Navigating the Ethereal Realm of Volatility

In the labyrinthine world of options trading, implied volatility stands as a pivotal compass, guiding traders through the treacherous currents of market uncertainty. Embracing the nuanced intricacies of this enigmatic force empowers options traders to capitalize on opportunities and mitigate risks with unparalleled precision. Mastering the art of interpreting and utilizing implied volatility is akin to unlocking an alchemical secret — transforming market volatility into a catalyst for substantial financial gains.

Image: optionstradingiq.com

Deciphering the Implied Volatility Enigma

Implied volatility, in its essence, reflects the market’s collective perception of an underlying asset’s future price fluctuations. It represents an annualized measure of the expected volatility derived from the pricing of options contracts. Concealed within the intricate tapestry of option premiums, implied volatility serves as a beacon of insight, signaling potential market sentiment and the perceived risk associated with the underlying asset.

Understanding the interplay between implied volatility and option premiums is paramount for successful options trading. Higher implied volatility translates into higher option premiums, indicating a market expectation of significant price fluctuations. Conversely, lower implied volatility corresponds with lower option premiums, suggesting a market belief in相對 stable price movements.

Exploiting Volatility’s Tendencies

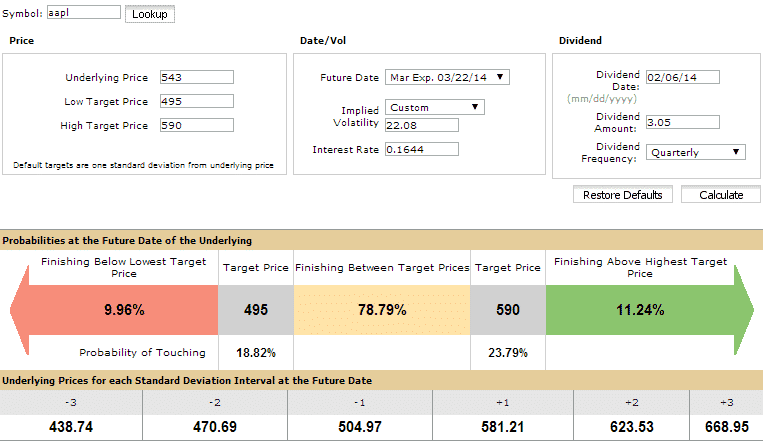

The dynamic nature of implied volatility presents astute traders with a wealth of opportunities. When implied volatility is elevated, signifying a heightened market anticipation of future price swings, traders can seize the moment to enter options strategies that thrive in volatile markets. Bullish call options or bearish put options become the weapons of choice, capitalizing on the anticipated price surges or downturns.

On the contrary, when implied volatility plunges to uncharted lows, traders may adopt a more conservative approach, opting for options strategies that benefit from stable market conditions. Strategies such as selling call options or buying protective put options enable traders to generate income while hedging against potential market fluctuations.

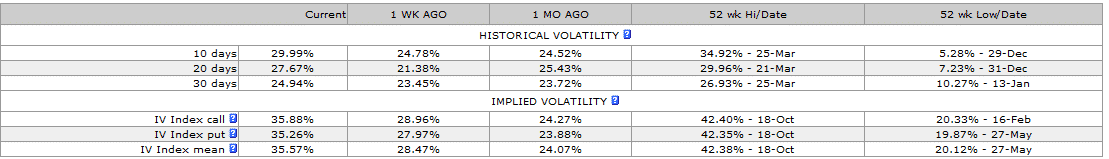

Historical Volatility vs. Implied Volatility: Bridging the Divide

Historical volatility, a retrospective measure of past price oscillations, serves as a complementary tool in the options trader’s arsenal. By comparing implied volatility to historical volatility, traders gain valuable insights into the market’s current perception of risk relative to past experiences.

Discrepancies between implied volatility and historical volatility can often lead to lucrative trading opportunities. When implied volatility significantly exceeds historical volatility, the market may be pricing in an excessive premium for volatility, creating an opportunity for selling volatility via strategies such as selling straddles or strangles. Conversely, when implied volatility falls below historical volatility, traders may consider buying volatility through strategies like buying straddles or strangles, anticipating a potential underestimation of future price fluctuations.

Image: optionstradingiq.com

How To Use Implied Volatility In Options Trading

Conclusion: Mastery Over Volatility — A Pathway to Market Dominance

Navigating the intricate world of implied volatility empowers options traders with a profound understanding of market dynamics, enabling them to anticipate and capitalize on potential price swings. By embracing the nuanced interplay between implied volatility, historical volatility, and option premiums, traders gain the ability to craft strategies tailored to the ever-shifting market conditions.

Remember, mastering the art of implied volatility is a continual journey, requiring diligent research, practice, and a deep-seated understanding of underlying market forces. As you refine your skills, harnessing implied volatility will become an indispensable weapon in your pursuit of trading success, guiding you towards the pinnacle of profitability.