The world of options trading can be daunting, but with the right knowledge, it can also be highly rewarding. In this comprehensive guide, we’ll delve into the ins and outs of option trading ABCD, a powerful strategy that can help you maximize your profits and minimize your risk.

Image: www.forex.com

Understanding Option Trading ABCD

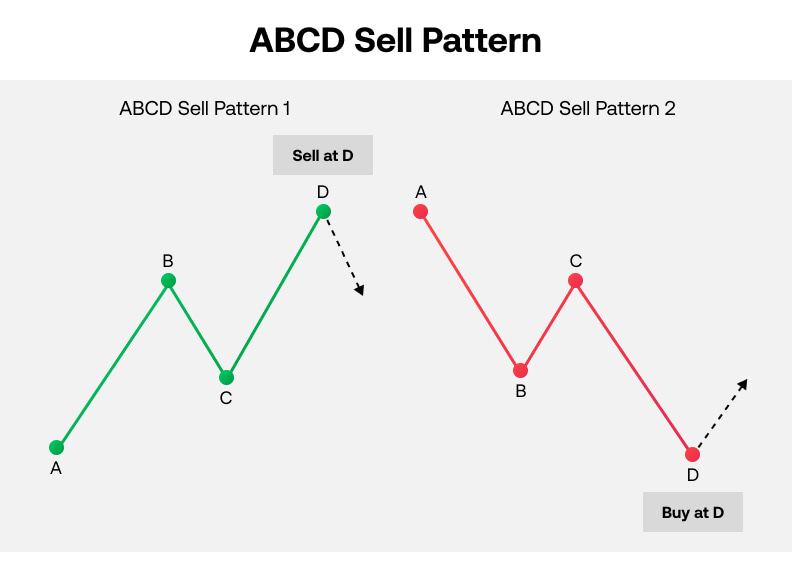

Option trading ABCD refers to a trading strategy that involves buying and selling four different options in a specific pattern. The “ABCD” stands for “At-the-money,” “Below-the-money,” “Call,” and “Down.” Each of these options is strategically positioned to capture different market movements, allowing you to capitalize on various scenarios.

How does Option Trading ABCD Work?

The ABCD strategy involves buying an at-the-money call option and a below-the-money call option simultaneously. Additionally, you sell an at-the-money put option and a below-the-money put option. This combination creates a “neutral” position, meaning you have little to no exposure to immediate market fluctuations.

The profit potential for the ABCD strategy lies in its ability to capitalize on different market movements. If the market moves up, the at-the-money and below-the-money call options increase in value, generating profits. Conversely, if the market moves down, the put options gain value, offsetting the losses on the call options.

Latest Trends and Developments

The ABCD strategy continues to be a popular choice among options traders due to its flexibility and adaptability to different market conditions. Recent trends have seen an increase in the use of the strategy in exchange-traded funds (ETFs) and index options. This allows traders to gain diversified exposure to the underlying assets and mitigate single-stock risk.

Image: www.youtube.com

Tips and Expert Advice

- Choose the right underlying asset: The ABCD strategy is suitable for stocks with moderate volatility and a well-defined trend.

- Set realistic profit targets: Don’t be greedy with your profits. Know when to take your winnings and avoid holding on to losing positions for too long.

- Manage your risk: Always calculate your potential losses before entering an ABCD trade. Use stop orders to protect your capital if the market moves against you.

FAQ

Q: What is the potential profit of the ABCD strategy?

A: The profit potential depends on market conditions and trade execution. It can range from modest gains to substantial returns.

Q: How long should I hold ABCD trades?

A: The duration of the trade can vary depending on the market volatility and your strategy. Typically, trades are held for a few days to several weeks.

Option Trading Abcd

Image: fxopen.com

Conclusion

Option trading ABCD is a versatile and profitable strategy that can enhance your investment portfolio. By combining strategic option positioning and sound risk management, you can navigate the complexities of the options market and potentially achieve your financial goals.

Are you ready to explore the exciting world of options trading ABCD? Join the ranks of successful traders and start profiting from market movements today!