Image: www.youtube.com

Introduction

In the realm of financial markets, where risk and reward dance in a delicate pas de deux, options trading stands out as a tantalizing game of skill and strategy. It’s a world where savvy traders harness the power of implied volatility, a subtle yet potent force that can amplify profits and mitigate losses. Join us on an enlightening journey as we unveil the intricacies of this elusive concept, empowering you to navigate the treacherous waters of options trading with confidence and finesse.

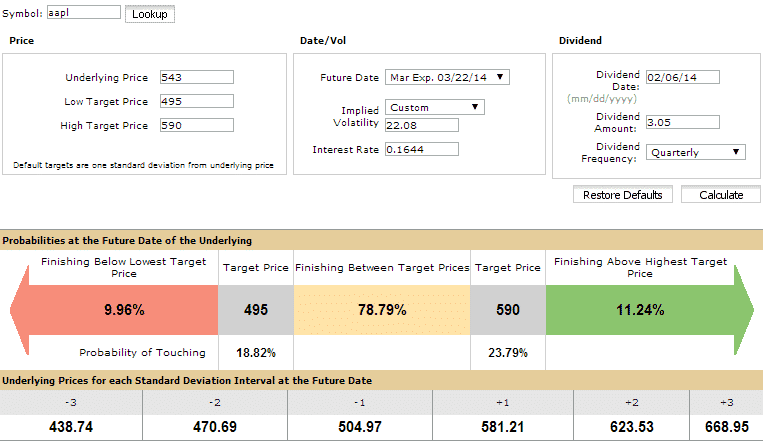

Implied volatility is a forward-looking measure of market participants’ expectations of future price fluctuations in an underlying asset. It’s embedded in the pricing of options contracts, like a crystal ball forecasting the level of market uncertainty and potential price swings. By understanding how to decipher and utilize implied volatility, traders can gain a competitive edge in the high-stakes game of options trading.

Implied Volatility: A Window into the Market’s Pulse

Implied volatility is derived from the Black-Scholes model, a sophisticated mathematical formula that quantifies the variables affecting an option’s price. These variables include the underlying asset’s price, the time to expiration, the strike price, and of course, implied volatility. By analyzing these factors, traders can gauge the market’s perception of future price fluctuations.

High implied volatility indicates that the market anticipates significant price volatility, while low implied volatility suggests a period of relative price stability. This information is invaluable for traders, as it allows them to anticipate future price movements and position their trades accordingly. For instance, when implied volatility is high, traders may opt for options strategies that profit from volatile market swings. Conversely, when implied volatility is low, strategies that capitalize on price stability may yield more favorable returns.

Trading with Implied Volatility: Strategies for Success

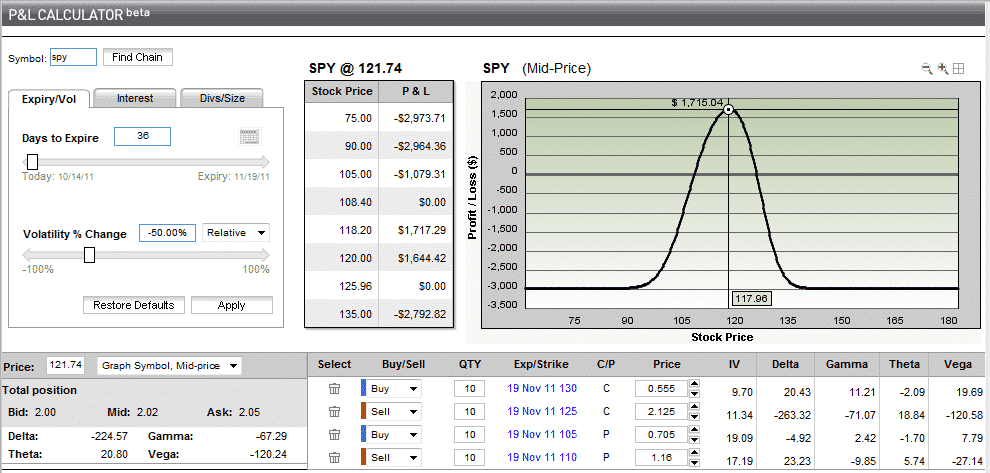

Armed with the knowledge of implied volatility, traders can unlock a world of trading opportunities. Let’s delve into some practical strategies that leverage this potent force:

1. Trading Historical Volatility:

Historical volatility, a measure of past price fluctuations, provides insights into the underlying asset’s typical volatility. By comparing historical volatility to implied volatility, traders can assess whether the market is overestimating or underestimating future volatility. This comparison can inform trading decisions, as options strategies that align with market expectations are more likely to generate profits.

2. Exploiting Implied Volatility’s Mean Reversion:

Implied volatility tends to mean-revert over time. This means that periods of high implied volatility are often followed by periods of low implied volatility, and vice versa. Traders can capitalize on this pattern by buying options when implied volatility is low and selling them when implied volatility is high.

3. Unlocking Volatility Skew Trading Opportunities:

Volatility skew refers to the difference in implied volatility for calls and puts with the same strike price and expiration date. Traders can exploit these disparities by buying options where the implied volatility is abnormally high and selling options where the implied volatility is abnormally low. This strategy can yield significant profits if the volatility skew reverts to more normal levels.

Expert Insights and Actionable Tips

To further enhance your trading acumen, let’s consult with experts in the field of options trading:

“Implied volatility is a crucial variable that should not be overlooked in options trading,” advises renowned trader Mark Douglas. “Traders who master the art of incorporating implied volatility into their trading strategies gain a significant advantage in the market.”

“Options strategies that leverage implied volatility are powerful tools, but they should be approached with caution,” cautions financial analyst Dr. Alexander Elder. “Traders must fully understand the risks involved and only trade with a well-defined risk management plan.”

Conclusion

Options trading, once a mysterious art, can be demystified by harnessing the power of implied volatility. By understanding the concept, interpreting it accurately, and employing strategic trading approaches, traders can navigate the choppy waters of options markets with increased confidence and profitability. Remember, knowledge is power, and in the realm of financial markets, understanding implied volatility is a key that unlocks the door to trading success.

Image: yolafoq.web.fc2.com

How To Use Implied Volitility In Options Trading

Image: optionstradingiq.com