Managing risk is paramount in options trading, and an essential tool in this endeavor is the stop loss order. A stop loss is an order placed with your broker to automatically sell an option contract when it reaches a predetermined price. By setting a stop loss, you can limit potential losses and protect your capital. This article will provide a comprehensive guide to options trading stop loss strategies, empowering you with the knowledge to implement them effectively.

:max_bytes(150000):strip_icc()/dotdash_Final_How_the_Trailing_Stop_Stop_Loss_Combo_Can_Lead_to_Winning_Trades_Sep_2020-01-4c3b54bb0ca947608471ea2248542111.jpg)

Image: www.investopedia.com

Understanding Stop Loss Orders

A stop loss order is an instruction to your broker to sell an option contract when its price reaches a specified level. The purpose of a stop loss is to prevent further losses if the market moves against your position. For example, if you buy a call option with a strike price of $100 and set a stop loss at $95, the option will be automatically sold if its price falls to $95.

There are two main types of stop loss orders:

- Market stop loss: This order will sell the option at the current market price when the stop loss price is reached.

- Limit stop loss: This order will sell the option at a specific price, which may be higher or lower than the current market price.

Advantages of Using Stop Loss Orders

Using stop loss orders in options trading offers several advantages:

- Risk management: Stop loss orders help you control your risk by limiting potential losses.

- Predefined exit strategy: They provide a predefined exit strategy, ensuring that you exit a losing position at a predetermined price.

- Emotional trading: Stop loss orders prevent emotional decision-making by automatically closing losing positions without your intervention.

- Margin protection: For margin accounts, stop loss orders help protect your margin by preventing excessive losses that could trigger a margin call.

Choosing the Right Stop Loss Level

Determining the right stop loss level is crucial for effective risk management. Consider the following factors:

- Risk tolerance: Your stop loss level should align with your overall risk tolerance.

- Market volatility: The volatility of the underlying asset will influence the appropriate stop loss level.

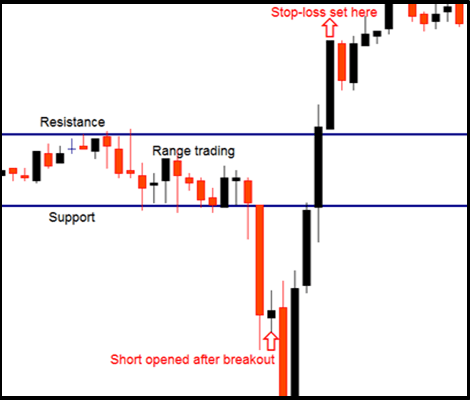

- Support and resistance levels: Identify key support and resistance levels to set stop loss orders that coincide with these levels.

- Time horizon: Consider the time horizon of your trade when determining the stop loss level.

Image: forex-strategies-revealed.com

Consider Using Trailing Stop Losses

A trailing stop loss is a dynamic stop loss that moves with the market price. As the option’s price moves in a favorable direction, the trailing stop loss is adjusted to protect your profits. Trailing stop losses can be particularly useful in trending markets.

Monitoring Stop Loss Orders

Once you have placed a stop loss order, monitor it regularly. As market conditions change, you may need to adjust the stop loss level to maintain effective risk management.

Options Trading Stop Loss Strategy

Image: userios-tenker.blogspot.com

Conclusion

Stop loss orders are essential tools for managing risk in options trading. By setting a stop loss, you can limit potential losses, protect your capital, and implement a predefined exit strategy. Understanding the various types of stop loss orders, choosing the right stop loss level, and monitoring them effectively will help you trade options with greater confidence and control. Remember, risk management is a pivotal component of successful options trading, and stop loss orders are invaluable in this endeavor.