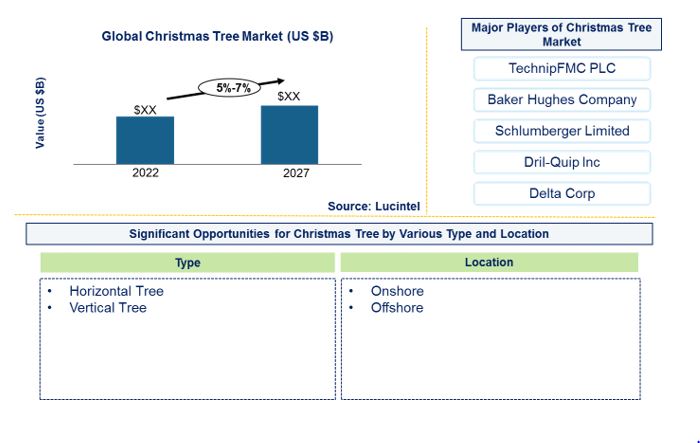

The holiday season is upon us, and with it comes the age-old tradition of decorating our homes with festive Christmas trees. However, have you considered leveraging the season’s popularity by delving into the exciting realm of Christmas tree options trading?

Image: www.lucintel.com

Options trading provides a unique opportunity to capitalize on the Christmas tree market’s fluctuations. By speculating on the future price movements of Christmas trees, traders can potentially generate significant profits.

Understanding Christmas Tree Options Trading

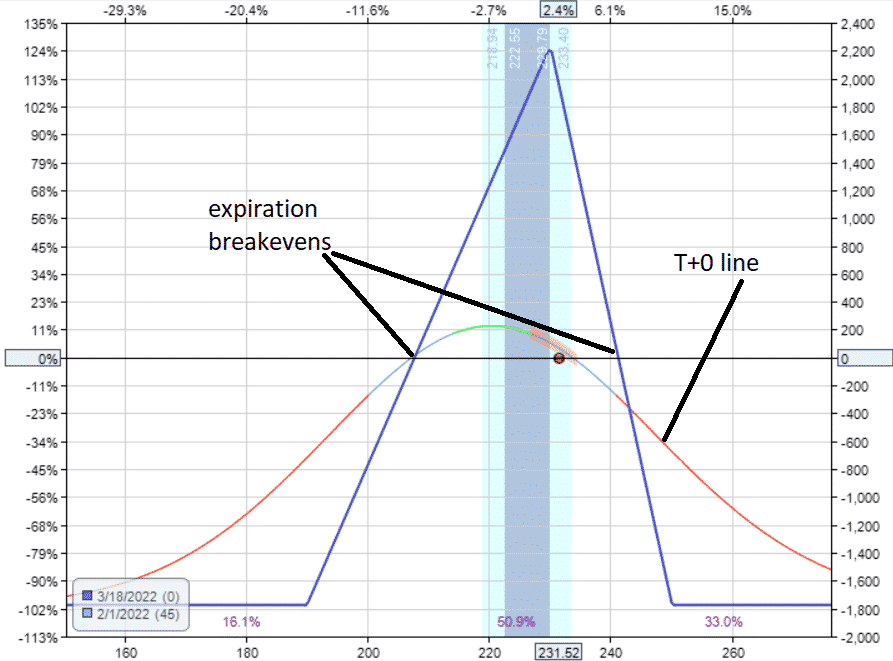

Options trading, in its essence, allows traders to buy or sell the right, but not the obligation, to buy or sell an underlying asset, in this case, Christmas trees. Options contracts specify a particular strike price, which is the price at which the trader can exercise the option to buy or sell the asset.

There are two primary types of options contracts: calls and puts. Call options grant the trader the right to buy Christmas trees at the strike price, whereas put options provide the trader the right to sell Christmas trees at the strike price. The expiration date of an options contract, known as the expiry date, determines when the right to buy or sell expires.

Latest Trends and Developments

The Christmas tree options market has witnessed a surge in interest over the past few years, driven by the increased popularity of online trading platforms and the growing appetite for alternative investment opportunities. Moreover, the rise of social media and online forums has fostered a thriving community of traders who share insights and strategies for navigating the complexities of the market.

Tips and Expert Advice

To succeed in Christmas tree options trading, it is crucial to cultivate a comprehensive understanding of the market dynamics and employ sound trading strategies. Here are a few expert tips to guide you:

- Stay Informed: Reading industry news, following market trends, and staying abreast of weather forecasts will arm you with the knowledge required for informed decision-making.

- Set Realistic Expectations: Options trading involves risk, and it is essential to set realistic profit goals. Avoid getting caught up in the excitement and always approach the market with a level of caution.

Image: optionstradingiq.com

FAQ on Christmas Tree Options Trading

Q: What are the risks involved in Christmas tree options trading?

A: Options trading carries inherent risks, including the possibility of losing the entire investment. It is crucial to thoroughly understand the mechanics of options contracts and exercise proper risk management strategies.

Q: What factors influence the price of Christmas trees?

A: Factors such as weather conditions, supply and demand, and consumer preferences can significantly impact the price of Christmas trees.

Christmas Tree Options Trading

Image: www.chron.com

Conclusion

Christmas tree options trading offers an exciting avenue for those seeking to capitalize on the holiday spirit. By delving into this dynamic market, traders can potentially generate profits while navigating the festive season’s unique opportunities.

So, if you find yourself drawn to the charm of the Christmas season and the thrill of investing, consider exploring the world of Christmas tree options trading. The journey may lead you to a path paved with festive cheer and profitable returns.

Would you like to learn more about Christmas tree options trading and delve deeper into the world of holiday-themed investments? Share your thoughts and questions in the comments section below.