Embark on an Empowering Journey into Excel Option Trading

Image: corinaamira.blogspot.com

With the advent of advanced trading tools, the once formidable world of option trading has become increasingly accessible. Among these indispensable aids, Microsoft Excel reigns supreme, offering a comprehensive suite of functionalities that streamline complex calculations and empower traders at all levels. In this comprehensive guide, we’ll delve into the intricacies of Excel option trading, arming you with the knowledge and resources to leverage this remarkable tool to maximize your trading acumen.

Excel Option Trading: The Ultimate Catalyst for Success

Excel, a widely accessible and user-friendly software, provides an immersive platform for option trading. Its potent formulas and wide range of functions cater to the diverse needs of both seasoned professionals and aspiring traders. From calculating Greeks and implied volatility to simulating trade scenarios and optimizing strategies, Excel empowers you to harness its myriad capabilities to gain a competitive edge in the dynamic world of options.

A Comprehensive Exploration of Option Trading Fundamentals

To fully appreciate the power of Excel option trading, a solid grasp of its underlying concepts is paramount. Options, essentially contractual agreements, grant buyers the right (but not the obligation) to buy or sell an underlying asset at a predetermined price within a specified timeframe. Understanding these essential components is the cornerstone of successful option trading.

Unveiling the Secrets of Excel Option Trading

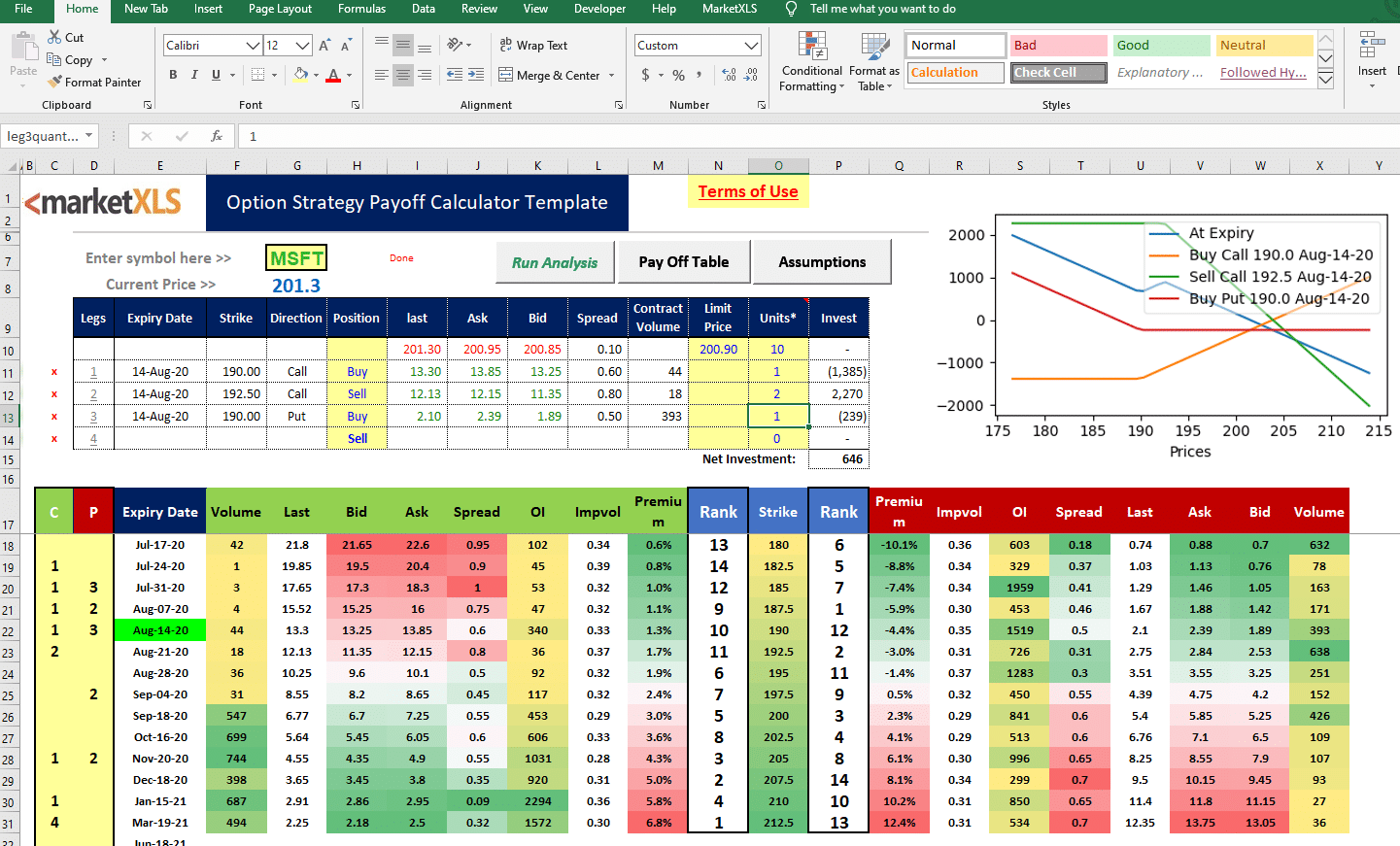

Excel seamlessly integrates key option trading concepts into its versatile toolkit. Traders can effortlessly calculate vital metrics such as delta, gamma, theta, and vega using sophisticated formulas. Implied volatility, a crucial indicator of market sentiment, can also be determined with Excel’s advanced functions.

Image: fadinafeesah.blogspot.com

Empowering Traders: From Basic to Advanced Techniques

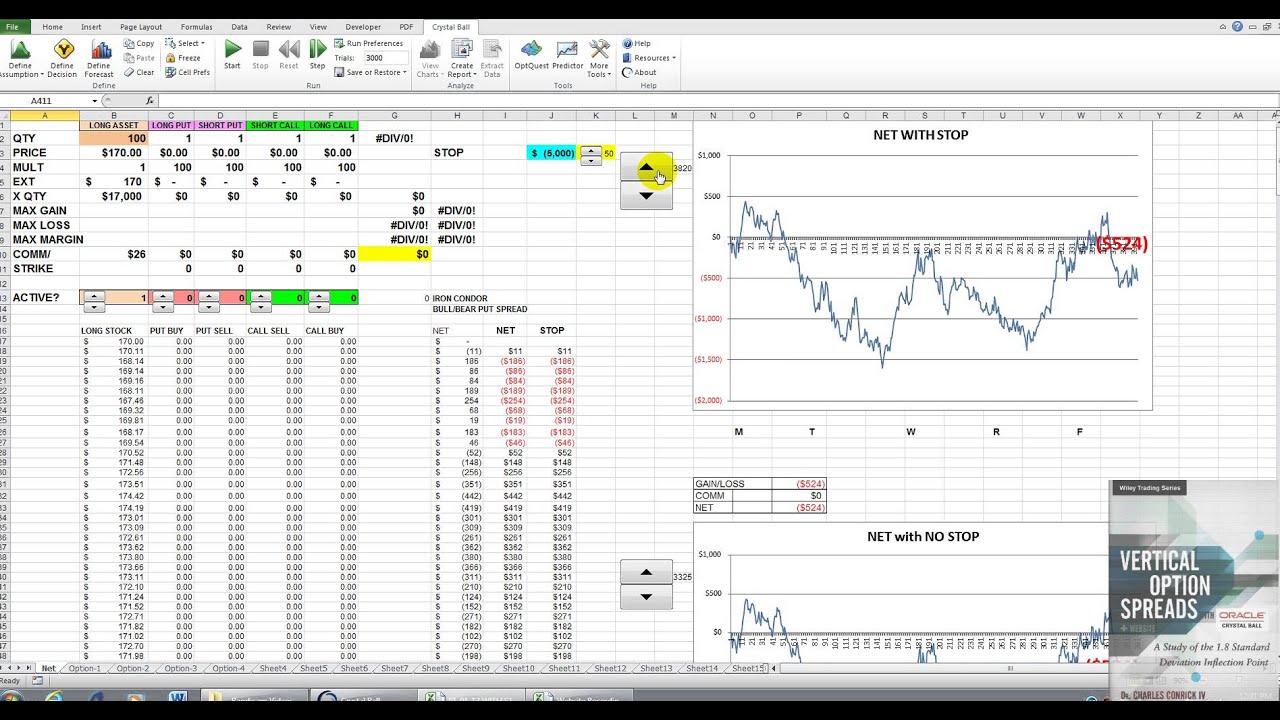

Excel’s vast repertoire extends far beyond fundamental calculations. It empowers traders to embark on advanced strategies, such as Black-Scholes option pricing models and Monte Carlo simulations. These powerful techniques provide unparalleled insights into option pricing and risk assessment, enabling informed decision-making.

The Future of Excel Option Trading: Innovation and Integration

The realm of Excel option trading is constantly evolving, fueled by technological advancements and innovative integrations. The integration of artificial intelligence and machine learning algorithms is transforming the landscape, enhancing the accuracy of option pricing and risk management.

Excel Option Trading Worksheet

Image: allbinaryoptionssignals.logdown.com

Conclusion: Unleashing the Excel Option Trading Advantage

Embracing Excel option trading opens up a world of possibilities for traders of all backgrounds. By harnessing its versatile capabilities, traders can achieve greater precision in option pricing, optimize trading strategies, and navigate the complex world of options with confidence. Excel’s intuitive interface and diverse functionalities empower you to unlock your full trading potential, giving you a decisive edge in the ever-evolving financial markets.