Imagine having a superpower that allows you to predict the future price movements of stocks or other assets and profit from them without actually owning the underlying asset. This superpower is not a fantasy but a reality in the world of finance known as option trading.

Image: zwemclubstz.be

Options are financial instruments that give the buyer the right, but not the obligation, to buy (in the case of a call option) or sell (in the case of a put option) a specified underlying asset at a preset price (known as the strike price) on or before a certain date (known as the expiration date). They provide a flexible and versatile tool for investors to protect their portfolios, speculate on market movements, or generate income.

Types of Options

There are two main types of options:

- Call options: Give the buyer the right to buy the underlying asset at the strike price.

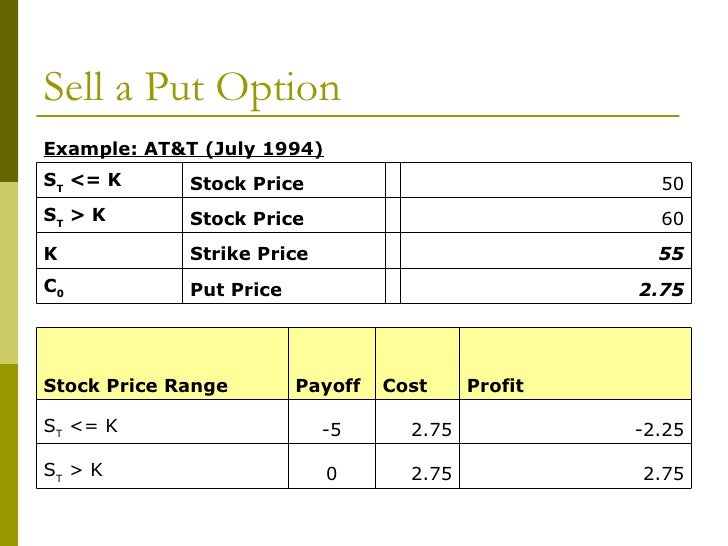

- Put options: Give the buyer the right to sell the underlying asset at the strike price.

How Options Work

Options are traded in pairs: one buyer and one seller. The buyer pays a premium to the seller in exchange for the right granted by the option contract. The seller, in return, has the obligation to fulfill the contract if the buyer exercises their right.

For example, let’s say the current price of Apple stock is $150 per share. An investor who believes Apple’s stock will rise in the future could buy a call option with a strike price of $160 and an expiration date of three months from now. The premium for this option might be $5 per share.

If Apple’s stock price rises to $170 before the expiration date, the buyer can exercise their right to buy the stock at $160 and immediately sell it in the market for $170, making a profit of $5 per share (excluding brokerage fees).

Key Components of an Option Contract

Understanding the key components of an option contract is crucial:

- Underlying asset: The stock, index, or other financial instrument that the option is based on.

- Strike price: The preset price at which the buyer can buy or sell the underlying asset.

- Expiration date: The date on or before which the option can be exercised.

- Call/Put: Indicates whether the option gives the buyer the right to buy or sell the underlying asset.

- Premium: The price paid by the buyer to the seller for the option contract.

Image: ejizajif.web.fc2.com

Advantage and Risks of Option Trading

Advantages:

- Leverage: Options provide leverage, allowing investors to control a larger position in the underlying asset with a relatively small investment.

- Flexibility: Options offer a wide range of strategies that can be tailored to specific investment goals and risk tolerances.

- Protection: Put options can be used as a hedge to protect against potential losses in the underlying asset.

Risks:

- Loss of premium: If the option expires worthless or the underlying asset price moves against the expected direction, the buyer loses the premium paid.

- Expiration risk: The value of an option decreases as it approaches its expiration date.

- Unlimited risk: Sellers of options face unlimited risk, as they are obligated to fulfill the contract even if the underlying asset price moves significantly against their favor.

What Is Option Trading With Example

Conclusion

Option trading is a powerful tool that can enhance an investor’s financial toolkit. By understanding the concepts, strategies, and risks involved, investors can leverage options to achieve a variety of investment goals, from speculative trading to income generation and portfolio protection.

It’s important to remember that option trading can be complex, and it’s always advisable to conduct thorough research, consult with a financial advisor, and consider factors such as risk tolerance, investment goals, and experience before engaging in option trading.