**

Image: www.pinterest.com

In the intricate tapestry of the financial markets, the concept of implied volatility stands as a captivating enigma, swaying the fortunes of countless traders and investors. This elusive metric, deeply entwined with the enigmatic world of options, wields an unparalleled influence over the pricing of these coveted financial instruments. Join us on an illuminating journey as we delve into the depths of implied volatility, unravelling its significance and unraveling its enigmatic nature.

Implied volatility, in essence, captures market expectations of a stock’s future price volatility. Unlike historical volatility, which gauges past price movements, implied volatility ventures into the opaque realm of the future, mirroring investors’ collective anticipation of upcoming price fluctuations. This forward-looking characteristic renders implied volatility an invaluable asset in the realm of option trading, serving as a compass guiding traders through the choppy waters of market uncertainty.

Comprehending the Mechanics of Implied Volatility: A Journey into the Pricing Labyrinth

At its core, implied volatility is ingeniously derived from the intricate calculations of option pricing models. These sophisticated algorithms, the Black-Scholes model being paramount, harness the delicate balance of factors shaping option values. Inputs such as strike price, time to expiration, risk-free interest rates, and of course, that elusive beast known as volatility, orchestrate a symphony of mathematical harmony culminating in the determination of an option’s theoretical value.

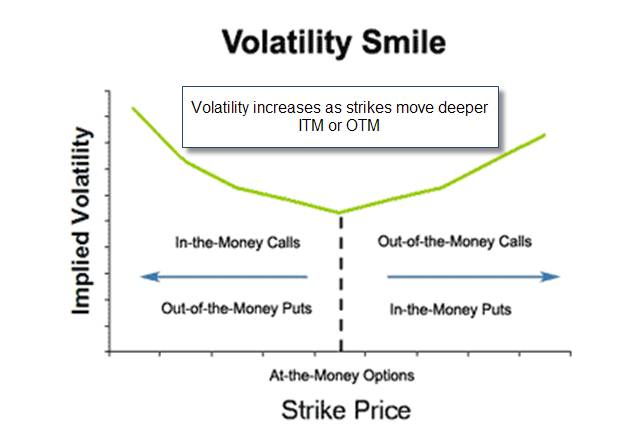

Strikingly, implied volatility materializes as an outcome of this elaborate dance, mirroring the market’s collective wisdom regarding future price gyrations. A lofty implied volatility implies heightened expectations of significant price oscillations, while a modest implied volatility suggests a belief in more subdued price movements. It whispers of the market’s anticipations, unveiling investors’ sentiments and collective perspectives on the underlying security’s future trajectory.

Implied Volatility: The Master Key to Unlocking Profitable Trading Strategies

For those navigating the tumultuous currents of option trading, understanding implied volatility is tantamount to deciphering an ancient hieroglyph. Seasoned traders leverage this profound insight to forge lucrative trading strategies, exploiting the market’s mispricing of volatility and reaping handsome rewards.

If implied volatility outstrips realized volatility, an astute trader senses an opportune moment to purchase options, wagering on a potential increase in price fluctuations. Conversely, when implied volatility wanes below realized volatility, selling options emerges as a prudent tactic, capitalizing on the market’s subdued volatility expectations. By aligning trading decisions with the ebb and flow of implied volatility, savvy traders navigate market uncertainties, maximizing their profit-making prowess.

Conclusion: Embracing Implied Volatility, Unveiling the Secrets of Option Trading

Implied volatility, a profound concept deeply entwined with the intricacies of option pricing, stands as a cornerstone of successful trading strategies. By mastering this enigmatic metric, understanding its underlying mechanics, and embracing its predictive power, traders empower themselves to unlock the hidden value within the financial markets.

Embrace the enigmatic allure of implied volatility, embark on a journey of financial exploration, and let its enigmatic charm guide you towards a realm of profitable trading triumphs.

Image: micaelachrislyn.blogspot.com

Implied Volatility In Option Trading

Image: www.defensahonorarios.cl