Introduction

The world of financial trading offers a multitude of opportunities to grow your wealth. For those seeking leveraged instruments, options trading and spread betting stand out as popular choices. Understanding the nuances between these two strategies is crucial for informed decision-making. This article delves into the intricacies of each, providing a comprehensive comparison to empower your financial journey.

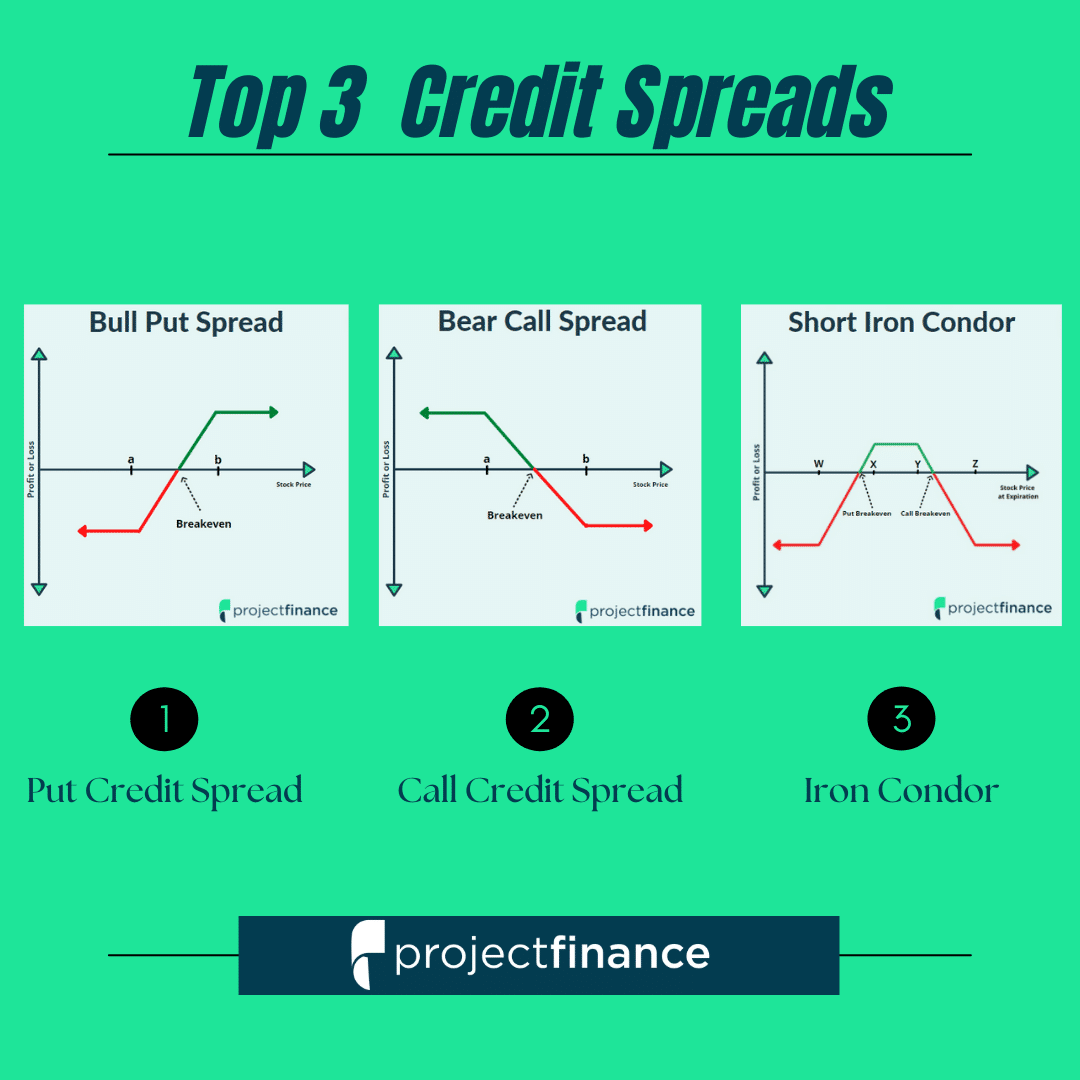

Image: www.projectfinance.com

What is Spread Betting?

Spread betting is a financial derivative in which two parties agree to exchange the difference between the buying and selling prices of an underlying asset, such as a stock, currency, or commodity. Unlike traditional betting, the profit or loss is determined by the accuracy of your predictions rather than the outcome of events. You don’t own the asset itself but speculate on its price movements.

Options Trading vs Spread Betting: Key Differences

1. Underlying Assets:

- Spread betting offers a wider range of underlying assets, including stocks, currencies, commodities, and indices.

- Options trading is typically limited to individual stocks or ETFs.

2. Leverage:

- Both instruments provide the potential for high leverage, but spread betting generally offers more significant leverage ratios.

- Higher leverage increases the potential for both profits and losses.

3. Liquidity:

- Spread betting benefits from high liquidity, facilitating quick entries and exits from positions.

- Options trading liquidity can vary depending on the underlying asset and contract specifications.

4. Risk Management:

- Spread betting carries unlimited potential losses beyond the initial investment amount.

- Options trading provides limited risk, as the maximum loss is capped at the premium paid.

5. Income Potential:

- Spread betting allows for both profit and loss in both rising and falling markets.

- Options trading provides limited income potential during stable market conditions.

Benefits and Drawbacks of Options Trading and Spread Betting

Image: www.ig.com

Options Trading

Benefits:

- Limited risk exposure

- Potential for high returns with capped losses

- Versatility in trading strategies

Drawbacks:

- Premium decay can erode profits

- Complex trading strategies require significant experience

- Limited scope of underlying assets

Spread Betting

Benefits:

- High potential leverage and returns

- No premium decay or holding periods

- Flexibility of trading both long and short positions

Drawbacks:

- Unlimited risk potential

- Requires high levels of discipline and risk management

- Limited availability of regulated traders

Expert Advice

To excel in either options trading or spread betting, consider the following expert tips:

- Gain in-depth knowledge of the underlying assets and trading strategies.

- Practice risk management techniques, including stop-loss orders and position sizing.

- Monitor market trends and news to make informed decisions.

- Start with small stakes and gradually increase your investment as you gain experience.

FAQs

Q: Which is more suitable for beginners, options trading or spread betting?

A: Options trading may be more appropriate due to its limited risk exposure.

Q: Can I make consistent profits in options trading or spread betting?

A: Both instruments carry inherent risk, and profits are not guaranteed. Consistent returns require discipline, skill, and market knowledge.

Q: What are the tax implications of options trading and spread betting?

A: Tax laws vary depending on jurisdiction. Consult a tax professional for guidance.

Options Trading Vs Spread Betting

Image: porukeicestitke.com

Conclusion

Options trading and spread betting offer distinct opportunities and challenges in the financial markets. By understanding the key differences, benefits, and drawbacks, traders can make informed decisions that align with their risk tolerance and investment goals. Remember, the path to trading success requires knowledge, discipline, and a commitment to continuous learning.

Would you like to know more about options trading or spread betting? Share your questions or experiences in the comments section below.