Navigating the intricate world of stock options trading can be a daunting task, particularly if you reside in the United Kingdom. With a plethora of stock options trading brokers operating within the UK, choosing the one that aligns with your investment objectives and risk tolerance is paramount. This comprehensive guide will delve into the essential aspects of stock options trading brokers in the UK, empowering you with the knowledge necessary to make informed decisions.

Image: www.cacaoavila.com

Demystifying Stock Options Trading

Stock options are financial instruments that confer upon the holder the right, but not the obligation, to buy or sell a specific number of shares of a particular stock at a predetermined price and within a specified time frame. These versatile instruments provide investors with the potential to magnify their returns, hedge against market volatility, and participate in intricate investment strategies.

Choosing the Right Stock Options Trading Broker UK

Selecting the ideal stock options trading broker in the UK involves a thorough evaluation of various factors, including:

- Fees and Commissions: Brokers charge fees and commissions for executing trades, which can vary significantly. Compare the fee structures of different brokers and opt for one that aligns with your trading volume and available capital.

- Platform Functionality: The trading platform offered by the broker should be user-friendly, intuitive, and provide robust charting and analysis tools. Consider the platform’s compatibility with your preferred devices and whether it offers access to advanced trading features.

- Regulatory Compliance: Choose a broker that is regulated by a reputable financial authority within the UK, such as the Financial Conduct Authority (FCA), to ensure the safety and integrity of your investments.

- Customer Service: Reliable and responsive customer support is crucial for resolving trading-related queries promptly. Evaluate the availability and quality of customer service offered by the broker.

- Educational Resources: Consider brokers that provide educational resources and market analysis to assist traders with informed decision-making and developing their trading skills.

Navigating the Landscape of Stock Options Trading Brokers UK

The UK financial landscape boasts a diverse range of stock options trading brokers, each with its unique strengths and offerings. Some notable examples include:

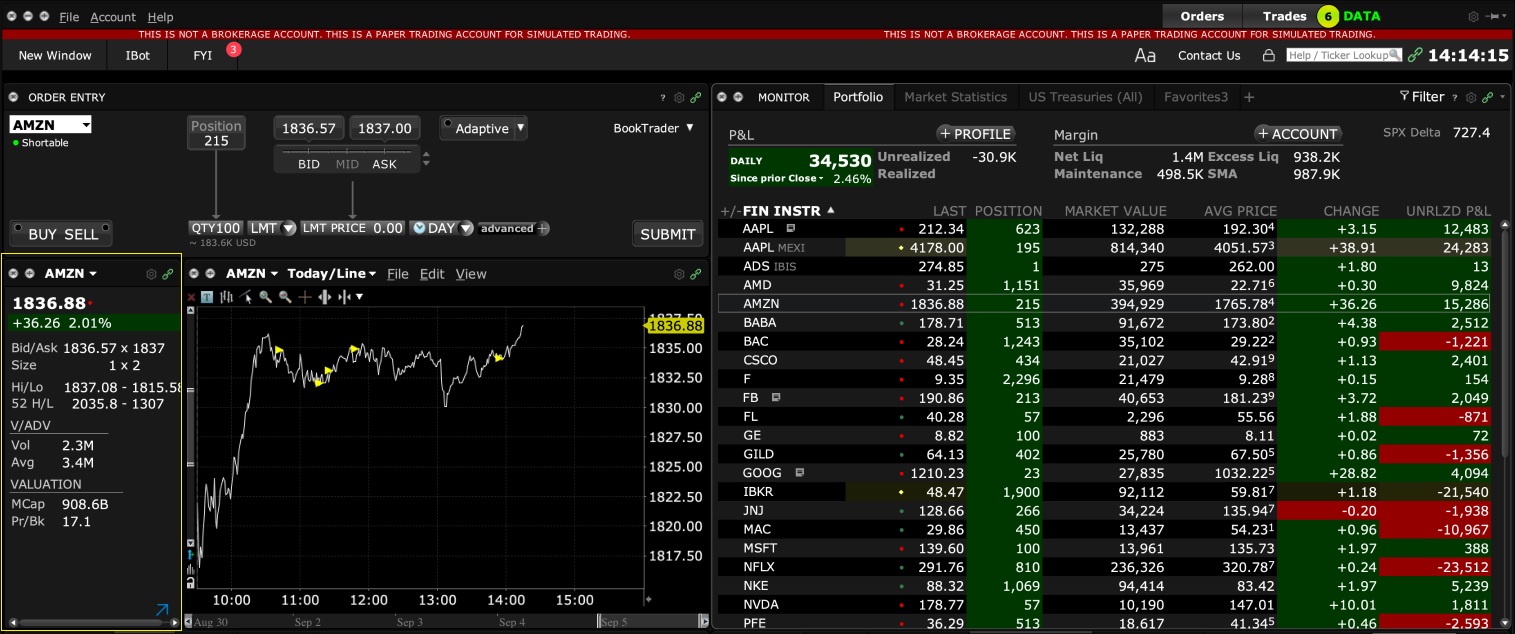

- Interactive Brokers: A renowned global brokerage offering a comprehensive suite of trading instruments, including stocks, options, forex, and futures. Known for its robust platform, low fees, and extensive educational resources.

- IG Group: A reputable broker specializing in spread betting and CFDs (Contracts for Difference), also offering stock options trading. Boasts a user-friendly platform, competitive fees, and educational seminars and webinars.

- Saxo Bank: A Danish multinational investment bank providing a full-service brokerage platform with access to a wide range of financial instruments. Known for its advanced platform, tailored account types, and personalized investment solutions.

- Admiral Markets: A popular broker offering forex and CFD trading, as well as stock options trading. Features a user-friendly platform, competitive fees, and educational materials.

- CMC Markets: A well-established broker specializing in forex and CFD trading, but also offers stock options trading. Known for its proprietary trading platform, educational webinars, and risk management tools.

Image: brokerchooser.com

Enhancing Your Options Trading Journey

Maximizing your success in stock options trading requires meticulous preparation and ongoing learning. Consider the following tips to enhance your journey:

- Define Your Investment Goals: Clearly define your investment objectives and risk tolerance before venturing into stock options trading.

- Master Options Strategies: Educate yourself on the various options trading strategies and their potential applications.

- Manage Risk Effectively: Employ effective risk management strategies, such as stop-loss orders and position sizing, to mitigate potential losses.

- Monitor Market Trends: Staying abreast of market trends and economic news is crucial for informed decision-making.

- Seek Professional Guidance: If necessary, consult with a qualified financial advisor or broker for personalized guidance and tailored investment strategies.

Stock Options Trading Brokers Uk

Image: aelieve.com

Conclusion

Navigating the world of stock options trading in the UK requires careful consideration and a thorough understanding of the available options. By evaluating the key factors outlined in this article and researching the various stock options trading brokers operating within the UK, you can make informed decisions that align with your investment goals and risk appetite. Remember to exercise due diligence, learn from experienced traders, and continuously educate yourself to enhance your chances of success in this exciting and potentially lucrative market.