Introduction

In the realm of financial markets, the pursuit of profit knows no shortage of strategies. When it comes to betting against the market’s expectations, short selling and options trading stand out as two distinct approaches that leverage risk to generate potential returns. This article delves into the intricate differences between these strategies, empowering investors with the knowledge to make informed choices.

Image: investobull.com

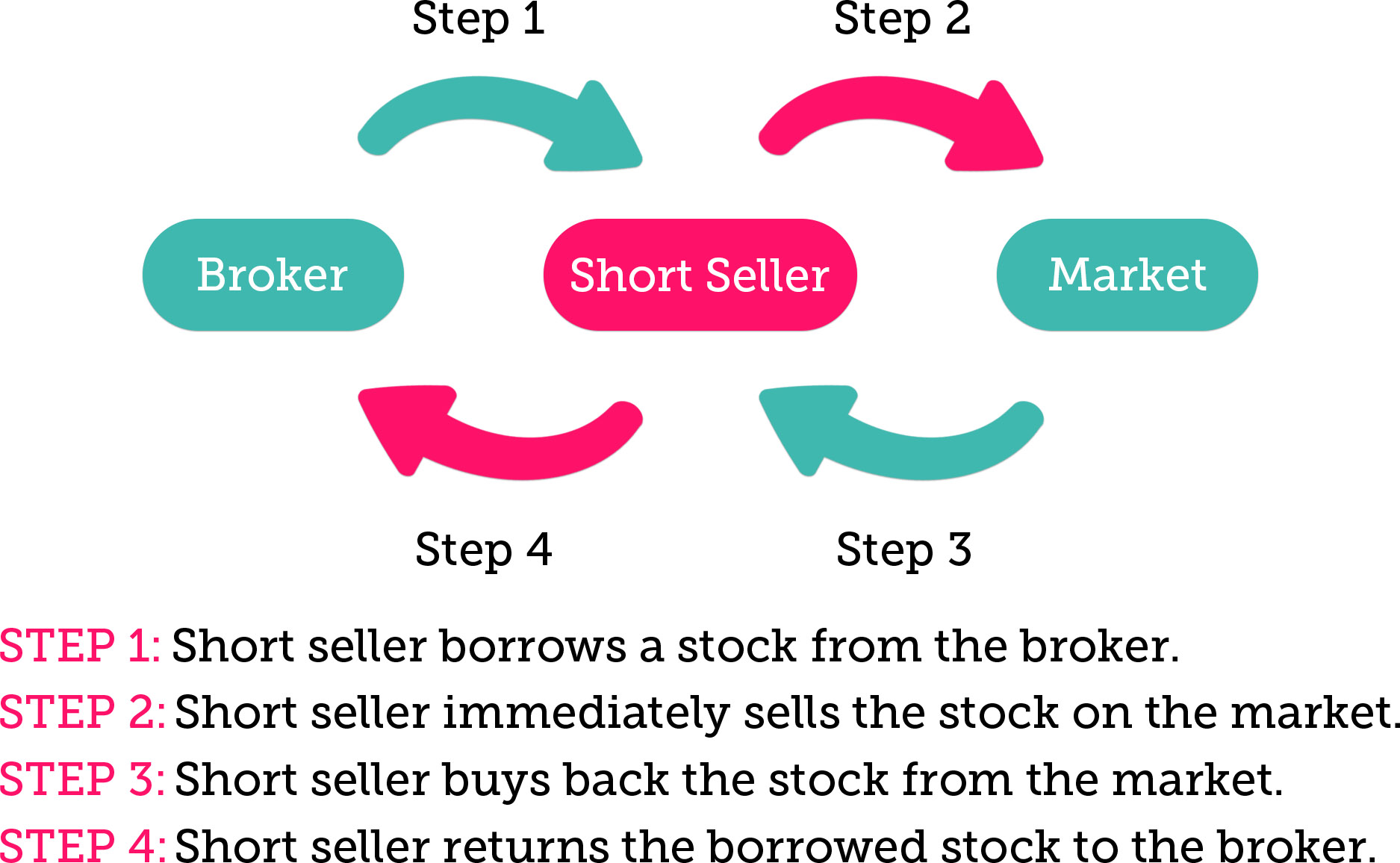

Understanding Short Selling

Short selling is a speculative betting technique that involves borrowing shares of a company with the intention of selling them at a higher price in the future. The fundamental principle is that if the stock price declines, the short seller can buy the shares back at a lower price and return them to the lender, profiting from the difference.

Navigating Options Trading

Options trading, on the other hand, involves contracts that grant the buyer the right (but not the obligation) to buy or sell an underlying asset at a specific price. Options contracts come in two primary flavors: calls and puts. Calls represent the right to buy, while puts grant the right to sell.

Comparing the Strategies

1. Risk Exposure and Potential Reward: Short selling potentially carries unlimited risk, as the stock price has no theoretical ceiling. Conversely, options trading offers limited risk, capped at the amount invested in the contract.

2. Leverage and Control: Short selling involves leveraging borrowed shares to amplify potential gains and losses. Options trading, on the other hand, provides greater flexibility and control, allowing investors to tailor risk and return profiles to their specific preferences.

3. Time Horizons and Strategy: Short selling is typically employed in a short-term context, while options trading offers a wider range of flexibility in terms of time horizon. Some options may expire within days, while others have lifespans extending several years.

4. Fortunes in Asymmetry: Short selling profits from declining stock prices, while options trading accommodates both bullish and bearish market expectations. Calls gain value when stock prices rise, while puts benefit from price declines.

5. Volatility’s Influence: Both short selling and options trading gain momentum in volatile markets, where price swings are more pronounced. Shrewd investors capitalize on these fluctuations, optimizing their potential for profit.

Image: napkinfinance.com

Expert Insights and Actionable Advice

“Options trading offers a versatile toolbox for investors,” notes renowned financial expert Jane Anderson. “It empowers them to tailor strategies based on their risk tolerance, time horizon, and market outlook.”

“Short selling is akin to walking on a tightrope,” cautions financial strategist Mark Thompson. “This strategy demands thorough research, meticulous execution, and the courage to navigate potential losses.”

Differnce Between Short Selling And Options Trading

Image: tessmorefinance.blogspot.com

Conclusion

Whether it’s short selling or options trading, each strategy unravels unique opportunities and risks in the labyrinth of financial markets. By delving into the distinctions between these approaches, investors gain a profound understanding of their nuances. Armed with this knowledge, they’re better equipped to shape informed decisions and navigate the intricate tapestry of investment strategies.