Embark on the Journey of Informed Option Trading with Excel’s Versatile Tools

In the dynamic landscape of financial markets, option trading has emerged as a potent strategy for risk management and profit generation. However, navigating the complexities of option contracts requires a blend of knowledge, intuition, and efficient tools. Among these vital tools, Excel templates stand out as indispensable aids for traders seeking to make informed decisions and maximize profitability.

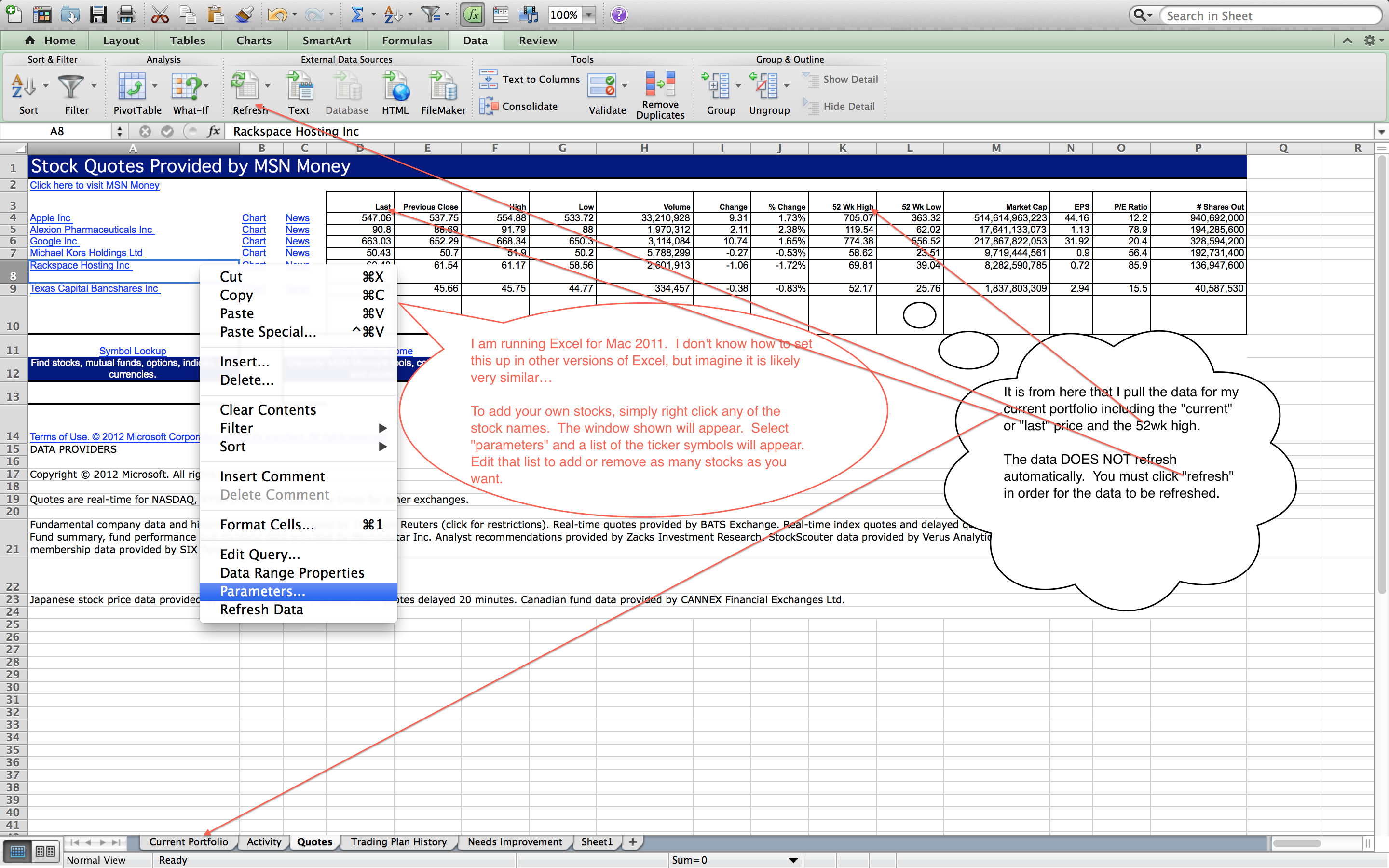

Image: www.stock-data-solutions.com

Excel templates, tailored to the specific demands of option trading, empower traders with a comprehensive suite of features. From real-time price tracking to customizable charting capabilities and advanced analytics, these templates provide a comprehensive platform for analyzing market trends, evaluating potential trades, and making insightful trading decisions.

Essential Excel Templates for Every Option Trader

1. Options Greeks Calculator Template:

This template simplifies the intricate calculations associated with options Greeks, including Delta, Gamma, Theta, Rho, and Vega. With real-time data integration, traders can swiftly assess the sensitivity of their positions to changes in underlying asset prices, volatility, time, and interest rates.

2. Implied Volatility Calculator Template:

Implied volatility plays a pivotal role in option pricing. This template provides a straightforward method to calculate implied volatility, equipping traders with valuable insights into market expectations and potential trading opportunities.

3. Historical Volatility Analysis Template:

Historical volatility analysis lays the groundwork for understanding market price movements and risk assessment. This template allows traders to chart historical price fluctuations, identify volatility patterns, and anticipate future volatility levels.

4. Option Price Sensitivity Analysis Template:

This template enables traders to explore the potential impact of various market conditions on their option positions. By adjusting parameters such as underlying asset price, volatility, and expiration date, traders gain a clearer perspective on the potential profit and loss scenarios.

5. Monte Carlo Simulation Template:

Monte Carlo simulation adds an element of stochastic analysis to option trading. This template facilitates probabilistic modeling, providing valuable insights into the likelihood of various outcomes and potential profit distributions.

Empowering Informed Decisions and Maximizing Profitability

Excel templates for option trading transcend the boundaries of mere calculations. They enhance trading strategy development, optimize position sizing, and foster effective risk management practices. Through the integration of dynamic data, customizable visualizations, and powerful analytics, these templates empower traders to identify trading opportunities, evaluate the potential for success, and make informed decisions that maximize profitability.

Moreover, the user-friendly interface of these templates eliminates the need for complex coding or data analysis expertise. Traders of all experience levels can leverage the capabilities of these templates to streamline their trading workflow and make insightful decisions without wrestling with technical complexities.

Image: coinpub.org

Excel Templates For Option Trading

Image: db-excel.com

Conclusion: Excel Templates – An Indispensable Tool for Option Trading Success

In the ever-evolving realm of option trading, Excel templates emerge as indispensable tools, providing traders with a comprehensive solution for informed decision-making and enhanced profitability. By harnessing the versatility of Excel, these templates unlock valuable insights into market dynamics, facilitate robust analysis, and empower traders to capitalize on trading opportunities with confidence and efficiency. Whether you are a seasoned veteran or a novice trader, embracing the capabilities of Excel templates will elevate your option trading acumen, enabling you to navigate market complexities with precision and maximize your trading potential.