Unlocking the Secrets of Margin for Option Trading in Zerodha

Image: tradingqna.com

In the exhilarating world of financial markets, options trading stands out as a potent tool for both risk-takers and astute investors. With its ability to magnify profits and hedge against potential losses, options trading has become an indispensable strategy for maximizing returns. However, navigating the intricacies of options trading requires a thorough understanding of margin requirements. Enter Zerodha, India’s leading online broker, which offers a robust margin trading platform specifically tailored for option traders.

Defining Margin in Option Trading

Margin is a crucial concept in option trading. It refers to the collateral or security that you must deposit with your broker to cover potential losses on your trades. By providing margin, you are essentially borrowing money from the broker to increase your buying power.

In the case of Zerodha, margin requirements for option trading are calculated based on two key factors:

- Premium: The cost of the option contract.

- Strike Price: The price at which you can buy or sell the underlying asset.

Calculating Margin for Option Trading

Zerodha employs a “Span Margin System” to determine margin requirements. This system considers various factors, including the underlying asset’s volatility, time to expiration, and current market conditions.

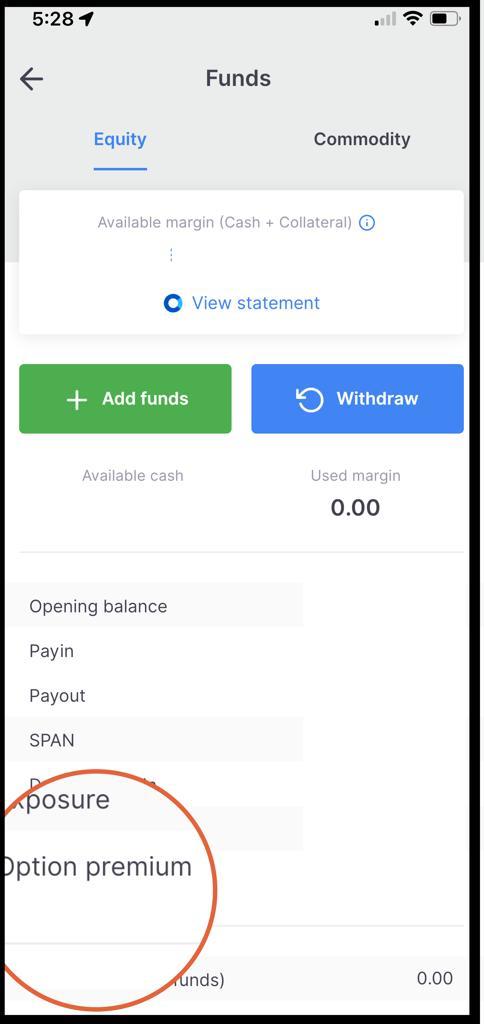

The precise margin calculation for a given option contract is complex. However, Zerodha displays the margin requirement in Indian rupees directly on the trading platform. This makes it easy for you to determine the amount of margin you need to maintain in your trading account.

Benefits of Using Margin in Option Trading

Margin trading offers several compelling benefits for option traders:

- Increased Buying Power: Margin allows you to trade larger positions with a smaller amount of capital. This means you can potentially make larger profits from your trades.

- Flexibility: Margin gives you the ability to adjust your positions as market conditions change. You can add to winning trades or reduce exposure to losing trades.

- Hedging: Margin trading provides you with the flexibility to hedge your portfolio against potential losses. This is especially useful in volatile markets.

Risks Associated with Margin Trading

While margin trading can enhance your trading potential, it also comes with certain risks:

- Increased Losses: Margin trading can amplify both profits and losses. If your trades turn against you, you may incur significant financial losses.

- Margin Calls: If your account balance falls below the minimum margin requirement, Zerodha may issue a margin call. You will then be required to deposit additional funds into your account within a specified time frame. Failure to do so may result in the liquidation of your positions.

- Stress: Margin trading can be a stressful endeavor, especially during volatile market conditions. It’s crucial to manage your emotions and make informed decisions.

Tips for Effective Margin Trading

To maximize the benefits and mitigate the risks of margin trading, consider the following tips:

- Start Small: Begin with small positions until you become comfortable with the mechanics of margin trading.

- Control Risk: Determine your risk tolerance and trade accordingly. Avoid trading with more margin than you can afford to lose.

- Use Stop-Loss Orders: Place stop-loss orders to automatically exit losing trades, limiting your potential losses.

- Monitor Your Account: Regularly monitor your account balance and positions to ensure you are within the margin requirements.

- Seek Professional Guidance: If you are unfamiliar with margin trading, consult with an experienced financial advisor before making any trades.

Conclusion

Margin for option trading in Zerodha offers a poderosa tool for enhancing your trading potential and hedging your risks. However, it’s essential to understand the concepts, risks, and responsibilities involved before deploying this strategy. By carefully managing your margin and implementing prudent risk management measures, you can harness the power of margin trading to achieve your financial goals while minimizing potential losses.

Image: www.adigitalblogger.com

Margin For Option Trading In Zerodha

Image: zerodha.com