Navigating the intricacies of the stock market can be a daunting task, especially for those venturing into the realm of options trading. Options contracts, with their unique characteristics and expiry dates, require a keen understanding of market dynamics to maximize potential profits. In this comprehensive guide, we delve into the intricacies of the last day of options trading, providing insights to empower traders in making informed decisions.

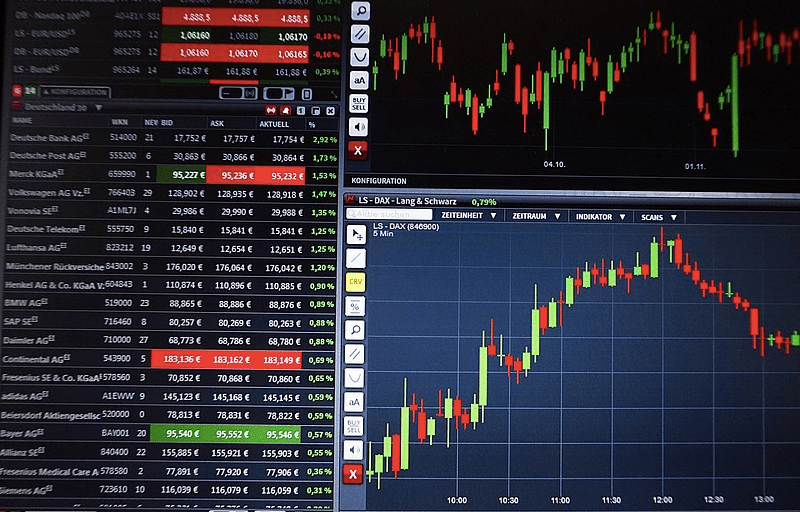

Image: www.daytrading.com

As the expiration day of an options contract approaches, the tension in the trading arena intensifies. This day holds immense significance, marking the final opportunity for traders to exercise or sell their contracts before they become worthless. Whether aiming to lock in profits or mitigate losses, understanding the intricacies of this critical day is crucial.

The Mechanics of Expiration Day

On the day of expiration, the options market operates on a “time-of-the-money” basis, meaning that the value of each contract is determined by its closeness to the underlying asset’s current price. Options that are “in the money” (ITM) hold intrinsic value, while those that are “out of the money” (OTM) have no intrinsic worth. ITM call options give the holder the right to buy the underlying asset at a specified price (strike price), while ITM put options provide the right to sell the asset.

Early exercise of options is uncommon, as traders typically prefer to hold their contracts until expiration to maximize potential profits. However, certain circumstances, such as significant price movements or anticipated dividends, may warrant early exercise for strategic reasons.

Strategies for Maximizing Profit on the Last Day

Approaching the last day of options trading demands a well-rounded strategy to enhance profitability. Here are some effective techniques employed by seasoned traders:

- Rollover Strategy: Selling an expiring option contract and simultaneously buying a new one with a later expiration date allows traders to extend their exposure while adjusting their position.

- Vertical Spread Strategy: Creating a vertical spread (combining calls and puts at different strike prices and expiration dates) enables traders to fine-tune their risk and reward parameters.

- Hedging Strategy: Utilizing a combination of options contracts and underlying assets, traders can hedge against potential losses, reducing overall risk exposure.

Expert Advice for Last-Day Trading

Tapping into the wisdom of experienced traders can provide invaluable insights for navigating the complexities of the last day of options trading. Here are some expert tips to enhance your trading edge:

- Monitor Market Sentiment: Staying abreast of market sentiment and news events is essential, as they can significantly influence option prices on the last day.

- Manage Risk Wisely: Options trading involves inherent risk; therefore, understanding your risk tolerance and implementing appropriate risk management strategies is crucial.

- Consider Implied Volatility: Implied volatility gauges the expected price fluctuations of an underlying asset. This metric is a key factor in options pricing and should be carefully considered when making trading decisions.

Image: www.youtube.com

Frequently Asked Questions on the Last Day of Trading

To address lingering questions and provide clarity on the intricacies of the last day of options trading, we present this comprehensive FAQ section:

- What is the optimal time to sell an option contract on expiration day? Selling closer to expiration generally yields higher premiums, but the risk of unfavorable price movements increases.

- Can options be exercised on the expiration day itself? Yes, options can be exercised on the expiration day up until the close of trading at 4:00 PM EST.

- What happens if I hold an option past its expiration date? Unexercised options expire worthless, resulting in a total loss of the premium paid.

Last Day Of Options Trading

Image: www.insidewallstreetreport.com

Conclusion

Understanding the last day of options trading empowers traders with the knowledge to make informed decisions and capitalize on potential profit opportunities. Whether you are a seasoned trader or just starting your journey into options trading, this comprehensive guide has provided invaluable insights into the mechanics, strategies, and expert advice that can help you navigate the complexities of this critical day. Remember, staying informed, adapting to market dynamics, and managing risk effectively are key to unlocking success in the world of options trading.

Are you ready to explore the thrilling and rewarding world of options trading? Let us guide you on this exciting journey. Dive deeper into our blog for more educational resources, updates on market trends, and expert analysis. Together, we can unravel the secrets of the financial markets and empower you to make informed trading decisions.