Introduction

In the intricate world of financial markets, stock options stand out as powerful tools that allow investors to navigate market volatility and potentially enhance their returns. To harness their full potential, however, it’s crucial to master the art of stock option trading, and one indispensable ally in this endeavor is Microsoft Excel. Excel’s robust features and versatility empower you to analyze, evaluate, and execute option strategies with precision and efficiency.

Image: peacecommission.kdsg.gov.ng

Key Concepts in Stock Option Trading

Before delving into the practical aspects of option trading with Excel, let’s first establish a foundation of key concepts:

- Option: A financial contract that gives the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified strike price on or before a specified expiration date.

- Strike Price: The price at which the buyer of the option has the right to exercise the option contract.

- Expiration Date: The date on which the option contract expires and ceases to be valid.

- Premium: The price paid by the buyer of the option to obtain the right to exercise the option.

- Underlying Asset: The security (e.g., stock) or index upon which the option is based.

Excel Tools for Enhanced Option Analysis

Excel equips you with a comprehensive suite of tools that transform option trading from a daunting task into an accessible and strategic endeavor:

- Black-Scholes Model: This widely accepted model allows you to calculate the theoretical value of an option based on various input factors such as the underlying asset’s price, strike price, time to expiration, and volatility.

- Greeks: Greek measures quantify the risk and sensitivity of an option to changes in underlying factors. Excel’s functions like DELTA(), VEGA(), and THETA() provide precise calculations of these Greeks.

- Historical Volatility: Excel’s ability to analyze historical price data enables the calculation of implied volatility, a key parameter used to determine option premiums and trading strategies.

- Risk Analysis: Using Excel’s risk management tools, you can assess the potential risks and rewards associated with different option strategies before making trading decisions.

- Option Chains: Excel allows you to assemble option chains that display the prices and specifications of all available options for a particular underlying asset, giving you a comprehensive view of trading opportunities.

Practical Applications with Excel

Empowered with these Excel tools, traders can navigate the complexities of option trading with confidence:

- Option Pricing: Excel’s Black-Scholes model and data analysis capabilities enable precise option pricing, allowing traders to identify undervalued or overvalued options.

- Strategy Optimization: By simulating different option strategies in Excel, traders can optimize their positions based on factors like risk tolerance and return objectives.

- Risk Management: Excel’s risk analysis tools help traders identify and mitigate potential risks associated with various option strategies.

- Trade Execution: Excel facilitates seamless integration with online trading platforms, allowing traders to execute option trades directly from their spreadsheets.

- Monitoring and Analysis: Traders can track the performance of their option trades over time and analyze the factors influencing their profitability.

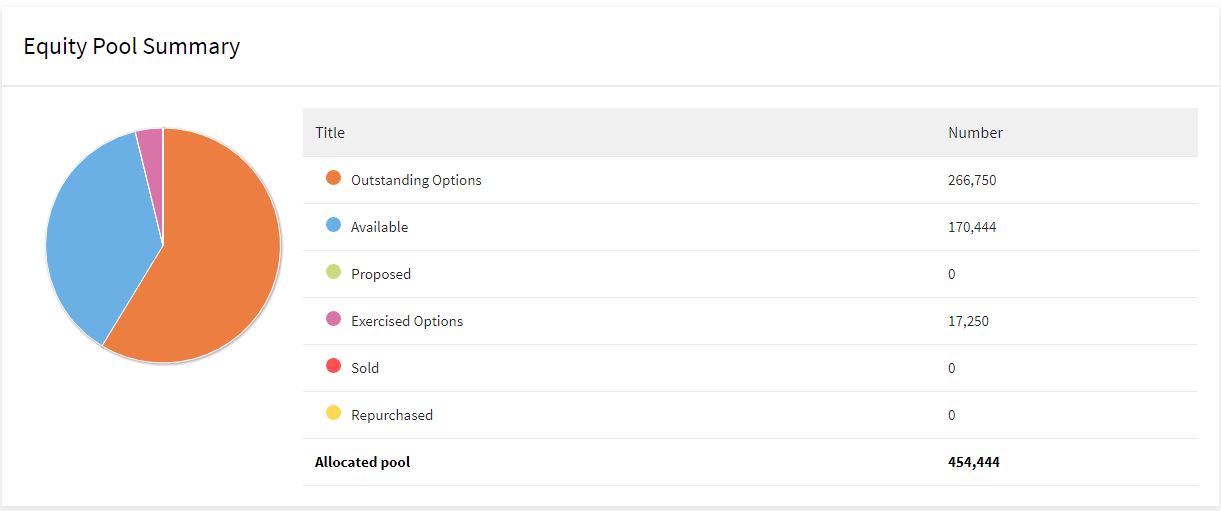

Image: www.equityeffect.com

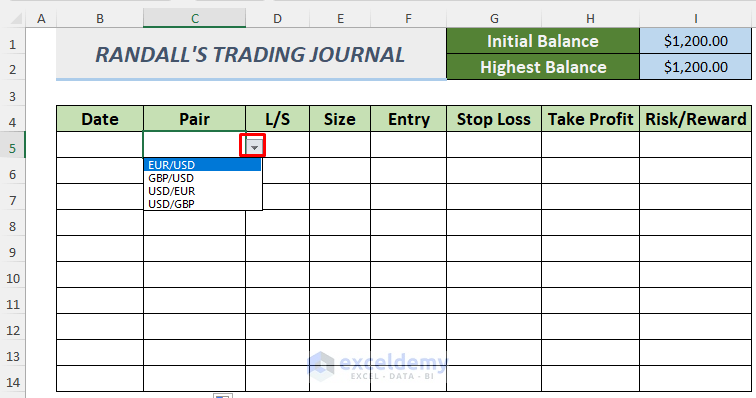

Online Stock Option Trading Guide Plus Ms Excel Software

Image: blog.deriscope.com

Conclusion

Mastering online stock option trading with MS Excel unlocks a world of opportunities for investors. Excel’s powerful tools empower you to analyze options, evaluate strategies, manage risk, and execute trades with precision. Coupled with your knowledge of financial markets, Excel becomes your trusted ally in navigating the intricacies of option trading and potentially maximizing your investment returns.

Embrace the power of Excel, delve into the realm of stock option trading, and unlock the potential for financial success.