Synopsis: Unraveling the Essentials for Successful Options Ventures

Embarking on the exhilarating realm of options trading with TD Ameritrade demands a thorough understanding of the requisite qualifications and nuances. Whether you’re an options trading novice or an experienced practitioner, comprehending these stipulations empowers you to navigate this financial landscape with confidence and reap its potential rewards. This comprehensive article delves into the intricacies of TD Ameritrade’s option trading requirements, unveiling the essential steps, key terms, and strategic considerations that underpin successful options trading endeavors.

Image: tickertape.tdameritrade.com

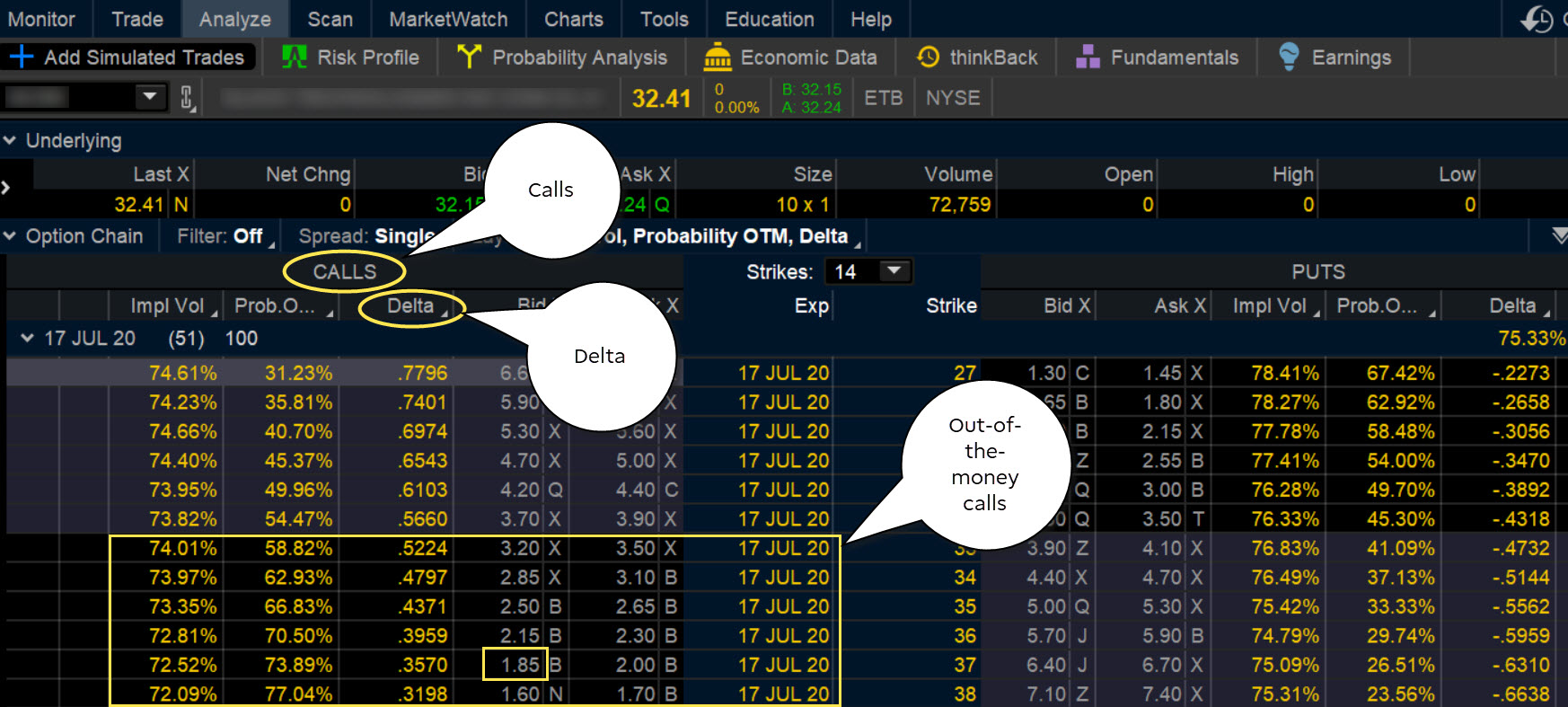

Cracking the Code: Understanding the Options Trading Alphabet

Options, a versatile financial instrument, present a unique opportunity to speculate on the future price movements of underlying assets, such as stocks. These contracts convey the right, not the obligation, to buy (call option) or sell (put option) the underlying asset at a predetermined price (strike price) on or before a specified date (expiration date). Options trading, conducted through reputable brokerages like TD Ameritrade, offers traders a plethora of strategies to capitalize on market fluctuations, generate income, and hedge against risk.

Delving into TD Ameritrade’s Option Trading Requirements

-

Account Eligibility: Establishing Your Options Trading Credentials

To delve into the realm of options trading with TD Ameritrade, you must fulfill certain account eligibility criteria. These prerequisites include maintaining a brokerage account with an options trading privilege. This privilege is typically granted after completing an Options Trading Agreement and passing a suitability assessment. The suitability assessment gauges your understanding of options trading concepts, risk tolerance, and investment objectives. Aspiring options traders must demonstrate a grasp of the complexities inherent in options trading to qualify for this essential credential.

-

Image: tickertape.tdameritrade.comMargin Account: Unlocking Advanced Trading Strategies

Options trading often requires the use of a margin account. A margin account provides leverage, allowing traders to amplify their buying power beyond the initial capital invested. This feature magnifies potential profits but also entails heightened risks, as losses can exceed the initial investment. Therefore, traders considering options trading should thoroughly evaluate their risk tolerance and ensure they possess a comprehensive understanding of margin trading principles.

-

Options Trading Experience and Knowledge: Foundation for Informed Decisions

TD Ameritrade deems it paramount for options traders to possess a foundational understanding of options trading concepts, strategies, and risks before engaging in this complex market. This knowledge equips traders to make informed decisions, mitigate risks, and capitalize on market opportunities effectively.

A Strategic Framework for Successful Option Trading

-

Goal Setting: Defining Your Trading Objectives

Before venturing into options trading, clearly define your trading goals. Whether seeking short-term income generation, long-term wealth accumulation, or hedging against portfolio volatility, your objectives will guide your trading strategy and risk tolerance.

-

Comprehensive Market Research: Delving into the Nuances

Meticulous market research forms the cornerstone of successful options trading. Delve into company financials, industry trends, and economic indicators to discern market conditions and identify potential trading opportunities. This in-depth analysis enhances your decision-making process and increases your chances of achieving your trading goals.

-

Risk Management: Safeguarding Your Trading Journey

Options trading, while alluring, carries inherent risks. Employ robust risk management strategies to minimize potential losses and protect your capital. Determine your risk tolerance, establish stop-loss orders, and diversify your portfolio to mitigate the impact of adverse market movements.

-

Continuous Learning: Embracing the Evolution of Knowledge

The financial markets are in a perpetual state of flux. As an options trader, it’s imperative to continually expand your knowledge and refine your skills. Attend webinars, read industry publications, and engage with experienced traders to stay abreast of market trends, new strategies, and emerging opportunities.

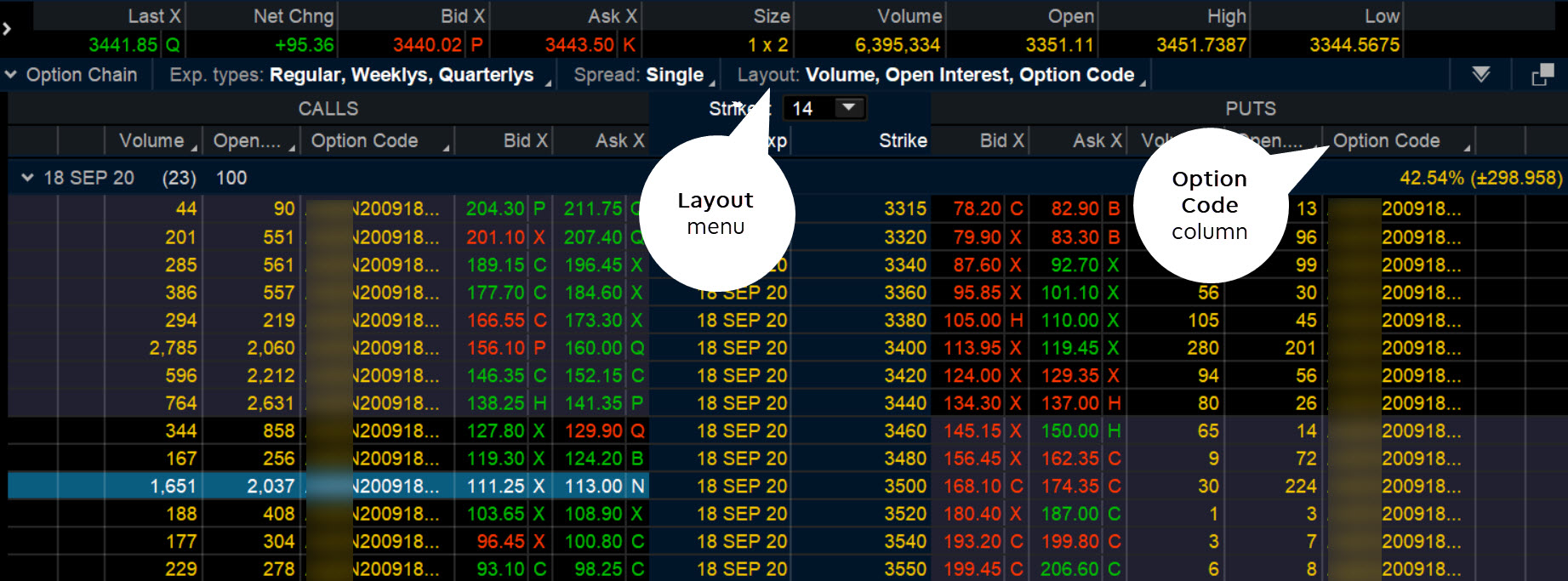

Option Trading Requirements Td Ameritrade

Image: thehindsightinvestor.com

Conclusion: Empowering Options Traders with Knowledge and Strategy

TD Ameritrade’s option trading requirements provide a framework for traders to engage in this dynamic and potentially lucrative market. By fulfilling these requirements and adhering to the strategic principles outlined in this article, you can unlock the immense potential of options trading, navigate market complexities with confidence, and realize your financial aspirations. Remember, success in options trading is not a destination but a continuous journey of learning, adaptation, and calculated risk-taking.