In the realm of financial markets, options trading holds a captivating allure for traders and investors seeking to mitigate risks and amplify potential returns. Leveraging mathematical models and the versatility of Microsoft Excel, this tutorial will equip you with the essential knowledge and tools to navigate the complexities of options trading effectively.

Image: www.tradingoptionscashflow.com

Understanding Options: A Path to Informed Trading

At its core, an option represents a contract that grants the buyer the right, but not the obligation, to either buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specified date (expiration date). Comprehending these fundamental concepts forms the foundation for successful options trading.

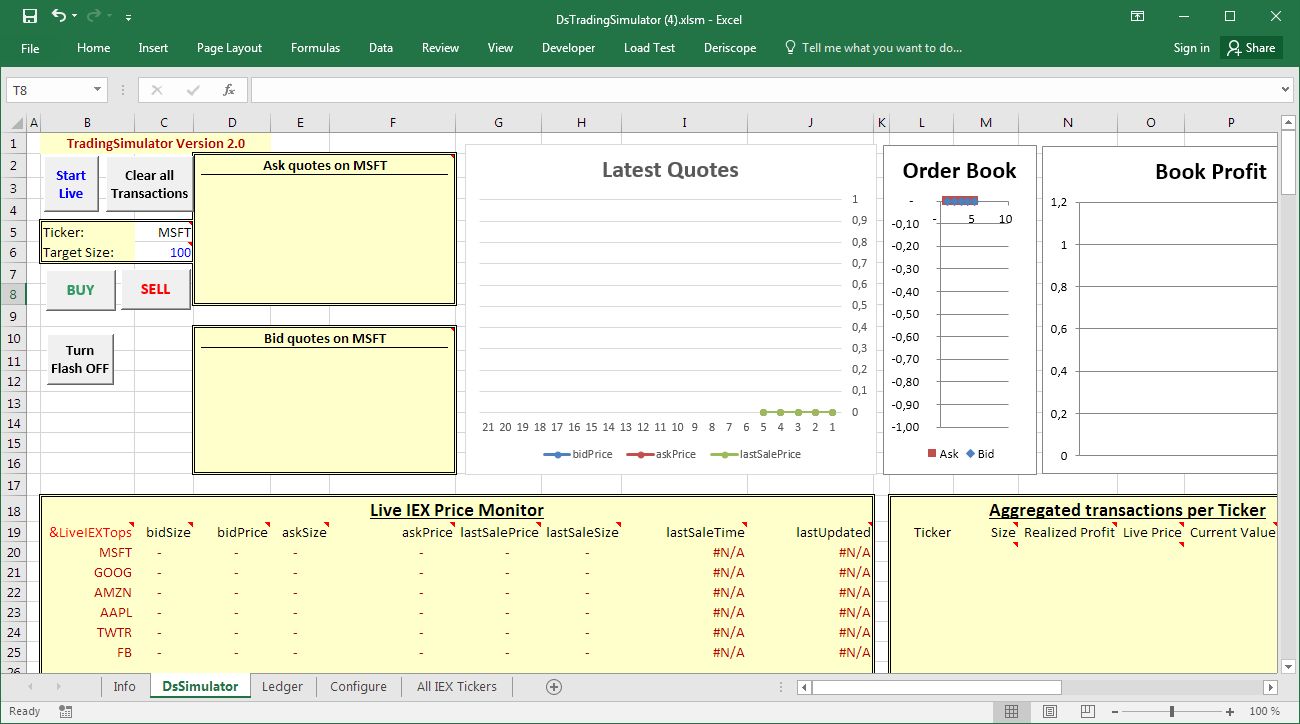

Excel as Your Trading Companion: Simplifying Options Analysis

Excel emerges as an invaluable ally in options trading, empowering you with robust computational capabilities and a user-friendly interface. Through its native functions and add-ons, Excel enables calculation of option prices, risk assessment, and optimization of trading strategies.

Exploring Excel’s Options Pricing Formulas: Delving into Black-Scholes-Merton

At the heart of options pricing lies the renowned Black-Scholes-Merton model. This formula considers factors such as underlying asset price, strike price, time to expiration, volatility, and risk-free rate to determine the theoretical value of an option. By integrating this formula into Excel, you gain the ability to accurately price options and make informed trading decisions.

Unveiling the Greeks: Deciphering Option Sensitivity

Understanding option Greeks, metrics that quantify the sensitivity of option prices to changes in underlying variables, is vital for risk management. Delta, Gamma, Theta, Vega, and Rho provide valuable insights into how options react to fluctuations in key parameters.

Crafting Trading Strategies: Harnessing Excel’s Analytical Prowess

Excel’s versatility extends to developing and testing trading strategies. From simple moving averages to complex option spreads, Excel empowers traders to analyze historical data, identify trading opportunities, and evaluate potential outcomes.

Managing Risk: An Essential Aspect of Options Trading

Risk management occupies a paramount position in options trading. Excel provides tools for calculating position risk, setting stop-loss orders, and implementing hedging strategies to protect capital and enhance overall portfolio performance.

Charting Tools: Visualizing Market Dynamics

Excel’s charting capabilities offer a comprehensive visual representation of market data, aiding traders in identifying trends, support and resistance levels, and potential trading opportunities. Customizing charts with technical indicators further enhances market analysis.

Conclusion: Excel – Your Indispensable Options Trading Companion

By embracing the power of Excel in options trading, you unlock a world of possibilities. From pricing options to managing risk, Excel serves as an indispensable tool that empowers traders to make informed decisions, enhance their strategies, and navigate the complexities of financial markets with greater confidence.

Investing in the mastery of Excel options trading opens doors to refined trading strategies, optimized portfolio management, and the potential for substantial returns. Whether you are a seasoned trader or just starting to explore the world of options, incorporating Excel into your trading arsenal will undoubtedly elevate your trading abilities to new heights.

Image: peacecommission.kdsg.gov.ng

Excel Options Trading Tutorial

Image: letyourmoneygrow.com