Backdrop: Embracing the Option Trading Landscape

In the realm of finance, options emerge as a potent tool, bestowing traders with the flexibility to capitalize on market fluctuations. Option trading, a strategy employed by astute investors, empowers individuals to speculate on the trajectory of underlying assets without the burden of ownership. India, a vibrant and burgeoning financial hub, has emerged as a sought-after arena for option trading, drawing enthusiasts and professionals alike. Comprehending the intricacies of option trading expiry dates, a concept pivotal to the successful execution of these transactions, is crucial in this context.

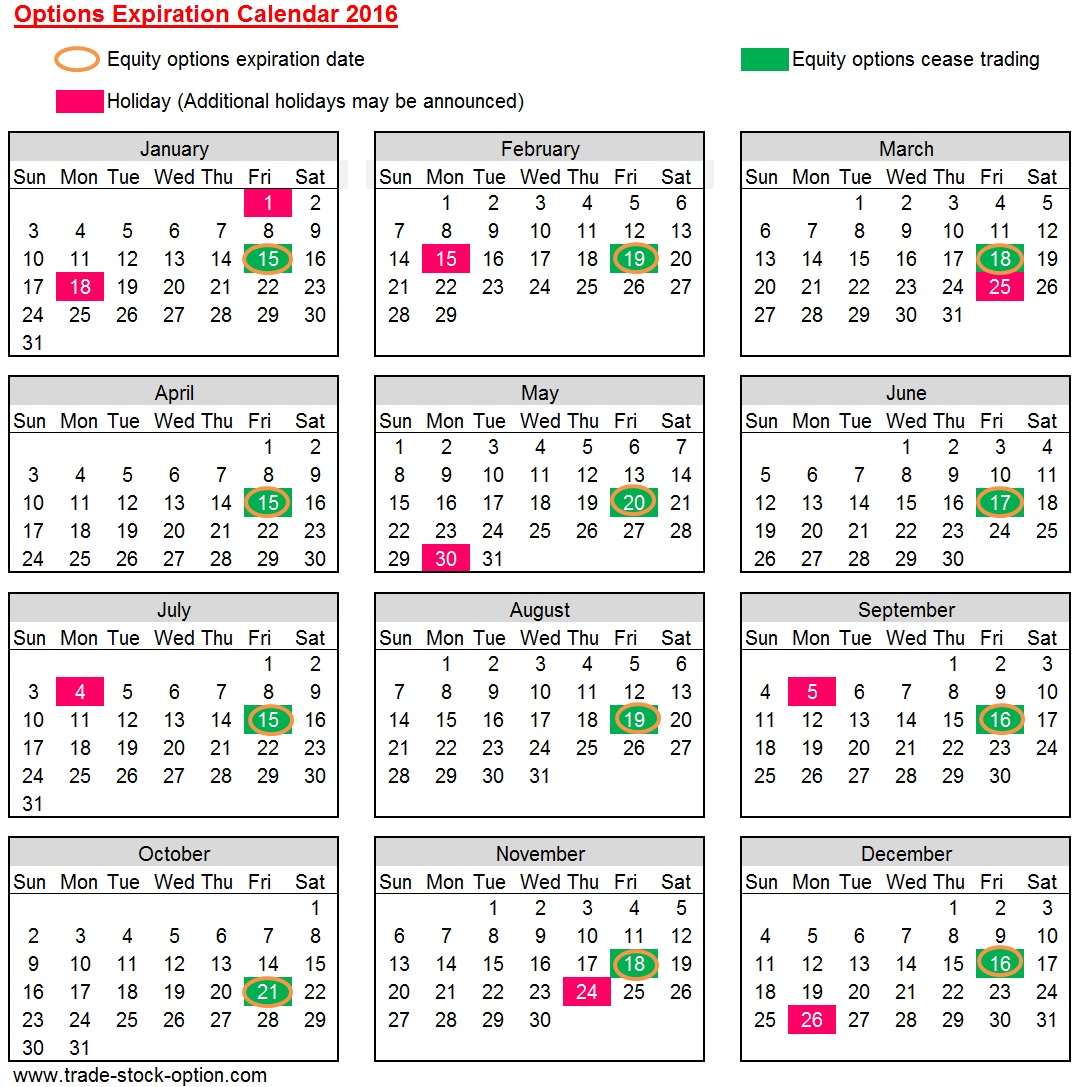

Image: acikubolex.web.fc2.com

Deciphering Option Trading Expiry Dates: A Key to Successful Transactions

Encapsulating the essence of option trading expiry dates involves recognizing the terminal juncture beyond which an option contract ceases to exist. As options are inherently time-bound, each contract holds a predetermined expiration date. This critical determinant establishes the timeframe within which option holders can exercise their rights. Should the option holder fail to act before this stipulated date, the contract expires worthless, and the initial premium paid for the option acquisition is forfeited.

Navigating the Expiry Date Landscape in India

Understanding the Indian context regarding option trading expiry dates proves essential. Indian exchanges, notably the National Stock Exchange (NSE), adhere to a uniform expiry cycle for stock options. This cycle aligns with four distinct expiry weeks namely, the first Thursday of every month, the second Thursday, the third Thursday, and the last Thursday. Each weekly expiry encompasses a diverse array of options, catering to varying investment horizons and risk appetites.

Implications of Expiry Dates: Strategic Implications for Option Trading

Option trading expiry dates bear profound implications on the strategic decision-making of traders. Astute investors meticulously consider the time decay associated with options. Time decay, an intrinsic characteristic of options, reflects the gradual erosion of an option’s value as its expiration date approaches. This inexorable decline in value compels traders to carefully assess the timing of their trades, striving to capture optimal returns before the option expires worthless.

Image: amalieqcaroline.pages.dev

Navigating the Nuances of Expiry Dates: Tips for Informed Traders

Embracing prudence in option trading necessitates a thorough understanding of the dynamics of expiry dates. Seasoned traders often emphasize the significance of considering the following factors:

-

Market Volatility: Options are highly sensitive to market fluctuations. Traders should gauge the volatility of the underlying asset to determine the appropriate duration for their options contracts. Increased volatility tends to favor shorter-term options, while lower volatility may warrant longer-term contracts.

-

Investment Objectives: Alignment between investment goals and option trading strategies is paramount. Traders should define their objectives (e.g., hedging, speculation) before selecting options with suitable expiry dates. Short-term objectives may be met with near-term options, while long-term goals may necessitate the utilization of longer-term options.

-

Premium Considerations: Option premiums, the price paid to acquire an option, are impacted by the time to expiration. Premiums for short-term options are typically lower than those for long-term options. Traders must carefully weigh the trade-off between premium costs and the potential rewards associated with different expiry dates.

Frequently Asked Questions: Addressing Common Queries on Option Trading Expiry Dates in India

Q: What happens if I do not exercise my option before its expiry date?

A: Failure to exercise an option contract before its expiry date renders the contract worthless, and the initial premium paid for its acquisition is forfeited.

Q: Can I extend the expiry date of an option contract?

A: Typically, the expiry date of an option contract cannot be extended. However, under exceptional circumstances, exchanges may consider such requests subject to specific regulations and guidelines.

Q: How can I determine the expiry date of an option contract?

A: Option expiry dates are standardized and adhere to a predetermined schedule. Traders can refer to the exchange website or utilize online resources to ascertain the expiry date of a particular option contract.

Option Trading Expiry Date India

Conclusion: Embracing Option Trading Expiry Dates for Informed Decisions

Option trading expiry dates, an integral facet of option trading in India, empower traders with the knowledge to optimize their strategies and maximize returns. By comprehending the implications of expiry dates, considering market volatility, aligning investment objectives, and weighing premium considerations, traders can navigate the dynamic world of options with greater confidence. Embrace the intricacies of option trading expiry dates, and embark on a journey of informed decision-making in the Indian financial landscape.