Introduction:

Image: www.trading-fuer-anfaenger.de

Imagine a vast financial landscape where traders navigate the treacherous waters of options trading. Amidst the clamor of bull and bear markets, there lies a hidden opportunity for astute investors seeking extraordinary returns – trading options with wide spreads. These strategies, like elusive gems in a treasure trove, offer the tantalizing possibility of substantial gains while mitigating risks. In this comprehensive guide, we delve into the world of wide spreads, empowering you with the knowledge and tools to unlock their full potential.

What are Options and Wide Spreads?

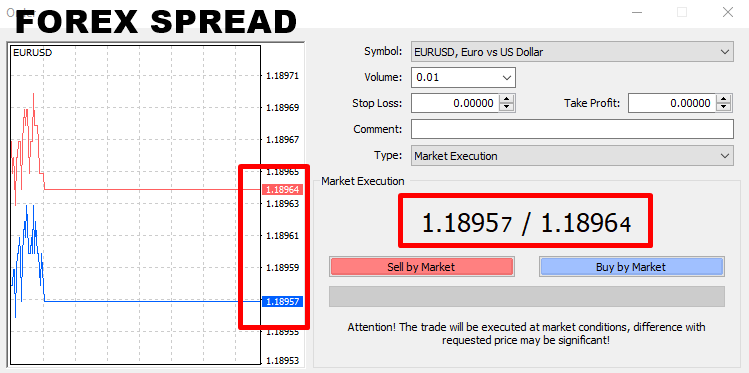

Options are financial instruments that grant traders the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on a specified date. Wide spreads refer to options strategies that involve buying and selling options with significantly different strike prices. This price divergence creates a substantial spread, the difference between the two option premiums.

The Advantages of Trading Wide Spreads:

The allure of wide spreads lies in their potential for substantial returns on investment. By exploiting the price differential between disparate strike prices, traders can reap the benefits of:

-

Low Premiums: Wide spreads typically involve buying a lower-priced option and selling a higher-priced option. This strategy allows traders to enter the trade with a relatively low premium investment.

-

Increased Leverage: Wide spreads leverage the underlying asset’s price movements more efficiently than single options contracts. This magnification of returns can lead to significant gains in favorable market conditions.

-

Enhanced Risk Management: The spread’s width serves as a buffer, mitigating the potential losses incurred in either option leg. This risk mitigation feature makes wide spreads attractive for traders looking to minimize their exposure while still pursuing significant profits.

Strategies for Trading Wide Spreads:

Navigating the world of wide spreads requires a strategic approach. Here are some proven methodologies:

- Bull Calls and Bear Puts:

» Bull Calls: Buy an out-of-the-money call option while selling a deeper out-of-the-money call option at a higher strike price. Profit when the underlying asset price rises, benefiting from the difference in option premiums.

» Bear Puts: Sell an out-of-the-money put option while buying a deeper out-of-the-money put option at a lower strike price. Profit when the underlying asset price falls, exploiting the spread between the option premiums.

- Iron Condor:

Involves selling both a bull call and bear put spread with the same expiration date. This neutral strategy profits from a range-bound underlying asset, benefiting from the decay of both options legs over time.

Expert Insights and Actionable Tips:

-

Warren Buffett’s Wisdom: “Wide spreads are a powerful tool for increasing returns and reducing risk. However, it’s crucial to understand the underlying asset thoroughly and manage your trades prudently.”

-

Monitor Market Volatility: Wide spreads are highly sensitive to market volatility. Monitor volatility indicators and adjust your trades accordingly to minimize potential losses.

-

Practice Patience: Wide spreads typically require patience and discipline. Don’t rush into trades; wait for the ideal market conditions to maximize your chances of success.

Conclusion:

Trading options with wide spreads is a potent strategy that can yield exceptional returns while minimizing risks. By harnessing the price divergence between disparate strike prices, traders can leverage the underlying asset’s price movements to generate substantial profits. However, it’s imperative to proceed with caution and employ a strategic approach. Armed with the knowledge and insights provided in this guide, you can navigate the world of wide spreads with confidence, unlocking the full potential of this rewarding investment strategy.

Image: www.andywltd.com

Trading Options With Wide Spreads

Image: www.pinterest.com