Embarking on the thrilling journey of option trading can be daunting, but partnering with the right broker can elevate your experience and maximize your returns. In this comprehensive guide, we delve into the intricacies of option trading, exploring the nuances of brokers, market trends, and expert advice to empower you with the knowledge and strategies for success.

Image: millennialmoney.com

The Landscape of Option Trading Brokers: A Diverse Spectrum of Services

Navigating the Broker Spectrum: Exploring Options for Every Need

The brokerage landscape offers a myriad of options, each tailored to specific trading styles and preferences. Whether you’re starting your journey or a seasoned professional, there’s a broker that aligns with your aspirations. This diversity caters to various levels of experience, account sizes, trading strategies, and specialized platforms.

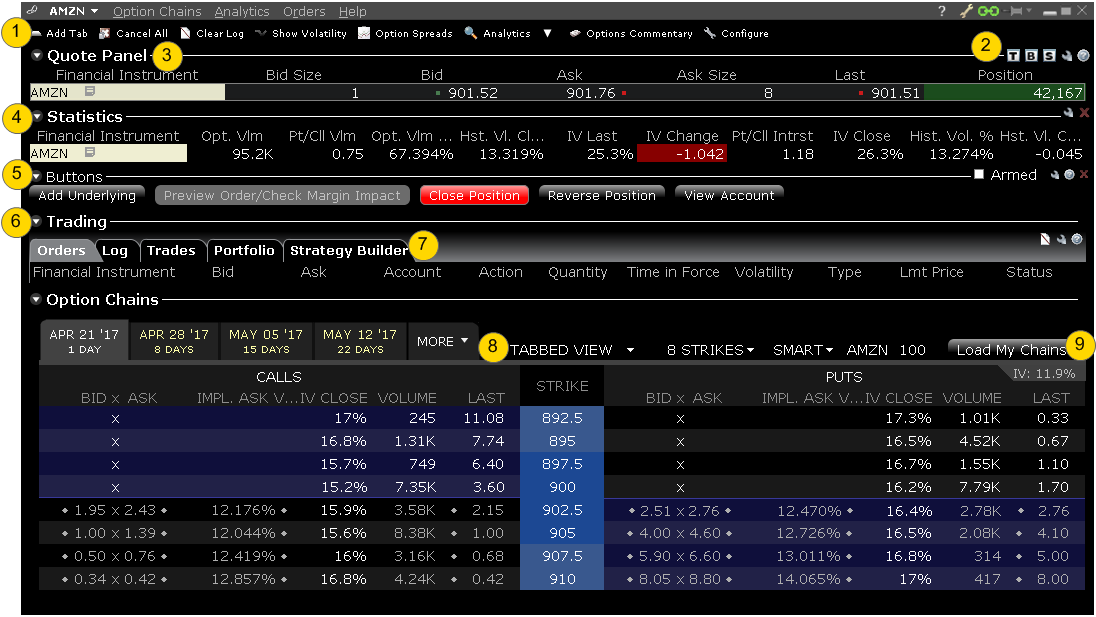

Brokers offering a comprehensive suite of services and advanced platforms appeal to experienced traders seeking sophisticated execution capabilities and analytical tools. Seasoned traders demand platforms that provide rapid order execution, charting capabilities, and in-depth market data to make informed decisions.

Novice traders, on the other hand, prioritize ease of use, educational resources, and low trading costs to minimize risks and optimize learning. Brokers catering to beginners provide user-friendly interfaces, simplified trading tools, and educational materials to equip them with the knowledge to embark on their trading journey confidently.

Understanding your trading style and specific requirements is paramount when selecting a broker. Meticulously assess their commission structure, account minimums, trading platforms, and customer support to identify the broker that aligns seamlessly with your trading goals.

Comprehensive Guide to Option Trading: Unlocking the Secrets

Option trading, a complex yet lucrative segment of financial markets, involves the buying and selling of options contracts. These contracts bestow upon their holders the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a stipulated date.

Options trading empowers investors with immense flexibility and potential returns but also carries inherent risks. Mastering the intricacies of options trading requires a thorough understanding of contract types, pricing models, and trading strategies.

Latest Trends and Developments Reshaping Option Trading

The world of option trading is constantly evolving, with technological advancements and regulatory changes shaping its trajectory. The surge in mobile trading apps and the advent of artificial intelligence and machine learning algorithms have transformed the trading experience, offering traders greater mobility and sophisticated analysis capabilities.

Regulatory measures, such as increased transparency and investor protection initiatives, have contributed to a more stable and transparent trading environment. As the option trading landscape continues to evolve, staying abreast of these trends is crucial for success.

Image: brokerchooser.com

Expert Advice and Trading Strategies for Maximizing Returns

Seasoned traders often employ a combination of strategies to navigate the complexities of option trading. Understanding market sentiment, analyzing historical data, and implementing risk management techniques are essential elements of successful trading.

Option trading strategies abound, each with its unique risk-reward profile. Covered calls, put selling, and iron condor strategies are popular choices among traders with varying risk appetites and return expectations. Seeking personalized advice from a financial advisor can help you tailor a trading strategy that aligns with your financial goals and risk tolerance.

FAQs: Demystifying Option Trading

Q: Are there any specific credentials or certifications I need to seek when choosing a broker?

A: While it’s not mandatory, certain credentials, such as the Certified Financial Planner (CFP) or the Chartered Financial Analyst (CFA), indicate a broker’s commitment to professional development and ethical standards.

Q: What factors should I consider when selecting an option trading platform?

A: Usability, charting tools, order execution capabilities, and access to market data are key factors to evaluate when choosing a platform. Consider your trading style and specific requirements to find the best fit.

Option Trading Best Broker

Image: www.ibkrguides.com

Conclusion: Unlocking the Gateway to Option Trading Success

Embracing the world of option trading empowers you with the potential to navigate market fluctuations and enhance your financial aspirations. Selecting the right broker, comprehending market trends, and implementing expert strategies are fundamental pillars of trading success.

As you embark on this exciting journey, remember that knowledge is your most valuable asset. Continuous education, critical analysis, and careful decision-making will guide you towards your trading goals.

Are you ready to delve into the captivating world of option trading? Together, we can unlock the potential and navigate the complexities of this thrilling financial arena.