In the realm of financial markets, two formidable instruments dominate the landscape: spread betting and options trading. Navigating the complex world of financial investments necessitates a comprehensive understanding of these options and their contrasting nature. As a seasoned financial blogger, I embark upon an in-depth exploration of spread betting versus options trading, unveiling their intricacies and guiding you toward informed decisions.

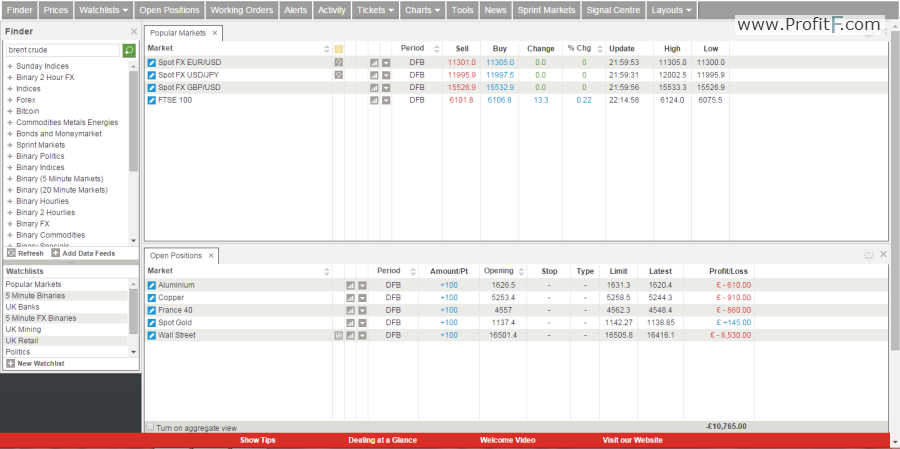

Image: www.profitf.com

Delving into Spread Betting

Spread betting is a form of speculative trading that allows investors to wager on the price movements of underlying assets, such as stocks, indices, commodities, and currencies. It operates on the fundamental principle of “the spread,” which represents the difference between the buying and selling prices quoted by a spread betting provider. Traders aim to profit by predicting the direction of asset price movements and placing trades accordingly.

Understanding Options Trading

Options trading, on the other hand, involves the trading of financial contracts known as options. These contracts convey the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a specified date. Options contracts consist of “calls,” which provide the right to buy, and “puts,” which provide the right to sell.

Key Distinctions: Spread Betting vs. Options Trading

To comprehend the underlying distinctions between spread betting and options trading, it is imperative to delve into their respective characteristics. Spread betting is predominantly characterized by the absence of fixed risk and reward, with potential profits and losses theoretically unlimited. This feature can amplify both the thrill and the risk associated with spread betting. Contrarily, options trading involves pre-defined risk and reward potential. The maximum potential loss for an options trader is limited to the premium paid for the option contract.

Moreover, spread betting is typically conducted on a margin, allowing traders to leverage their capital and potentially amplify their profits. However, this leverage amplifies both the potential profits and losses, making it a riskier proposition. In contrast, options trading does not involve the use of margin, reducing the potential for large losses but also limiting the potential for large profits.

Image: forexfakemoney.blogspot.com

Recent Trends and Developments

In recent times, the financial markets have witnessed significant advancements in spread betting and options trading. Notably, there has been a surge in the popularity of spread betting on mobile platforms, enabling traders to access markets and execute trades on the go.

Furthermore, the introduction of new types of options contracts, such as binary options and exotic options, has broadened the horizons for options traders. These innovative instruments provide additional ways to speculate on market movements and cater to different risk appetites.

Tips and Expert Advice

As a seasoned blogger, I have encountered numerous market experts and gained valuable insights into spread betting and options trading. Here are some valuable tips to navigate these markets effectively:

- Gain a Comprehensive Understanding: Before venturing into either form of trading, it is crucial to acquire a thorough understanding of the underlying concepts, risks, and rewards involved.

- Start Small: Beginners are advised to commence with small trades, enabling them to gain practical experience and confidence before risking substantial capital.

- Leverage Technology: Utilize modern trading platforms and tools to enhance your trading experience, automate processes, and access real-time market data.

Frequently Asked Questions (FAQs)

To consolidate our exploration, let us turn to some commonly encountered queries regarding spread betting and options trading:

- Q: Which trading instrument is better suited for beginners?

- A: Options trading generally offers a lower barrier to entry and predefined risk and reward potential, making it more suitable for novice traders.

- Q: How do I choose between spread betting and options trading?

- A: The choice between these instruments depends on individual risk appetite and trading style. Spread betting is suitable for traders seeking potentially higher rewards and willing to embrace unlimited risk, while options trading is appropriate for those preferring defined risk and reward parameters.

- Q: Can I lose more than my investment in spread betting?

- A: Yes, spread betting involves leveraged trading, which means the possibility of losses exceeding your initial investment.

Spread Betting Vs Options Trading

Image: eaglesinvestors.com

Conclusion

Spread betting and options trading represent powerful financial instruments with unique characteristics and applications. By comprehending their dynamics, you can confidently navigate the intricate world of financial markets. Remember to approach these markets with a well-informed strategy and prudent risk management practices. Whether you are a seasoned trader or a novice venturing into the financial realm, continuous learning and adaptation are key to achieving success.

I would appreciate feedback from our esteemed readers. Do you have any compelling experiences or insights related to spread betting or options trading that you would like to share with our community? Join the discussion, share your thoughts, and let us collectively delve deeper into these fascinating financial instruments.