Emotions can run high when it comes to trading, but as Peter Lynch aptly said, “Investing in the stock market is like trying to predict the winner of a beauty contest. The prettiest girl doesn’t always win.” Enter options trading – a prudent strategy that mitigates risk while amplifying potential gains, enabling you to navigate market fluctuations with confidence.

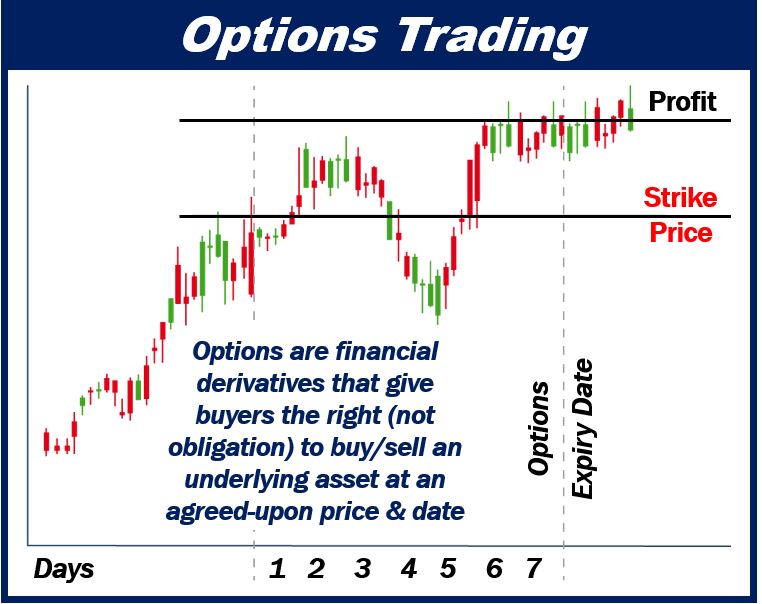

Image: marketbusinessnews.com

In this comprehensive guide, we’ll delve into the intricacies of options trading 100 shares, empowering you with the knowledge to make informed decisions and maximize your financial potential.

Understanding Options Trading

Options trading involves contracts that grant you the right, but not the obligation, to buy or sell an underlying asset (like a stock) at a predetermined price within a specified period. There are two main types of options: calls and puts.

- Call Options: Give you the right to buy the underlying asset at a certain price.

- Put Options: Allow you to sell the underlying asset at a certain price.

Advantages of Trading 100 Shares

Trading 100 shares through options offers several advantages:

- Hedging against Risk: Options provide a safety net against market downturns, minimizing potential losses.

- Limited Downside: Unlike traditional stock purchases, options limit your potential loss to the premium paid.

- Enhanced Returns: Options offer the potential for higher returns compared to simply holding the underlying asset.

Strategies for Trading 100 Shares

Numerous options trading strategies cater to different investment goals and risk appetites. Here are some popular techniques:

- Covered Calls: Sell call options against a stock you own, aiming to generate additional income from the premium.

- Cash-Secured Puts: Sell put options and set aside cash to purchase the underlying asset if the option is exercised.

- Iron Condors: A complex strategy involving simultaneous purchase and sale of different put and call options.

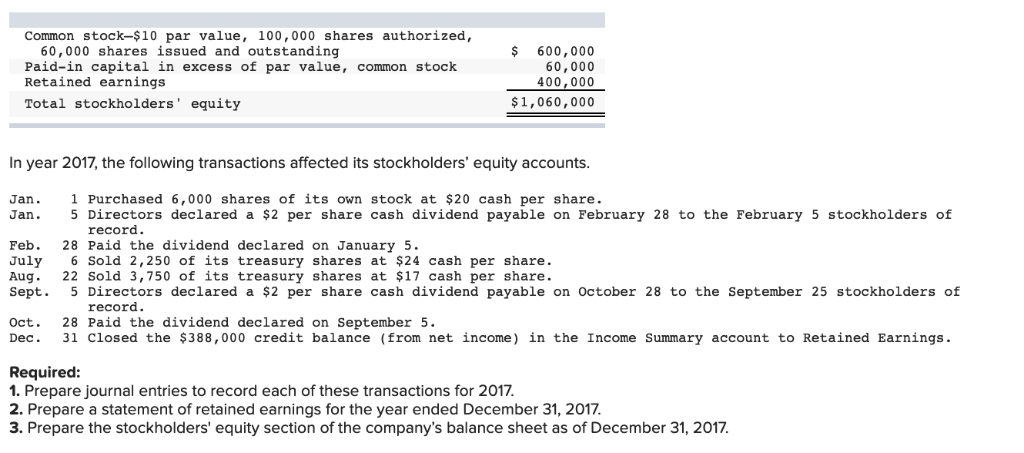

Image: www.chegg.com

Expert Insights and Actionable Tips

- “Options are not just for speculators; they’re powerful tools for risk management.” – Warren Buffett

- “Manage your risk carefully by understanding the Greeks, which measure option price sensitivity.” – Cboe Options Institute

- “Practice paper trading before risking real capital to gain experience.” – The Options Playbook

Options Trading 100 Shares

Image: biz.libretexts.org

Conclusion

Options trading 100 shares is a potent financial tool that can enhance your portfolio’s performance and mitigate risks. By grasping the concepts and strategies outlined in this guide, you can confidently navigate the options market and unlock the potential of this versatile investment approach.

Remember, investing involves risk, and options trading is not suitable for all investors. Thorough research, a sound understanding of options mechanics, and diligent risk management are paramount to successful options trading. Embrace the principles discussed in this article, seek guidance from experts, and empower yourself to make judicious trading decisions. May your options trading journey be a prudent and profitable one!