In the realm of financial markets, options trading presents a dynamic playground where investors can navigate risks and potential rewards. One crucial element that plays a pivotal role in this intricate game is implied volatility (IV). It weaves its influence into the heart of options pricing, shaping expectations of future market fluctuations and guiding the decisions of seasoned traders.

Image: www.youtube.com

Understanding implied volatility is akin to deciphering a cryptic Rosetta Stone; once its enigmatic secrets are unlocked, the path to maximizing trading outcomes becomes illuminated. This comprehensive guide will delve into the depths of IV, unraveling its intricacies and empowering you with the knowledge to harness its power.

Defining Implied Volatility

Implied volatility measures the market’s perception of future price fluctuations within an underlying asset, such as a stock, commodity, or currency. It gauges the degree to which market participants anticipate volatility, a metric that influences the premiums and valuations of options contracts.

Contrary to historical volatility, which examines past price movements, implied volatility looks into the future, encapsulating expectations and sentiments of market actors. This forward-looking nature renders IV a potent indicator of market sentiment and a valuable tool for forecasting future market behavior.

Influences on Implied Volatility

A myriad of factors dance together to shape the delicate balance of implied volatility. These include:

- Underlying Asset’s Volatility: The historical price swings of the underlying asset serve as a crucial ingredient in the IV calculation.

- Time to Expiration: Options with longer time horizons tend to exhibit higher IV, as there is greater uncertainty regarding the future.

- News and Events: Market-moving events, both anticipated and unforeseen, can stir the waters of IV, leading to sudden shifts.

- Market Sentiment: The collective mood of market participants, whether bullish or bearish, influences IV, reflecting their expectations of future price movements.

- Supply and Demand: The interplay of buyers and sellers in the options market directly affects IV, as both seek favorable prices and hedge their portfolios.

The Role of Implied Volatility in Options Trading

Implied volatility forms the cornerstone of options pricing, casting a profound influence on their premiums and profitability. Higher IV leads to higher premiums, as the market anticipates greater price fluctuations, and vice versa.

Traders leverage IV to gauge potential outcomes and adjust their strategies accordingly. By understanding the market’s expectations, they can make informed decisions about buying or selling options, hedging against risks, and maximizing their chances of success.

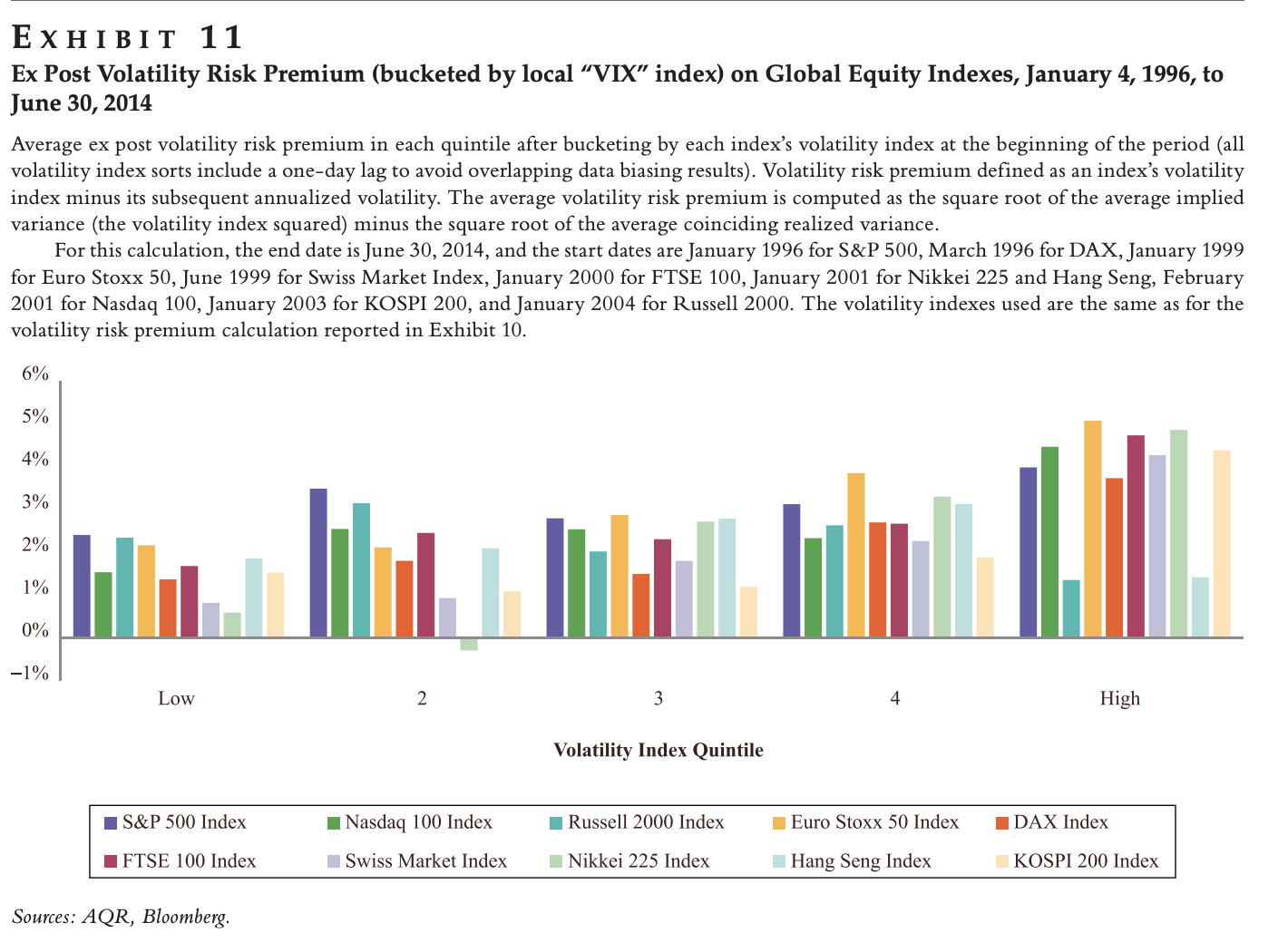

Image: www.ainfosolutions.com

Expert Insights: Harnessing Implied Volatility

To harness the power of IV in your trading endeavors, consider the following insights from market veterans:

- Assess IV vs. Historical Volatility: Compare implied volatility to historical volatility to identify potential mismatches and capitalize on opportunities.

- Consider Option Delta: Delta measures the sensitivity of option premiums to changes in the underlying asset’s price. Use this knowledge to hedge risks and fine-tune your strategies.

- Monitor Market Conditions: Stay abreast of market news, events, and sentiment, as these factors can swiftly alter IV and impact option prices.

Trading Options Do Implied Volatility

Image: www.derivativetradingacademy.com

Conclusion: Unlocking the Secrets of Implied Volatility

Implied volatility stands as a pivotal force in the realm of options trading, shaping pricing, influencing decisions, and dictating market outcomes. By unraveling the intricacies of IV, investors can gain a profound understanding of market sentiment, forecast future behavior, and navigate the options landscape with increased confidence.

Remember, the pursuit of financial knowledge is a continuous journey. Delve deeper into the world of implied volatility, explore advanced trading strategies, and seek guidance from reputable sources. With dedication and a thirst for knowledge, you can conquer the enigmatic world of options trading and emerge as a seasoned investor.