Imagine a world where you could potentially enhance your retirement savings while managing risk. That’s the alluring prospect of trading options within your Registered Retirement Savings Plan (RRSP).

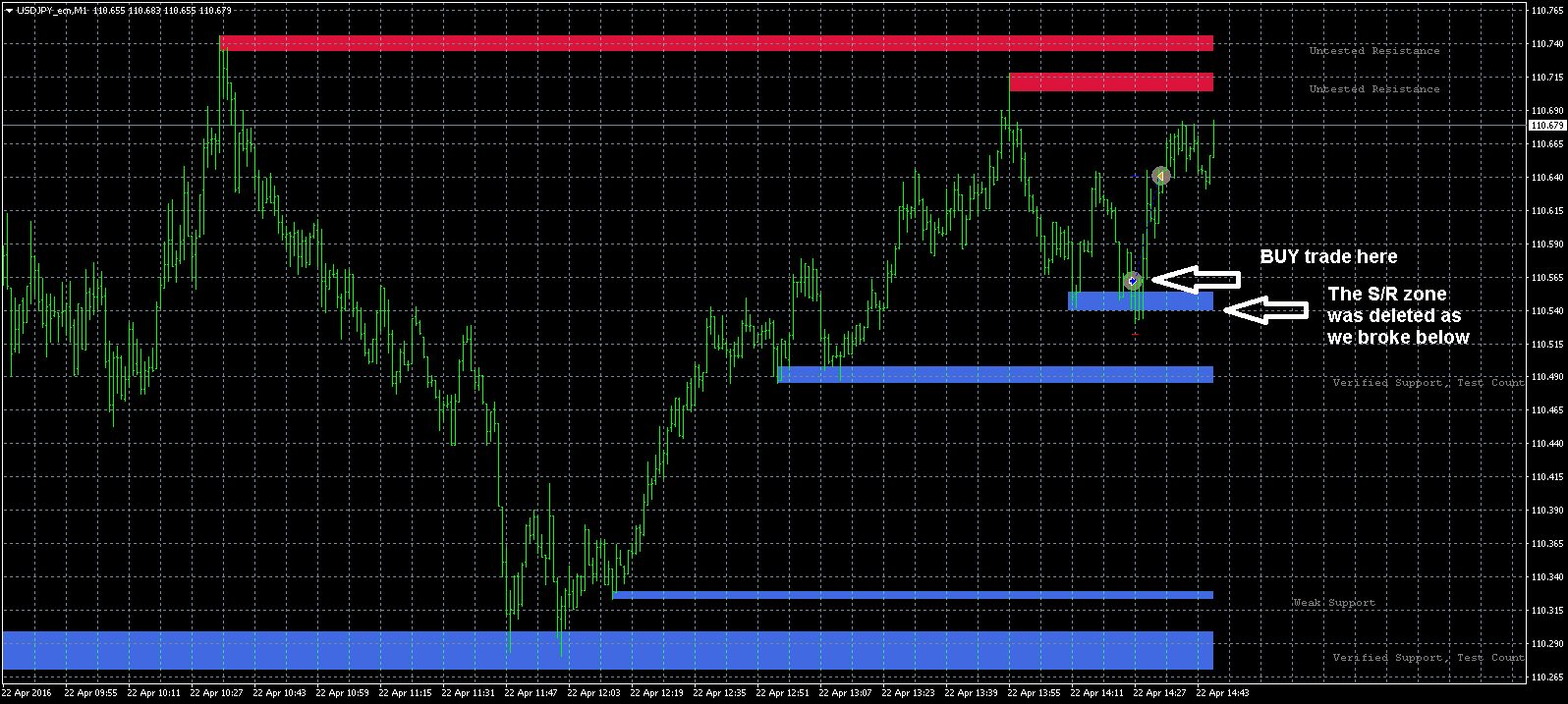

Image: www.mql5.com

Options, financial instruments that offer the right but not the obligation to buy or sell an underlying asset, provide an intriguing tool for savvy investors seeking to optimize their retirement portfolios.

Navigating the Options Landscape

In the realm of options trading, you have two main choices: buying or selling an option contract. When you buy an option, you acquire the right to execute the contract at a predetermined price on or before a specific date. On the other hand, selling an option contract involves granting this right to another party.

Options contracts come in two flavors: calls and puts. Calls give you the right to buy the underlying asset, while puts grant the right to sell it. Each contract also has two key attributes: a strike price, which is the price at which the option can be exercised, and an expiration date, which determines how long the option remains valid.

Trading Options in Your RRSP: Strategies and Considerations

Integrating options trading into your RRSP opens up a world of opportunities. With careful planning and risk management, you can explore various strategies to potentially boost your retirement savings:

- Covered Calls: Sell an out-of-the-money call option on a stock you own to generate additional income while maintaining exposure to share price increases.

- Protective Puts: Buy a put option on a stock you own to protect against potential price declines.

- Collar Strategy: Combine covered calls and protective puts to create a range within which your stock can fluctuate. This strategy limits both potential gains and losses.

- Iron Condor: Execute a simultaneous purchase and sale of out-of-the-money call and put options with different strike prices to target limited profit from moderate price movements.

However, it’s crucial to approach options trading with a clear understanding of the risks involved, including the possibility of losing your entire investment.

Stay Informed: Latest Trends and Developments

The world of options trading is constantly evolving. Keep abreast of recent trends and developments to refine your strategies:

- Options on ETFs: Options trading has expanded beyond individual stocks to include exchange-traded funds (ETFs), providing exposure to a diversified portfolio.

- Options on Indices: Trade options on indices such as the S&P 500 to gain exposure to broader market movements.

- Online Options Trading Platforms: Technology has made options trading more accessible. Explore online platforms offering intuitive interfaces and advanced trading tools.

- Social Media and Forums: Connect with other options traders on social media and forums to share insights, knowledge, and strategies.

Image: www.mql5.com

Tips for Success: Expert Advice from an Experienced Option Trader

Drawing from years of experience, seasoned option traders offer invaluable advice:

- Start Small: Begin with smaller trades to familiarize yourself with options trading and minimize potential losses.

- Research Thoroughly: Before executing any trade, research the underlying asset, the options market, and your own risk tolerance.

- Utilize Stop-Loss Orders: Protect your investments by setting stop-loss orders to limit your potential losses if the market moves against you.

- Manage Your Risk: Diversify your options positions and avoid concentrating your investments in a single strategy or asset.

- Seek Professional Guidance: If you’re a novice or unfamiliar with options trading, consider seeking advice from a qualified financial advisor.

Trading Options In Rrsp

Image: ibkrcampus.com

FAQ: Your Questions Answered

Q: Are options suitable for all RRSP investors?

A: Options trading involves inherent risk and is not appropriate for all investors. It suits experienced and knowledgeable traders comfortable with active risk management.

Q: Can I lose money trading options in my RRSP?

A: Yes, it’s possible to lose the entire amount invested in options trading. Options contracts are leveraged products, amplifying both potential gains and losses.

Q: What is the tax treatment of options profits in an RRSP?

A: Profits from options trading within an RRSP are generally tax-deferred until withdrawn at retirement. However, options premiums are not eligible for the RRSP contribution limit.

Conclusion: Enhancing Your Retirement with Options Trading

Trading options in your RRSP offers a powerful tool to potentially boost your retirement savings. By leveraging strategies, staying informed, and implementing expert advice, you can harness the opportunities while mitigating risks.

Are you ready to explore the world of options trading in your RRSP? Share this article, discuss it with your friends and financial advisor, and let’s embark on this exciting and potentially rewarding journey together