Are you an options trader contemplating how your trading income might impact your Social Security benefits? Or perhaps you’re a retiree considering supplementing your Social Security income through options trading? Understanding the intricacies of options trading income and Social Security is crucial for financial planning and maximizing your benefits. This comprehensive guide will explore the interplay between these two income sources, providing valuable insights for savvy investors and retirees alike.

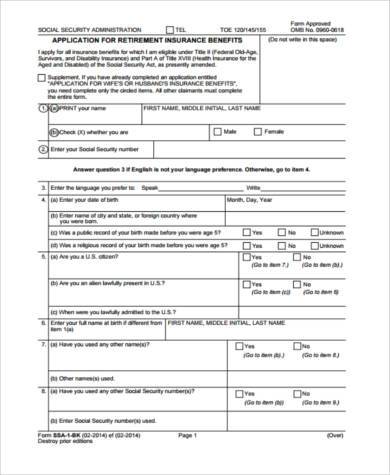

Image: www.sampleforms.com

Options Trading: A Primer

Options trading involves the buying and selling of contracts that give the buyer the right (but not the obligation) to buy (in the case of call options) or sell (in the case of put options) an underlying asset at a specified price within a set time frame. Options contracts are derived from stocks, commodities, currencies, and indices, allowing traders to speculate on price movements without directly owning the underlying asset. Options trading offers potential for profit but also carries inherent risks. Thus, it’s crucial to thoroughly understand the mechanisms and risks associated with options trading before engaging in this investment strategy.

Social Security: A Retirement Lifeline

Social Security is a federal retirement program that provides monthly benefits to eligible individuals who have contributed to the system through payroll taxes. Retirement benefits are calculated based on a worker’s earnings history over their lifetime, up to a maximum allowable income. Social Security benefits are intended to provide a financial safety net for retirees and supplement other retirement savings and investments. However, it’s important to note that Social Security benefits are subject to taxation and may be reduced if you continue working and earning income above certain thresholds during retirement.

The Interplay: Options Trading Income and Social Security

Now that we have a foundational understanding of options trading and Social Security, let’s delve into the relationship between these two income sources. The key consideration is when and how options trading income is reported to the Social Security Administration (SSA).

Image: www.socialsecurityintelligence.com

Earnings Reporting Timeline

The SSA considers options trading income as self-employment income. As such, it is reported on Schedule SE (Form 1040) when you file your annual taxes. The deadline for filing your tax return and reporting self-employment income, including options trading income, is typically April 15th.

Tax Implications on Social Security Benefits

Options trading income may impact your Social Security benefits in two primary ways:

-

Delayed Retirement Credits: If you are claiming Social Security retirement benefits before reaching full retirement age (FRA), your benefits may be reduced by a certain percentage for each month you are under FRA. However, if you continue working and have substantial self-employment income, including options trading income, it may delay the application of these reductions or even offset them completely.

-

Earnings Test: If you are already receiving Social Security retirement benefits and you continue to earn income, including options trading income, your benefits may be subject to an earnings test. In 2023, if you are under FRA and earn more than $19,560 per year, or $21,240 if you reach FRA by the end of the year, your benefits will be reduced by $1 for every $2 you earn above these limits.

Maximizing Your Options Trading Income and Social Security

To optimize your financial well-being, consider the following strategies:

-

Plan Ahead: As you approach retirement age, plan how options trading income will complement your Social Security benefits. Consider your FRA and the potential impact of earnings on your benefits.

-

diversify Income Sources: Don’t rely solely on options trading income or Social Security benefits. Create a diversified retirement portfolio that includes other income streams, such as 401(k) plans, IRAs, and annuities.

-

Consult a Financial Advisor: Seek professional guidance from a financial advisor who specializes in retirement planning and Social Security optimization. They can help you navigate the complexities and maximize your benefits.

Options Trading Income And Social Security

Image: www.nasdaq.com

Conclusion

Understanding how options trading income impacts Social Security benefits is crucial for financial planning. By carefully planning, diversifying your income sources, and seeking expert advice when necessary, you can optimize your retirement income and ensure a secure financial future. Options trading can be a valuable tool for supplementing Social Security benefits, but it’s important to be aware of the potential implications and take steps to mitigate any negative effects on your benefits.