Margin trading, a cornerstone of options trading, offers the potential for enhanced returns but also entails significant responsibilities. Understanding margin requirements is paramount to mitigating potential pitfalls and safeguarding against financial ruin. This comprehensive guide will delve into the intricacies of option trading margin requirements, empowering traders to make informed decisions and maximize their trading potential.

Image: zerodha.com

Margin requirements serve as a critical risk management tool in options trading. Essentially, they represent the minimum amount of capital an investor must maintain in their account to cover potential losses on open positions. By providing brokers with a cushion of safety, margin requirements ensure that traders have sufficient funds to fulfill their obligations should the market move against them.

Types of Margin Requirements

Depending on various factors such as the type of option, trading strategy, and market volatility, margin requirements can vary. Here are the predominant types:

- Initial Margin: The minimum amount required to initiate a new option position.

- Maintenance Margin: The amount that must be maintained in the account throughout the life of the position to prevent it from being liquidated.

- Variation Margin: Additional funds required when the market value of the position moves unfavorably, increasing the risk to the broker.

Historical Evolution of Margin Requirements

The history of margin requirements can be traced back to the early days of Wall Street. The Securities and Exchange Commission (SEC) has played a pivotal role in establishing and enforcing margin rules since the passage of the Securities Exchange Act of 1934. Over time, margin requirements have been refined and strengthened to enhance stability and protect investors.

Key Concepts of Margin Requirements

To fully navigate option trading margin requirements, it is essential to understand the underlying concepts:

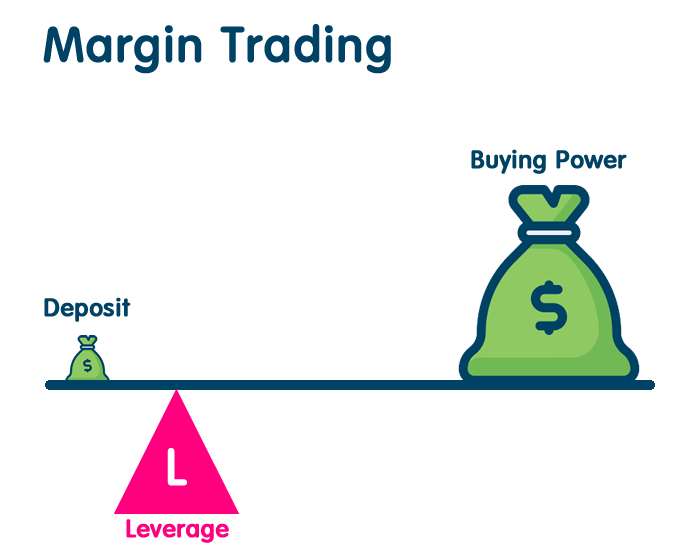

- Leverage: Margin trading amplifies the trader’s leverage, allowing them to control a larger position with a smaller amount of capital. However, this comes with increased risk, as losses are also magnified.

- Risk Management: Margin requirements serve as a critical risk management tool. By maintaining sufficient margin, traders can cushion potential losses and protect their overall trading portfolio.

- Broker Regulation: Brokers are obligated to comply with margin regulations set by the SEC and other regulatory bodies. Failure to maintain adequate margin levels can result in penalties or even account liquidation.

Image: www.livingfromtrading.com

Impact on Trading Strategy

The margin requirements for a particular option trade can significantly influence the trader’s strategy. For instance, those with limited capital may need to adjust their position size or opt for less volatile options. Conversely, traders with ample capital may leverage margin to increase their potential returns, but they must be prepared for the associated risks.

Recent Developments in Margin Requirements

In recent years, there have been ongoing discussions and debates surrounding margin requirements for option trading. Regulatory bodies are continuously evaluating and adjusting these requirements to strike a balance between mitigating risks and fostering market accessibility.

Option Trading Margin Requirements

Conclusion

Option trading margin requirements are an indispensable part of the options trading landscape. By understanding the types, rationale, and key concepts associated with margin requirements, traders can navigate the risks and uncertainties of the market with greater confidence and awareness.

Investing in options carries substantial risk. Before engaging in options trading, investors should carefully consider their investment objectives, risk tolerance, and experience level. Margin trading can magnify both profits and losses, making it crucial to proceed with caution and sound judgment. By adhering to prudent risk management practices, investors can harness the potential of margin trading while mitigating the inherent risks.