Unveiling the World of Employee Equity

Have you ever wondered how tech giants like Google or Facebook reward their employees beyond traditional salaries? The answer lies in stock option trading, a game-changing strategy that empowers employees to reap the rewards of their company’s success. Stock options grant employees the right to purchase company shares at a predetermined price, often below market value. By exercising these options, employees can potentially generate significant financial gains if the company’s stock price rises.

:max_bytes(150000):strip_icc()/BuyingPuts-d28c8f1326974c16807f23cb32854501.png)

Image: www.pelletplus.hu

Understanding the Fundamentals

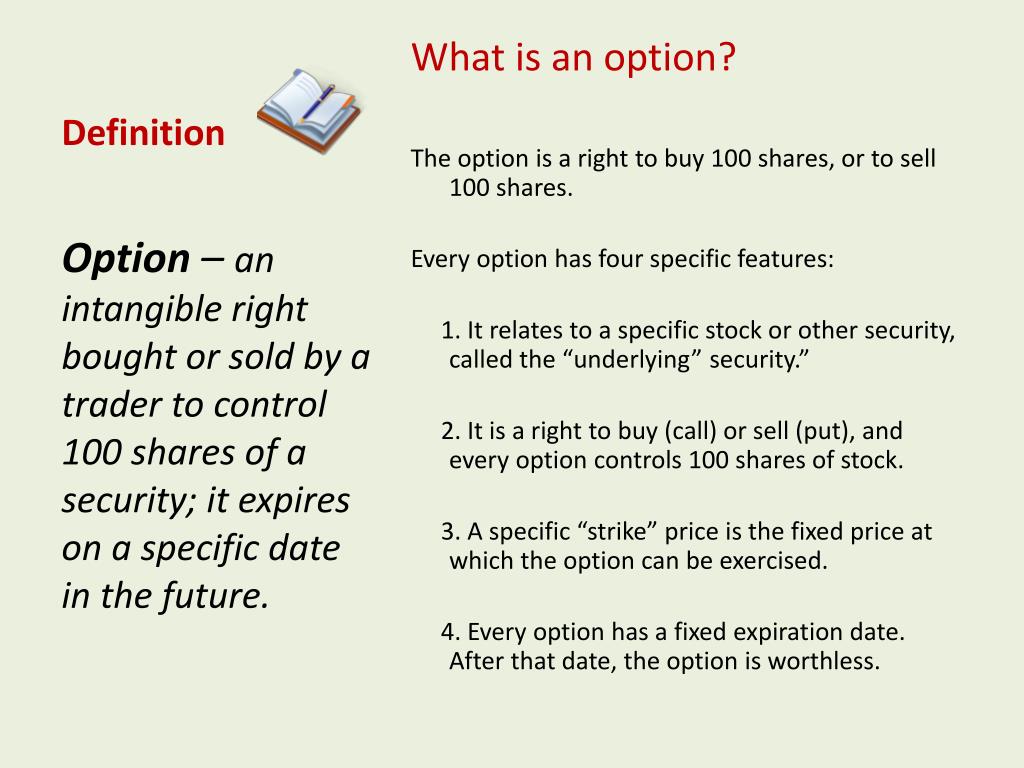

Stock options are essentially contracts between an employee and their employer. They specify the number of shares the employee can purchase, the exercise price (the price at which they can buy the shares), and the expiration date by which the options must be exercised. The underlying principle is that employees have the potential to profit if the company’s stock price exceeds the exercise price during the option period.

Types of Stock Options

There are two primary types of stock options:

-

Incentive Stock Options (ISOs): These options are granted to employees who meet certain service requirements. They offer tax advantages if held for a specified period.

-

Non-Qualified Stock Options (NSOs): These options have no service requirements and are taxed as regular income when exercised.

Advantages and Disadvantages

Like any financial instrument, stock options have both benefits and risks:

- Potential for Gain: Stock options provide employees with the opportunity to share in the company’s growth and earn substantial profits.

- Tax Advantages (ISOs): ISOs offer favorable tax treatment compared to NSOs.

- Risk of Loss: If the company’s stock price falls below the exercise price, the options become worthless and the employee loses any investment.

Image: www.strike.money

Recent Trends and Developments

Stock option trading has evolved in recent years, with companies exploring innovative ways to attract and retain top talent. Some notable trends include:

- Option Strikes at-the-Money: Companies are increasingly setting exercise prices close to the current market value, reducing the risk for employees.

- Longer Option Periods: Companies are extending option periods to give employees more time to profit from potential growth.

- Tech Sector Dominance: Tech companies continue to lead in stock option grants, with many start-ups using options as a key employee incentive.

Tips and Expert Advice

Navigating the world of stock option trading requires a strategic approach:

- Understand Your Options: Carefully review the terms of your stock options to ensure you comprehend the rights and risks.

- Diversify Your Portfolio: Consider stock options as part of a broader investment portfolio to manage risk.

- Consult an Advisor: Seek advice from a financial advisor who specializes in stock options to make informed decisions.

Frequently Asked Questions

Q: How do I exercise my stock options?

A: You can typically exercise your options online through your company’s broker.

Q: When should I exercise my stock options?

A: Determining the optimal time to exercise your options depends on factors such as the stock price, your financial situation, and tax implications.

Q: What happens if I don’t exercise my stock options?

A: Unexercised options will expire worthless, resulting in you losing any potential gain.

Define Stock Option Trading

Image: www.slideserve.com

Conclusion: Unlock Your Financial Potential

Stock option trading provides employees with a unique opportunity to share in the success of their company. Understanding the basics, considering the latest trends, and seeking expert advice can empower you to maximize the potential benefits of this powerful financial tool. So, are you ready to dive into the world of stock option trading and unlock your financial potential?