Introduction

For investors seeking to venture into the dynamic world of options trading, understanding the practical aspects is crucial. In this comprehensive guide, we will delve into a real-world example of options trading using Zerodha, a prominent online trading platform in India. We’ll explore the basics, walk you through a step-by-step example, and provide valuable insights to help you navigate this exciting financial instrument.

Image: tradingqna.com

What is Options Trading?

Options contracts offer traders the right, but not the obligation, to buy or sell a specific asset (e.g., a stock) at a predetermined price (strike price) within a specified period (expiration date). They come in two flavors: Calls and Puts. Calls give the buyer the option to buy an asset, while Puts give the option to sell it.

Step-by-Step Example with Zerodha

Consider a scenario where you believe the stock of company XYZ will rise in the coming weeks. To capitalize on this prediction, you could buy a Call option through Zerodha. Here’s how:

-

Create an Account: Sign up for a Zerodha account and complete the necessary documentation.

-

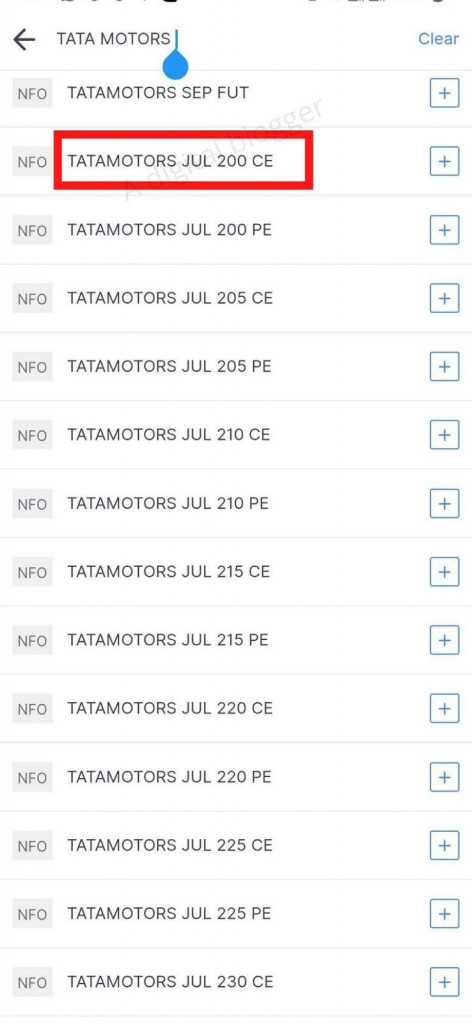

Choose the Underlying Asset: Go to the Zerodha trading platform and select XYZ as the underlying asset for your Call option.

-

Set Strike Price and Expiration Date: Determine the strike price at which you believe XYZ will exceed and select an expiration date that aligns with your expected timeframe.

-

Buy the Call Option: Enter the quantity of Call options you wish to purchase, considering your risk tolerance and available capital.

-

Monitor Performance: Track the performance of the stock and your option contract regularly to assess whether you’re on track to profit or need to adjust your strategy.

Key Considerations

-

Time Decay: Option contracts lose value over time, so timing your trades is essential.

-

Volatility: Higher volatility in the underlying asset can lead to significant gains or losses, so understanding price movements is crucial.

-

Margin Requirements: Options trading requires margin, so be aware of the margin rules and ensure you have sufficient funds to cover potential losses.

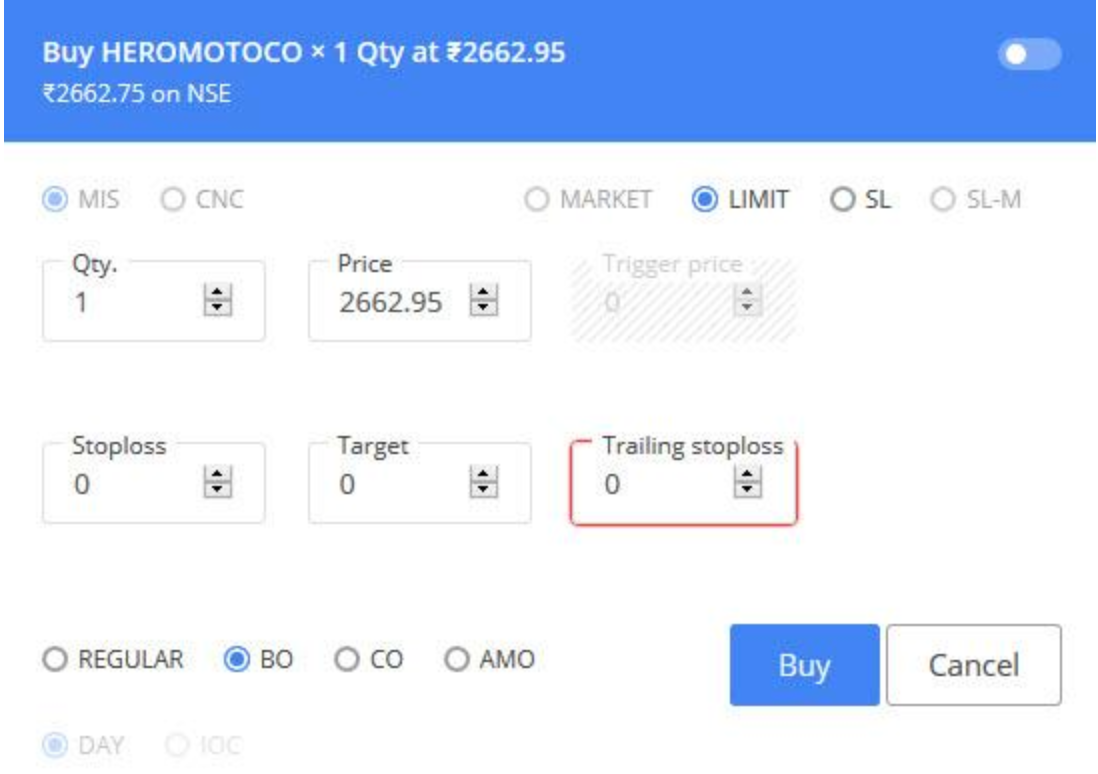

Image: www.adigitalblogger.com

Options Trading Example Zerodha

Image: www.adigitalblogger.com

Conclusion

Options trading with Zerodha can be an effective way to enhance your returns, but it’s important to approach it with caution and a thorough understanding of the risks involved. By following these steps and exercising prudent judgment, you can harness the power of options trading to potentially boost your financial goals. Remember to consult a financial advisor if you have any doubts or need personalized guidance.