In today’s dynamic financial landscape, option trading has emerged as a popular strategy for managing risk and enhancing returns. India, with its burgeoning economy and growing financial markets, offers ample opportunities for option traders. To navigate this complex market effectively, it’s crucial to have the right software that can empower you with real-time data, robust analytics, and advanced trading capabilities.

Image: www.topbuyingtrends.com

In this comprehensive guide, we delve into the intricacies of option trading, explore the latest trends in software solutions, and guide you in selecting the best software for your needs in India. Let’s embark on a journey to elevate your option trading prowess.

**Demystifying Option Trading: A Foundation for Success**

Option trading involves the buying and selling of contracts that provide the right, but not the obligation, to buy or sell an underlying asset at a pre-determined price on a specific date. Options are versatile financial instruments that can be used for various strategies, including hedging, income generation, and speculation.

Understanding the fundamentals of option trading is paramount for successful investing. Factors like option types, strike prices, expiration dates, and Greek letters play a crucial role in shaping the risk and reward profile of your trades. By grasping these concepts, you can develop informed trading decisions.

**The Technological Edge: Empowering Option Traders**

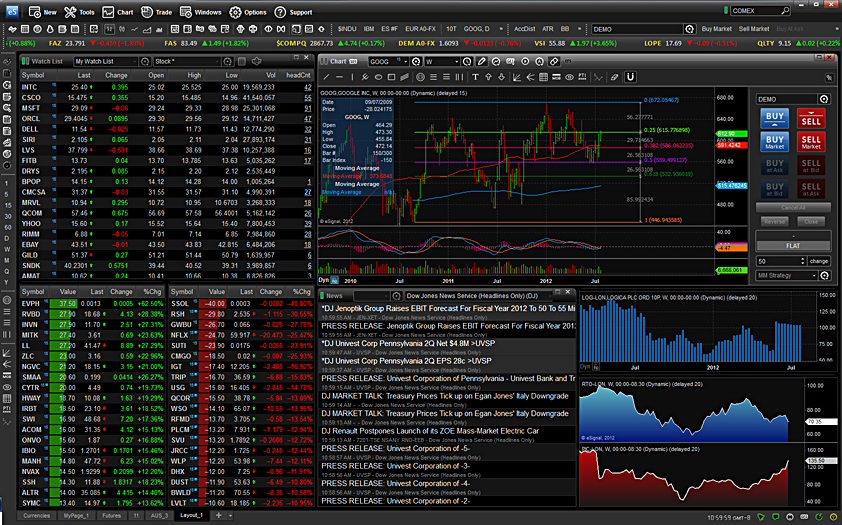

In the digital age, technology has become an indispensable ally for option traders. Software specifically designed for option trading in India offers a myriad of features that can enhance your trading experience. Here are some key functionalities to look for in a good software solution:

- Real-time Data Streaming: Access to up-to-date market data is crucial for monitoring price movements and making informed decisions.

- Technical Analysis Tools: Advanced charting tools and technical indicators help you identify trends, patterns, and potential trading opportunities.

- Greeks Calculation and Analysis: Comprehensive Greeks calculators and visualizations provide insights into the risk and sensitivity of your option positions.

- Position Management and Optimization: Manage your trades effectively with features like order entry, stop loss, and profit target management.

- Strategy Backtesting and Paper Trading: Test your strategies and gain confidence without risking real capital through backtesting and paper trading features.

- News and Market Analysis: Stay informed about market events and news that may affect your trades with integrated news feeds and market analysis tools.

**Tips and Expert Advice: Navigating the Option Trading Landscape**

Navigating the complexities of option trading requires a combination of knowledge, experience, and a healthy dose of expert guidance. Here are some tips and expert advice to help you become a more proficient option trader:

- Start Small: Begin with small trades to build your confidence and gain a practical understanding of option trading.

- Manage Risk: Implement proper risk management techniques such as position sizing, stop loss orders, and hedging strategies to protect your capital.

- Educate Yourself Continuously: Seek out knowledge and insights from books, articles, and reputable financial publications to stay updated on market trends and trading strategies.

- Master the Greeks: Understand the Greeks and their impact on your option positions to make well-informed decisions and adjust your strategies accordingly.

- Seek Guidance from Professionals: Consult with experienced option traders or financial advisors for guidance and support in developing effective trading strategies.

Image: opecmiss.weebly.com

**Frequently Asked Questions (FAQs): Unraveling Option Trading Uncertainties**

Option trading can raise several questions for aspiring traders. Here are answers to some common FAQs to clarify any lingering doubts:

- Q: What are the different types of options trading strategies?

- A: There are various options trading strategies, including long and short calls/puts, covered and uncovered calls/puts, straddles, strangles, and butterflies.

- Q: Can I trade options with a small capital?

- A: Yes, you can trade options with a modest capital by focusing on low-priced options, using leverage with caution, and implementing proper risk management practices.

- Q: How do I evaluate the risk of my options trades?

- A: Utilize Greek metrics such as delta, gamma, vega, and theta, along with factors like implied volatility, to assess the risk and potential rewards of your trades.

Best Software For Option Trading India

Image: www.youtube.com

**Conclusion: Empowering Option Traders in India**

With the right software, knowledge, and guidance, you can unlock the potential of option trading in India. Remember, successful option trading requires a blend of strategy, risk management, and continuous learning. By embracing the tools and insights outlined in this guide, you can embark on a rewarding journey of enhancing your financial prowess in the dynamic and ever-evolving world of option trading.

Are you ready to elevate your option trading game? Let the insights provided in this comprehensive guide be your compass, empowering you to make informed decisions and navigate the complexities of the market with confidence. The journey to becoming a successful option trader starts now!