Are you intrigued by the allure of the stock market but overwhelmed by the jargon and complexities? Look no further than option trading, the enigmatic yet lucrative arena where savvy investors multiply their profits. In this comprehensive guide, we will demystify the world of option trading, empowering you with the knowledge to harness its untapped potential.

Image: www.forex.com

What is Option Trading? The Art of Probability and Profit

Option trading revolves around “options,” contracts that grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price (strike price) on or before a specified date (expiration date). These contracts, akin to insurance policies, empower investors to manage risk and enhance their returns.

Understanding the Players: Call and Put Options

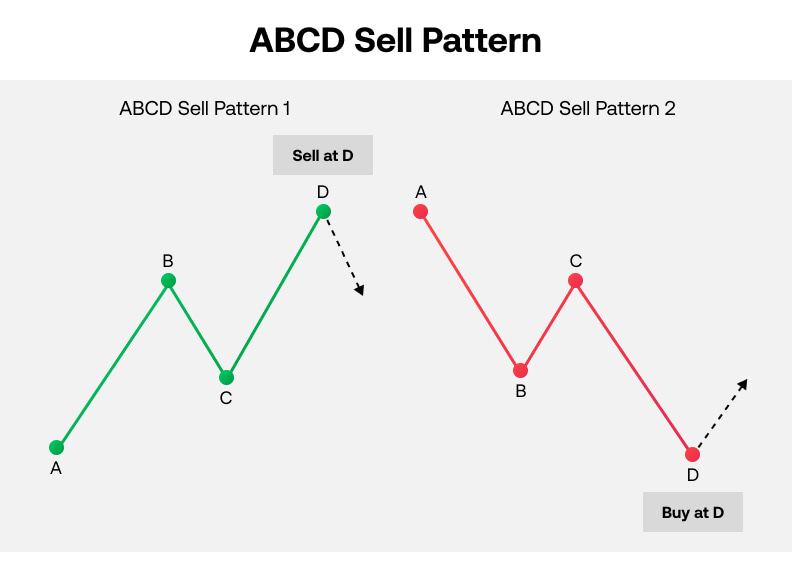

Understanding call and put options is paramount in option trading ki abcd. Call options grant the holder the right to buy the underlying asset at the strike price, while put options grant the right to sell the asset. These versatile contracts allow investors to speculate on asset price movements, hedge against risk, and amplify their profits.

Decoding the Lingo: Premium, Strike Price, and Expiration Date

Unraveling the jargon is crucial in option trading ki abcd. The premium is the price paid by the buyer for the right to exercise the option contract. The strike price is the predetermined price at which the buyer can exercise the option. Finally, the expiration date is the final date on which the option contract can be exercised.

Image: www.youtube.com

Exploring Strategies: The Compass of Option Trading

Navigation is key in the vast sea of option trading. Covered call and cash-secured put strategies provide downside protection while generating income. On the other hand, naked call and naked put strategies offer higher risk and potential rewards but require adept risk management. Understanding these strategies will equip you to steer towards maximum profitability.

Historical Heritage: A Glimpse into Option Trading’s Past

Option trading has a rich history, dating back to the 19th century. Amsterdam merchants invented the first known option contracts to mitigate spice prices during shipping. Over the years, options have evolved into complex financial tools, revolutionizing the way investors manage risk and amplify returns.

Option Trading in India: A Land of Opportunities

India’s vibrant stock market presents a fertile ground for option trading. The National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) offer a wide array of options contracts on various underlying assets, including stocks, indices, and commodities. As the Indian economy surges forward, option trading emerges as a potent tool for wealth creation.

Mastering the Craft: Skills for Successful Option Trading

Becoming an adept option trader requires discipline and continuous learning. Risk management, a paramount skill, involves understanding how to limit losses and mitigate risks. Technical analysis, a powerful tool, allows traders to discern price trends and patterns, guiding their decision-making. Finally, staying abreast of market news and economic indicators ensures informed trading decisions.

Cautionary Tales: Navigating Risks in Option Trading

While option trading offers alluring rewards, it is not without risks. Uninformed trading, overleveraging, and poor risk management can lead to substantial financial losses. It’s crucial to approach option trading with prudence, seeking guidance from financial advisors when needed.

Option Trading Ki Abcd

Image: www.youtube.com

Conclusion: Unearthing the Secrets of Option Trading Ki Abcd

Option trading, an intricate yet empowering realm of the stock market, presents boundless opportunities for profit and risk management. This comprehensive guide has laid the foundation for your journey as an option trader. Embrace the learning process, equip yourself with the necessary skills, and navigate this market with knowledge and strategy. Remember, option trading ki abcd holds the key to unlocking your financial potential.