Have you ever wondered about the financial instruments that allow you to trade options continuously throughout the trading day? Continuous trading options, also known as European-style options, offer traders a unique opportunity to capitalize on market movements. In this comprehensive guide, we will delve into the world of continuous trading options, exploring their intricacies and empowering you with valuable knowledge to navigate this dynamic financial landscape.

Image: www.sidewaysmarkets.com

The allure of continuous trading options lies in their flexibility. Unlike traditional options, which can only be exercised at their expiration date, European-style options grant you the freedom to exercise them at any time before expiry. This flexibility empowers traders to respond swiftly to market fluctuations, maximizing their profit potential.

Understanding Continuous Trading Options

Definition and History

Continuous trading options are a type of financial option that can be bought or sold at any time during the trading day, providing continuous liquidity and enabling traders to adjust their positions as the market evolves. These options have roots in the European financial markets, hence the term “European-style.” Today, they are traded globally, offering investors and traders an essential instrument for managing risk and exploiting market opportunities.

Meaning and Mechanism

The significance of continuous trading options lies in their continuous trading feature. Unlike traditional options, which have specific expiration dates, these options can be exercised at any point before their designated expiration. This continuous exercise window allows traders to capitalize on market movements throughout the life of the contract, providing greater flexibility and potential profit-making opportunities.

Image: www.homeworklib.com

Exploring Continuous Trading Options in Detail

Types and Characteristics

Continuous trading options encompasses two primary types: call options and put options. Call options convey the right, but not the obligation, to acquire an underlying asset at a specified price. Conversely, put options empower traders to sell the underlying asset at a predetermined price. Understanding these two fundamental option types is crucial for effective trading.

Moreover, European-style options are cash-settled, meaning that physical delivery of the underlying asset does not occur upon exercise. Instead, the trader receives the financial difference between the strike price and the prevailing market price.

Key Considerations

When trading continuous trading options, several crucial factors warrant prudent evaluation. The strike price, which represents the price at which the option can be exercised, plays a pivotal role. Additionally, the expiration date, denoting the last day the option can be exercised, is another essential consideration.

Furthermore, the premium paid to acquire the option is a key factor. This premium reflects the market’s assessment of the likelihood of the option being profitable. A thorough understanding of these elements is paramount for effective option trading.

Latest Trends and Developments

Market Dynamics and Market Volatility

Continuous trading options are highly influenced by market dynamics and volatility. During periods of high volatility, options tend to trade at elevated premiums, reflecting the increased uncertainty in the underlying asset’s price movement. Conversely, in stable markets, options may trade at lower premiums.

Technological Advancements and Innovation

The advent of electronic trading platforms has revolutionized the continuous trading options landscape. These platforms offer real-time market data, advanced order execution capabilities, and sophisticated analytical tools, empowering traders to make informed decisions and execute trades efficiently.

Tips and Expert Advice

Embracing Volatility and Trading Strategies

Understanding market volatility plays a crucial role in successful continuous trading options trading. Traders can adopt various trading strategies based on whether the market is trending or fluctuating within a range. For instance, during trending markets, traders may employ momentum-based strategies, while range-bound markets may call for more conservative approaches.

Managing Risk and Position Sizing

Risk management is paramount when trading continuous trading options. Proper position sizing is essential to align trade risk with one’s risk tolerance and financial capacity. Diversifying across multiple options and underlying assets can further mitigate risk.

FAQ on Continuous Trading Options

Q: What are the primary advantages of continuous trading options?

A: Continuous trading options offer the benefits of continuous liquidity, enabling traders to adjust positions swiftly. Their flexibility allows for exercise at any point before expiry, providing greater control over profit-making opportunities.

Q: How can I determine the value of a continuous trading option?

A: Option pricing models, such as the Black-Scholes model, can be employed to calculate the theoretical value of an option. These models consider factors like the underlying asset’s price, volatility, time to expiration, strike price, and risk-free interest rate.

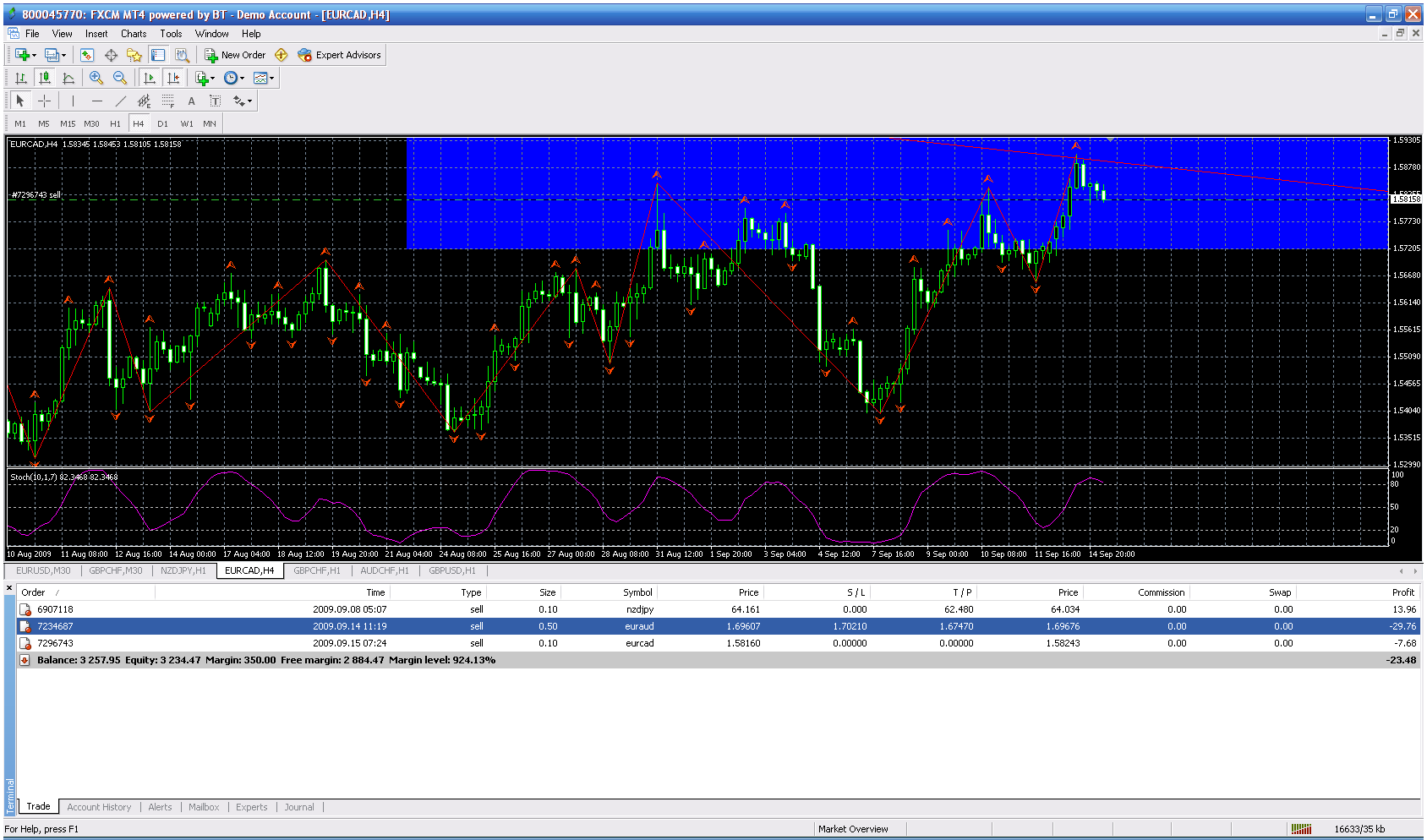

Continuous Trading Options European

Image: forex-strategies-revealed.com

Conclusion

Continuous trading options present a dynamic and rewarding avenue for traders seeking to enhance their financial acumen and navigate market fluctuations. By comprehending the intricacies of these options and employing prudent risk management strategies, traders can leverage continuous trading options to their advantage, unlocking the boundless opportunities they present.

Are you intrigued by the world of continuous trading options? Embark on a journey of financial exploration today and immerse yourself in the exhilarating realm of options trading.