Introduction:

Are you ready to embark on the thrilling world of options trading? As the global markets continue to fluctuate, options trading has emerged as an increasingly popular way for savvy investors to navigate these dynamic waters. In the United Kingdom, there’s no shortage of online brokers offering their services to empower traders. However, choosing the right broker is paramount to maximizing your potential and minimizing risks. This comprehensive guide will delve into the intricacies of options trading online brokers UK, providing you with the knowledge and insights needed to make an informed decision.

Image: yzypohu.web.fc2.com

Understanding Options Trading:

Options trading involves contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset, such as a stock or an index, at a specific price within a specified timeframe. Options can be categorized into two main types: calls and puts. Call options grant the holder the right to buy an asset, while put options grant the right to sell an asset. The versatility of options allows traders to speculate on market movements, hedge against risks, and enhance their investment strategies.

Factors to Consider When Choosing an Options Trading Broker:

With numerous options trading online brokers UK available, choosing the right one can be a daunting task. Here are key factors to consider:

-

Regulation and Reputation: Verify that the broker is authorized and regulated by the Financial Conduct Authority (FCA), the UK’s financial regulatory body. A reputable broker adheres to ethical guidelines, ensures client fund safety, and complies with industry standards.

-

Trading Platform: The trading platform is your gateway to the markets. Look for a platform that is user-friendly, intuitive, and equipped with advanced features such as real-time market data, charting tools, and risk management functionalities.

-

Fees and Commissions: Brokerage fees and commissions can eat into your profits. Compare fees charged by different brokers and opt for one that offers competitive rates, transparency, and various account options to suit your trading needs.

-

Customer Service: When the markets move fast, having reliable customer support can be invaluable. Choose brokers with responsive and knowledgeable support teams available through multiple channels to assist you with queries or troubleshooting.

-

Education and Resources: A supportive broker provides educational resources such as training courses, webinars, and market analysis to enhance your trading knowledge and skills.

Top Options Trading Online Brokers UK:

Based on the aforementioned criteria, here are some of the top options trading online brokers UK:

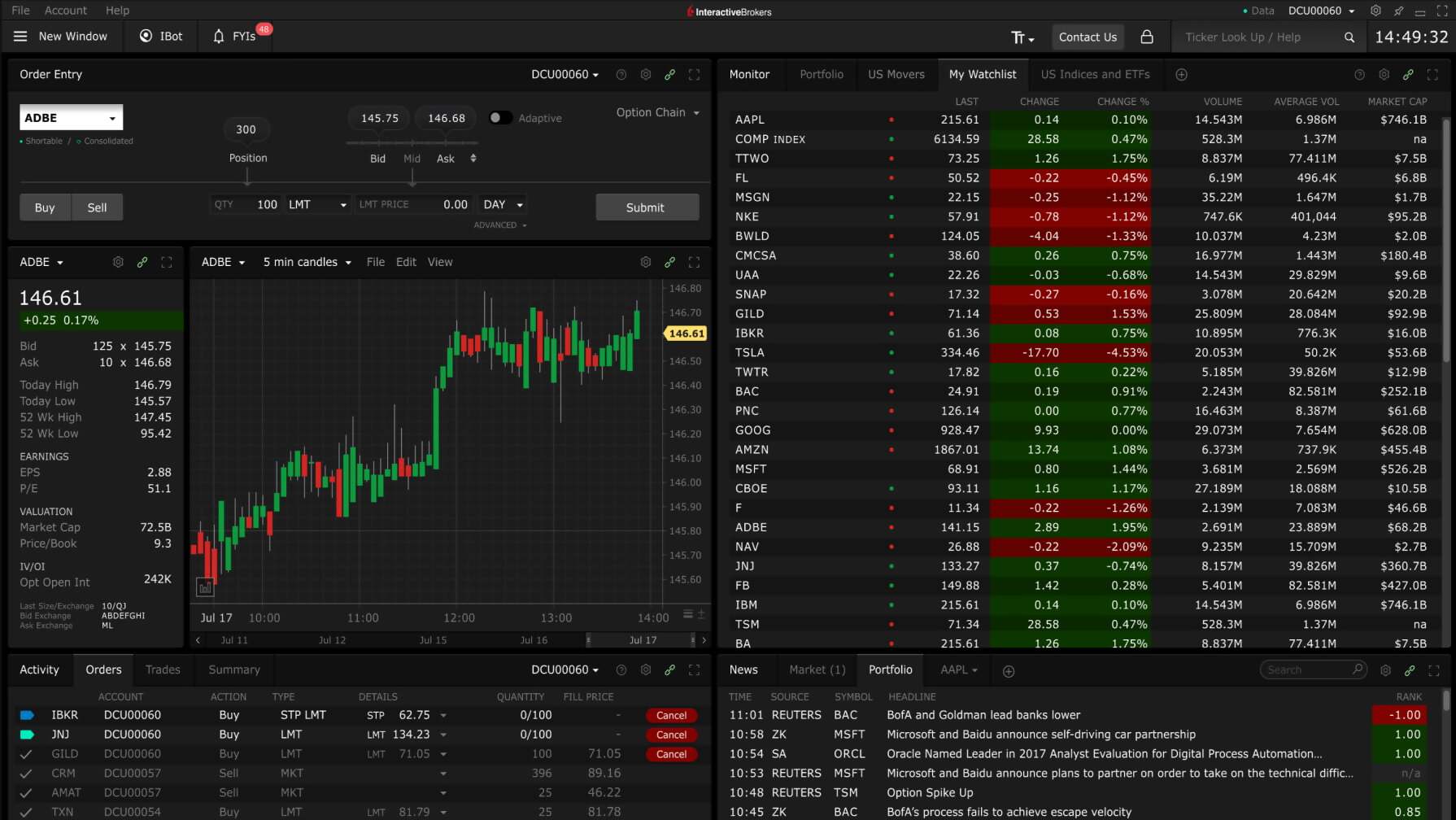

1. Interactive Brokers: Renowned for its comprehensive trading platform, low fees, and extensive market coverage, Interactive Brokers is a top choice for experienced options traders.

2. Saxo Bank: Known for its powerful trading platform and vast research resources, Saxo Bank caters to both retail and institutional traders.

3. IG: Offering a user-friendly platform, IG is popular among beginner and intermediate options traders, providing educational resources and competitive pricing.

4. TD Ameritrade: TD Ameritrade has a robust trading platform, intuitive mobile app, and a reputation for reliable customer service.

5. eToro: As a social trading platform, eToro allows traders to copy trades from experienced investors, making it suitable for those new to options trading.

Image: www.interactivebrokers.co.uk

Expert Insights and Actionable Tips:

-

Start Gradually: Options trading involves risks, so it’s crucial to start with a small investment and gradually increase your exposure as you gain experience.

-

Understand Volatility: Volatility is a measure of price fluctuations. Options trading heavily relies on volatility; study the underlying asset’s historical volatility to make informed decisions.

-

Set Exit Strategies: Determine your profit targets and risk tolerance before entering a trade. Have clear plans for exiting positions to minimize losses.

Options Trading Online Brokers Uk

Conclusion:

Navigating the options trading landscape requires a knowledgeable and trusted partner. By carefully considering the factors outlined in this guide, you can choose an options trading online broker UK that aligns with your needs and aspirations. Remember to trade responsibly, seek professional financial advice if necessary, and let the market’s momentum guide you towards financial success.