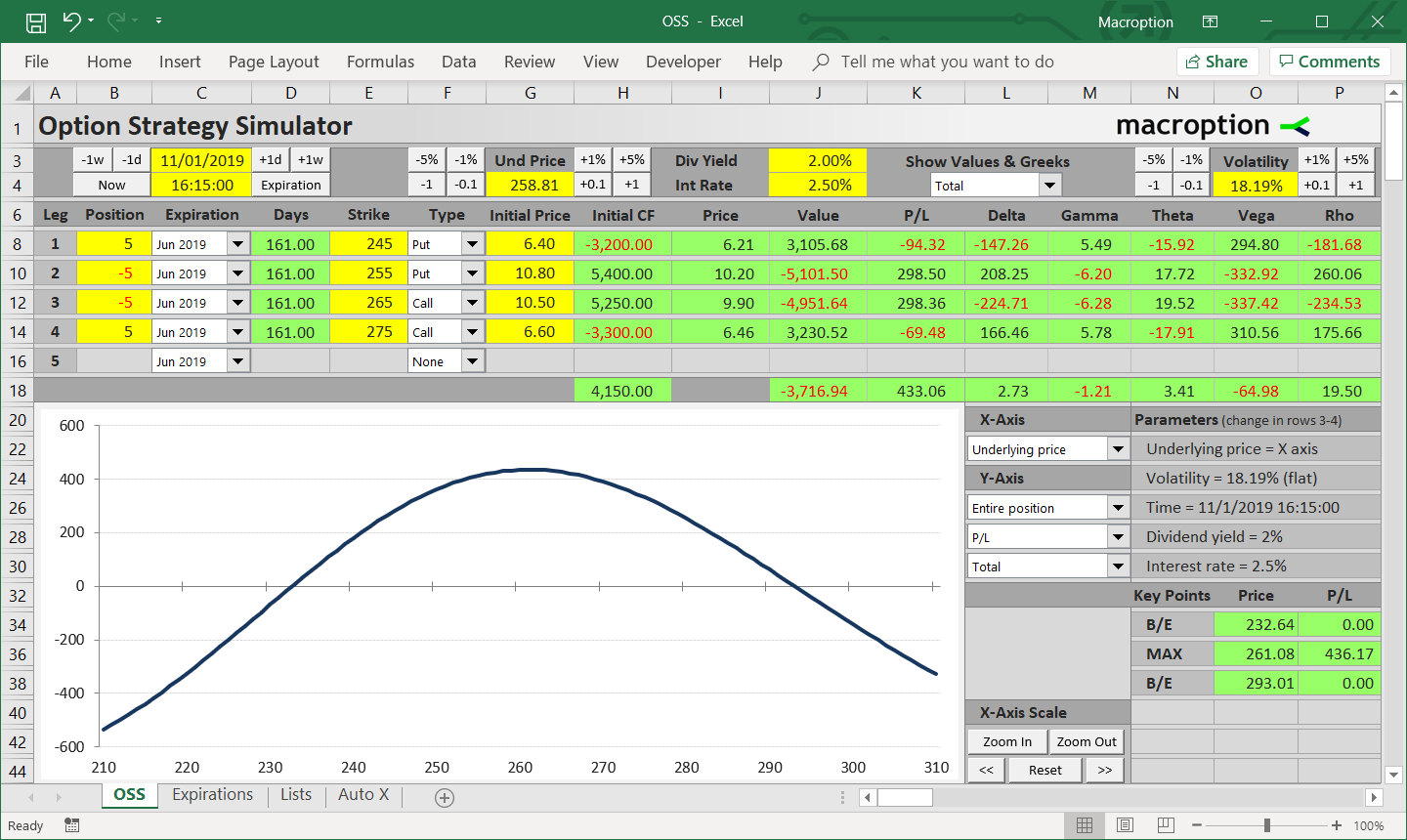

Unveiling the Secrets of Options Strategies

Options strategies, intricate combinations of multiple options, are the cornerstone of sophisticated trading endeavors, unlocking a world of risk management and potential profit maximization. Excel emerges as the indispensable ally in unraveling the intricacies of these strategies, enabling traders to seamlessly evaluate their risk-reward profiles, fine-tune their execution, and optimize their trading outcomes.

The Power of Visual Analytics

The adage “a picture is worth a thousand words” rings true in the realm of financial analysis. Excel’s charting capabilities transform complex data into visually compelling graphs, allowing traders to discern trends, identify patterns, and make informed decisions at a glance. By leveraging charts to visualize option prices, traders can intuitively gauge market sentiment, track price movements, and pinpoint potential trading opportunities.

Realizing the Potential of Real-Time Data

In the fast-paced world of options trading, accessing real-time market data is paramount, and Excel stands ready to deliver. Seamlessly integrating with data feeds from reputable sources, Excel empowers traders with up-to-the-minute insights into market movements, enabling them to make agile adjustments to their trading strategies and capitalize on market shifts as they unfold.

Option Trading Excel

https://youtube.com/watch?v=KxfmoR0cjxk

Conclusion: Empowering Traders with Excel’s Mastery

Through this comprehensive guide, we’ve embarked on an enlightening journey, exploring the boundless potential of Excel for options trading. By harnessing its analytical prowess, pricing models, strategy evaluation tools, visual analytics capabilities, and real-time data integration, traders gain an unrivaled advantage, navigating the complexities of the options market with precision and confidence. Embrace the power of Excel today, and witness your trading endeavors soar to new heights of success.