SEO Title: Enhance Your Retirement Savings: Unlock the Potential of Options Trading for Retirement Income

Image: retirement-insight.com

Headline: Retire with Peace of Mind: Generate Passive Income Streams through Options Trading

Introduction

In the twilight of your working years, securing a comfortable retirement becomes paramount. While diligently planning and saving is crucial, it might not be enough to sustain the desired quality of life during retirement. That’s where options trading emerges as a potentially lucrative strategy to supplement your retirement income.

Options, financial instruments derived from stocks, indices, or commodities, offer flexible and profitable ways to generate income in retirement. This comprehensive guide aims to unravel the intricacies of options trading and demonstrate its potential to enhance your retirement savings.

Understanding Options Trading: The Basics

Options contracts provide the buyer (holder) with the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specified date (expiration date). These contracts offer two distinct advantages:

- Limited Risk: Unlike stocks where losses can be substantial, options have a clearly defined maximum risk equal to the premium paid for the contract.

- Unlimited Profit Potential: Unlike bonds where returns are capped, options allow for potentially limitless profits depending on the underlying asset’s price movements.

Covered Call Strategy: Generating Passive Income

One of the most popular options strategies for retirement income generation is the covered call strategy. This involves selling (writing) a call option on a stock you already own. By granting someone else the option to buy your stock at a higher price, you receive an immediate premium payment. If the stock price rises and the buyer exercises the option, you sell the stock at a profit. However, if the stock price falls, you retain ownership of the stock and can continue to collect dividends or wait for it to recover.

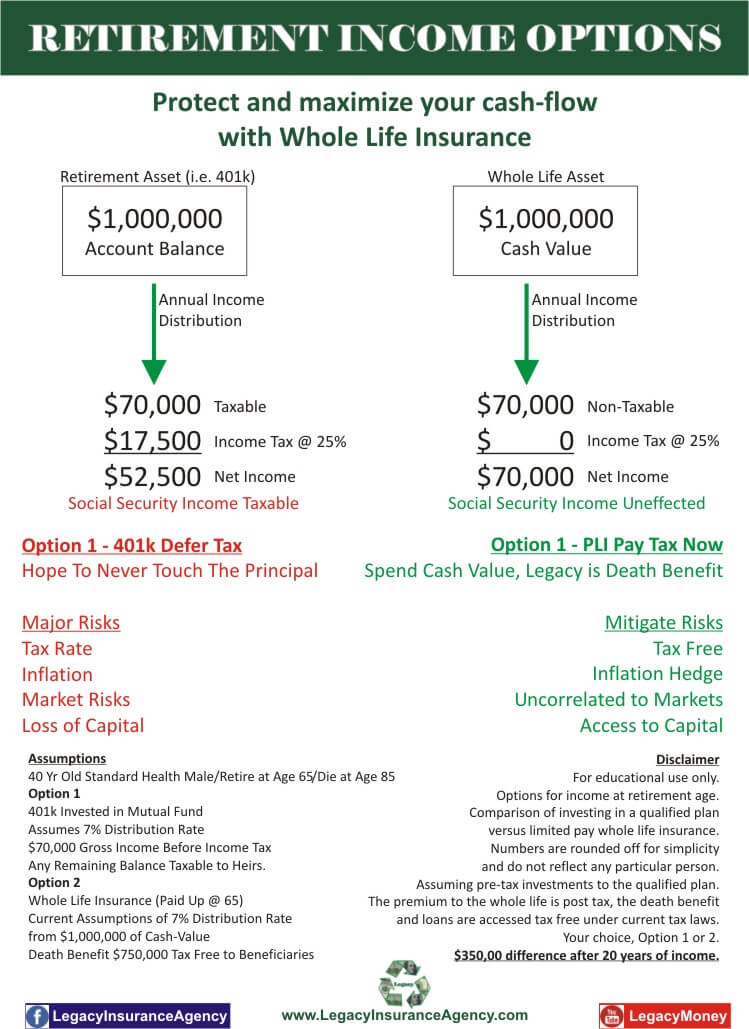

Image: legacyinsuranceagency.com

Put-Selling Strategy: Protecting and Generating Income

Put-selling involves selling (writing) a put option, giving someone else the option to sell you a stock at a set price. This strategy is often used to generate income while providing downside protection for your portfolio. If the stock price falls, you may be obligated to buy it at a specified price, but you can sell it immediately for a higher price in the market to capitalize on the price discrepancy. Conversely, if the stock price rises, you simply keep the premium earned from selling the put option.

Considerations for Retirement Income Generation

While options trading can be an effective tool for retirement income generation, it’s important to proceed cautiously and consider the following factors:

- Market Volatility: Options are highly sensitive to market movements, so understanding and managing risk is essential.

- Time Decay: Option premiums decay over time, so consider the time frame and expiration date of the contracts carefully.

- Tax Implications: Options trading profits are subject to taxation, so consult with a tax professional for guidance.

- Knowledge and Experience: Options trading requires a sound understanding of financial markets and trading strategies. Consider seeking professional guidance if necessary.

Options Trading For Retirement Income

Image: workplace.schwab.com

Conclusion

Options trading can be a powerful tool to supplement your retirement income if approached strategically and with careful consideration. By understanding the basics of options and implementing strategies such as covered calls and put-selling, you can generate passive income, protect your portfolio, and enhance your financial security in retirement. Remember to consult with professionals, stay informed about market conditions, and trade responsibly to maximize the potential benefits of options trading.