Unveiling the Secrets of Options Trading Success

Options trading, a multifaceted and potentially lucrative financial strategy, has captivated the attention of investors seeking to amplify their returns or hedge against market fluctuations. However, mastering this complex endeavor requires a robust understanding of options strategies and meticulous tracking of trades. Enter the realm of options trading spreadsheet templates – indispensable tools that empower traders to streamline their operations, enhance precision, and maximize profitability.

Image: www.pinterest.com

The Genesis of Options Trading Templates

The advent of digital spreadsheets revolutionized options trading by providing traders with a versatile platform to manage their portfolios efficiently. The ability to automate calculations, visualize data, and track historical performance propelled spreadsheet templates to the forefront of options trading software.

Unveiling the Treasure Trove of Options Trading Templates

Myriad options trading spreadsheet templates exist, each tailored to specific trading strategies and risk appetites. A comprehensive template typically encompasses sections for option selection, trade execution, risk management, and performance analysis.

– Option Selection Templates:

These templates facilitate the evaluation of options contracts based on predefined criteria, such as strike price, expiration date, and implied volatility. They assist traders in identifying potentially profitable trading opportunities.

Image: www.youtube.com

– Trade Execution Templates:

These templates streamline the trade execution process by automating order placement, monitoring order status, and calculating transaction costs. They ensure accuracy and efficiency in trade execution.

– Risk Management Templates:

Managing risk is paramount in options trading. These templates incorporate sophisticated risk management techniques, such as delta hedging and stop-loss orders, to mitigate potential losses.

– Performance Analysis Templates:

Tracking and analyzing performance is crucial for traders to refine their strategies and optimize returns. These templates generate comprehensive performance reports that provide insights into trade profitability, risk-reward ratios, and areas for improvement.

Best Practices for Options Trading Spreadsheet Templates

To harness the full potential of options trading spreadsheet templates, consider these best practices:

– Customize to Your Needs:

While pre-made templates offer a solid foundation, customization is key. Tailor the template to align with your specific trading strategies and risk tolerance.

– Accuracy and Validation:

Accuracy is non-negotiable in options trading. Regularly check and validate the formulas and calculations within your templates to ensure precise results.

– Historical Data Integration:

Incorporate historical data into your templates to analyze past performance, identify patterns, and make informed trading decisions.

– Regular Updates and Refinement:

Options trading evolves continuously. Keep your templates up-to-date with the latest market trends and incorporate new insights to enhance their efficacy.

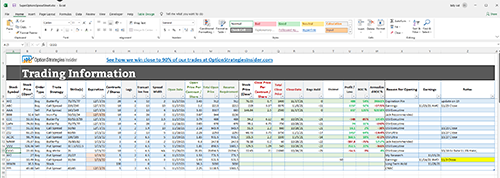

Options Trading Spreadsheet Templates

Image: optionstrategiesinsider.com

Conclusion: Embracing the Power of Options Trading Spreadsheet Templates

Options trading spreadsheet templates are invaluable tools that elevate the trading experience and empower traders to make informed decisions. By leveraging these templates, traders can unlock precision, efficiency, and enhanced returns in the dynamic world of options trading. As the financial landscape continues to evolve, embracing the power of these templates will remain a cornerstone of successful options trading.