In the realm of financial trading, two alluring concepts stand out: binary options and forex spot trading. Both hold the promise of significant returns, yet they differ markedly in their mechanisms and risk profiles. In this detailed article, we will embark on a comparative odyssey, delving into the intricacies of these two distinct trading instruments, with the ultimate aim of unraveling their profitability conundrums.

Image: xbinop.com

A Tale of Two Instruments

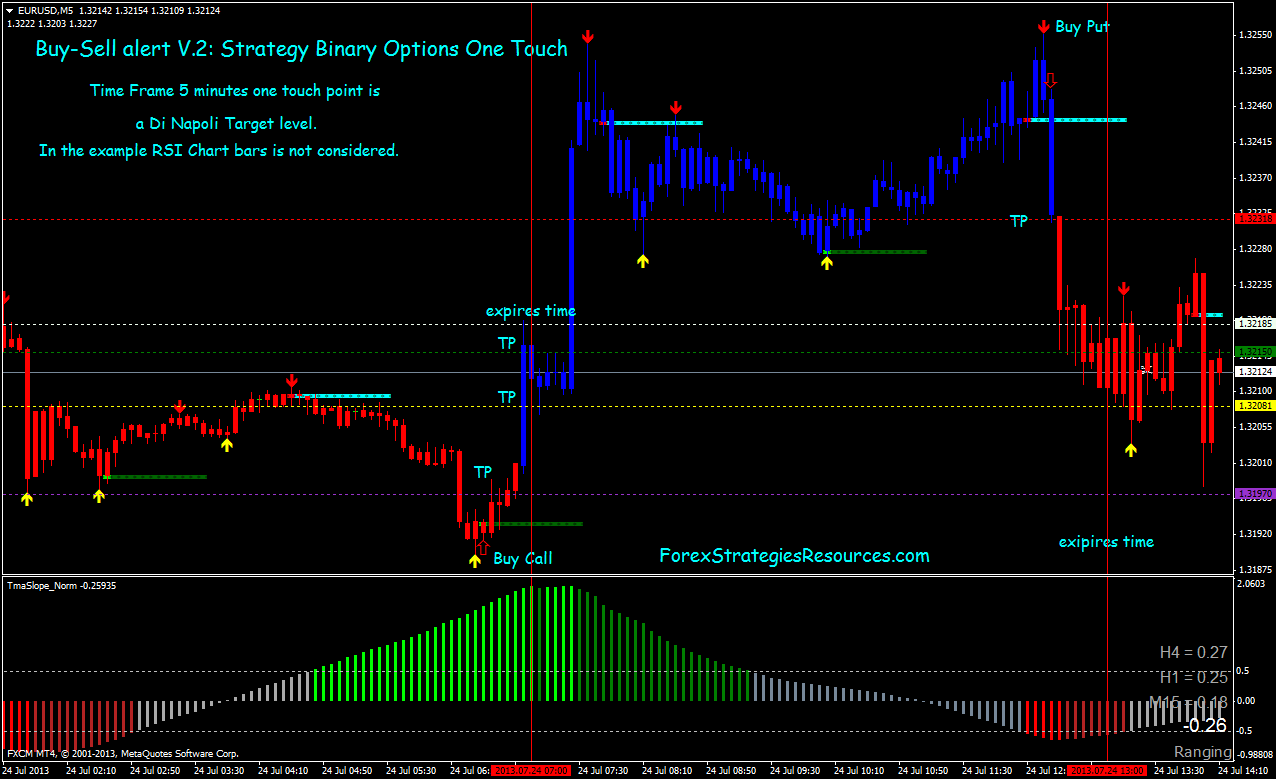

Binary options, often hailed as the epitome of simplicity, offer a binary outcome: the underlying asset either surpasses or falls short of the stipulated strike price. Success grants the trader a pre-determined payout, while failure leads to the forfeiture of the invested premium. In stark contrast, forex spot trading involves the exchange of foreign currency pairs at the prevalent spot price, presenting traders with the opportunity to profit from fluctuations in their relative values.

Profit Landscape: A Nuanced Comparison

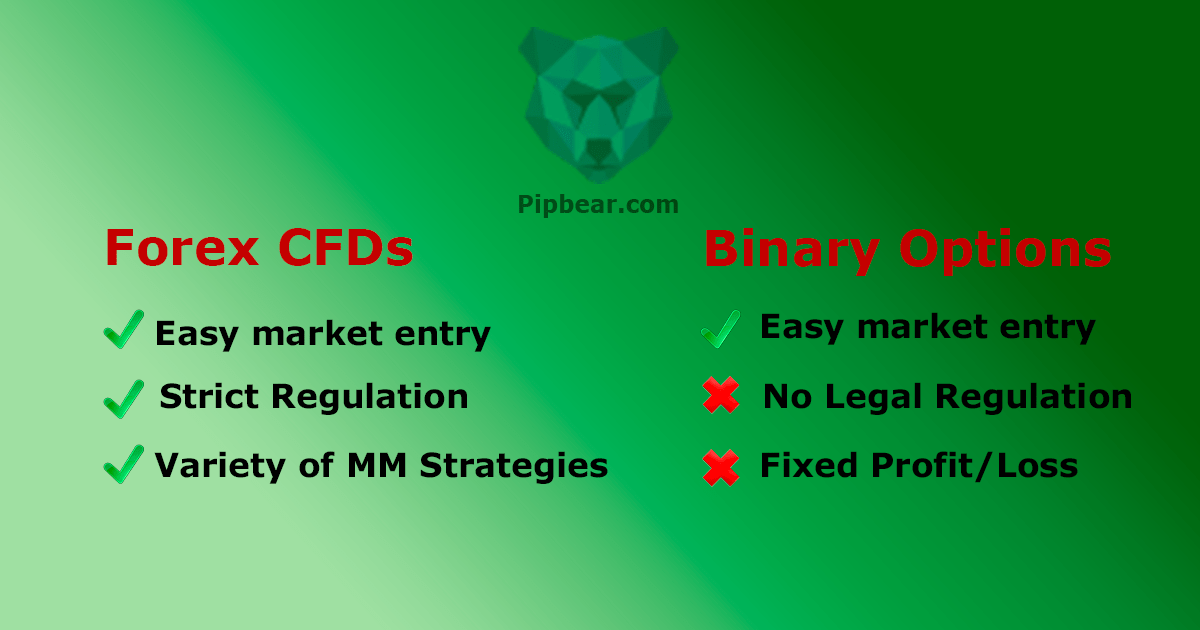

The profitability of any trading instrument hinges upon a myriad of factors, and binary options and forex spot trading are no exception. In the case of binary options, the potential profit is typically capped at around 90%, with brokers retaining a portion of the transaction as commission. Conversely, forex spot trading offers the potential for unlimited profits due to the flexible nature of currency fluctuations.

However, this perceived advantage of forex spot trading comes at the price of increased complexity and market volatility, demanding robust risk management strategies. Binary options, on the other hand, offer a more standardized approach, with a clearly defined maximum loss and a predetermined profit payout.

Risks in the Trading Arena

Every financial endeavor entails its inherent risks, and binary options and forex spot trading are no different. The binary nature of binary options can amplify the potential for rapid losses, particularly for inexperienced traders. The lack of leverage further reduces the possibility of recovering from a series of unsuccessful trades.

Forex spot trading, on the other hand, introduces the concept of leverage, allowing traders to control a larger position size with a smaller amount of capital. While this leverage can multiply profits, it also magnifies potential losses, making it crucial for traders to exercise prudent risk management practices.

Image: forexstrategiesresources.com

Suitability and Audience

The suitability of a particular trading instrument depends largely on the trader’s individual risk appetite, financial circumstances, and trading experience. Binary options, with their defined risk and return parameters, may be more appropriate for risk-averse beginners who prefer a structured trading environment.

Forex spot trading, on the other hand, demands a higher level of trading acumen, tolerance for volatility, and a comprehensive understanding of currency markets. Experienced traders who are comfortable managing leverage and market dynamics may find forex spot trading more lucrative, albeit riskier.

Binary Options Vs Forex Spot Trading Profitability

Image: pipbear.com

Regulation and Ethical Considerations

Binary options have been mired in controversy over concerns regarding regulatory oversight and the prevalence of fraudulent brokers. Many brokers engage in aggressive marketing tactics, luring unsuspecting traders with promises of quick wealth while downplaying the inherent risks. This has led several regulatory bodies to implement stricter regulations, including mandatory broker licensing and increased transparency measures.

Fore