Navigating Market Uncertainty with Volatility-Driven Options

In the dynamic world of financial markets, options present a powerful tool for investors seeking to mitigate risk and capitalize on market movements. Among these options, implied volatility plays a pivotal role in determining the pricing and profitability of strategies.

:max_bytes(150000):strip_icc()/VolatilitySmileDefinitionandUses2-6adfc0b246cf44e2bd5bb0a3f2423a7a.png)

Image: www.investopedia.com

Implied volatility, in essence, measures the market’s perception of future price volatility. By understanding how to utilize implied volatility, traders can uncover valuable opportunities and fine-tune their options trading strategies.

Understanding Implied Volatility

Implied volatility is embedded within the pricing of an option and reflects the market’s collective expectations for the underlying asset’s future price fluctuations. A higher implied volatility suggests that the market anticipates significant price movement, while a lower implied volatility indicates a more stable pricing environment.

This inherent volatility information allows traders to gauge the potential rewards and risks associated with different options strategies. Higher implied volatility generally corresponds to higher potential profits but also increased risk, whereas lower implied volatility typically translates into lower potential returns and reduced risk.

Exploiting Implied Volatility Strategies

The comprehension of implied volatility empowers traders with a host of tactical strategies:

- Selling Options in High Volatility Environments: When implied volatility is elevated, options premiums are commonly inflated. By selling options in such scenarios, traders can potentially generate substantial income as the market corrects, leading the volatility to normalize.

- Buying Options in Low Volatility Environments: Conversely, when implied volatility is depressed, options become relatively inexpensive. Buying options in such conditions allows traders to position themselves for a potential surge in volatility, enabling them to capture significant returns.

Expert Insights and Tips

Seasoned options traders emphasize the following guidance for leveraging implied volatility:

- Monitor Volatility Historical Data: Conduct a thorough examination of historical volatility patterns to understand the normal volatility range of the underlying asset.

- Utilize Implied Volatility Charts: Visual representations of implied volatility can provide valuable insights into the market’s evolving expectations.

- Diversify Volatility-Based Strategies: Incorporate strategies that target both high and low volatility environments to balance risk and opportunities.

Image: www.pinterest.com

FAQs on Implied Volatility Options Trading

Q: How does elevated implied volatility affect option prices?

A: Elevated implied volatility inflates option premiums, potentially leading to higher profits but also increased risk.

Q: When is it advantageous to sell options in implied volatility contexts?

A: Selling options is profitable during high implied volatility, where the inflated premiums offer favorable risk-to-return ratios.

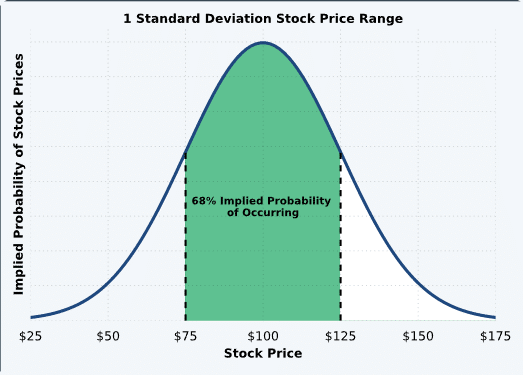

Option Trading Strategies Based On Implied Volatility

Image: www.projectfinance.com

Conclusion

In the financial realm, implied volatility stands as a beacon, illuminating the path to profitable options trading strategies. By comprehending and harnessing the dynamics of implied volatility, traders can navigate market uncertainty, mitigate risk, and seize the opportunities that lie within the intricacies of options trading.

Do you find yourself drawn to the enigmatic world of options trading? Embark on a journey to unravel the secrets of implied volatility and unlock the key to financial empowerment.