Introduction

Have you ever pondered the enigmatic world of no margin option trading, wondering if it holds the key to substantial financial gains or harbors unforeseen risks? If so, delve into this in-depth exploration of this intriguing trading strategy, where we will dissect its intricacies, unravel its benefits, and expose its potential pitfalls. Whether you are a seasoned trader or just a curious mind seeking knowledge, this comprehensive guide will arm you with the necessary insights to navigate the realm of no margin option trading with both confidence and informed decision-making.

The Essence of No Margin Option Trading

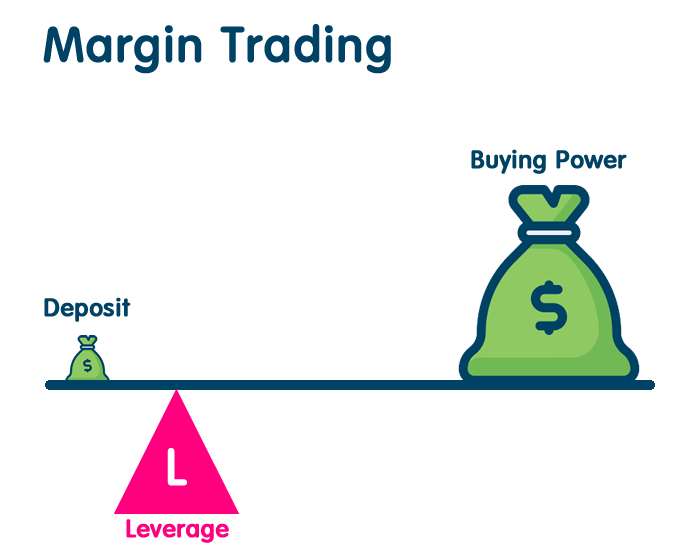

At its core, no margin option trading is a strategy employed by investors and traders to leverage their purchasing power by utilizing funds available in their brokerage accounts. Distinct from margin trading, where borrowed funds amplify potential gains and losses, no margin option trading relies exclusively on the trader’s own capital, eliminating the risks associated with margin calls and interest payments. This reduced risk profile makes no margin option trading an attractive proposition for those seeking to minimize their exposure to financial setbacks while still pursuing the potential rewards of option trading.

The Benefits of No Margin Option Trading

Embarking on the path of no margin option trading offers a plethora of advantages that make it a compelling choice for many traders. Firstly, the absence of margin eliminates the specter of margin calls, those dreaded notifications that can force traders to liquidate positions at inopportune moments. This financial safety net allows traders to maintain control over their investments, providing peace of mind and greater flexibility in managing their portfolios.

Secondly, no margin option trading minimizes the potential for devastating losses. When trading without borrowed funds, traders are solely responsible for the amount of capital they risk, reducing the likelihood of catastrophic financial setbacks. This controlled level of exposure creates a more forgiving environment for traders, particularly those with a lower risk tolerance or limited experience in the financial markets.

Image: stocktradingblog.net

Thirdly, no margin option trading fosters a sense of discipline and prudent risk management. By relying solely on their own capital, traders are forced to carefully consider each trade, weighing the potential rewards against the risks involved. This promotes a thoughtful and analytical approach to trading, encouraging traders to develop a robust understanding of market dynamics and volatility.

The Inner Workings of No Margin Option Trading

To fully grasp the nuances of no margin option trading, it is essential to comprehend the mechanics that drive this strategy. Options, financial instruments that grant the buyer the right but not the obligation to buy (in the case of calls) or sell (in the case of puts) an underlying asset at a predetermined price and date, play a central role in this trading universe.

In the realm of no margin option trading, traders purchase and sell options using the funds available in their brokerage accounts. The premium paid for the option represents the maximum potential loss, while the potential gain is theoretically unlimited, hinging on the performance of the underlying asset. As options have predetermined expiration dates, traders must exercise them before they expire to realize any potential profits.

Navigating the Risks of No Margin Option Trading

While no margin option trading offers a reduced risk profile compared to its margin-based counterpart, it is not impervious to potential pitfalls. Understanding and mitigating these risks is paramount for traders looking to achieve long-term success.

One inherent risk is the time decay associated with options. As options approach their expiration dates, their value diminishes, irrespective of the underlying asset’s performance. This inexorable erosion of value can eat into potential profits, making it crucial for traders to carefully consider the time horizon of their trades.

Another risk factor is the volatility of the underlying asset. Options are highly sensitive to price fluctuations in the underlying asset, and rapid or unpredictable movements can significantly impact option values. Traders should thoroughly research the historical volatility and trading patterns of the underlying asset before entering into any trades.

Strategies for No Margin Option Trading

The world of no margin option trading encompasses a diverse spectrum of strategies, each tailored to specific market conditions and risk tolerances. Some of the most commonly employed strategies include:

Covered Calls: A conservative strategy where traders sell (write) call options against an underlying asset they own. This strategy generates premium income while capping potential upside for the underlying asset.

Cash-Secured Puts: Another low-risk strategy involving selling (writing) put options while holding sufficient cash to purchase the underlying asset should the option be exercised. This strategy generates premium income while providing downside protection for the trader.

Bull Call Spreads: A bullish strategy involving buying a call option at a lower strike price while simultaneously selling a call option at a higher strike price. This strategy limits potential profits but also reduces risk compared to buying a single call option.

Bear Put Spreads: A bearish strategy that entails selling a put option at a higher strike price while buying a put option at a lower strike price. This strategy profits from a decline in the underlying asset but also limits potential gains and losses.

Image: www.babypips.com

No Margin Option Trading

Image: www.livingfromtrading.com

Conclusion

No margin option trading presents a viable strategy for traders seeking to harness the potential of options while managing their risk exposure. By eliminating the risks associated with margin trading, this approach offers a more controlled environment for investors and traders of all experience levels. However, mastering no margin option trading demands a thorough understanding of market dynamics, volatility, and the intricacies of options trading. Through diligent research, prudent risk management, and the judicious application of proven strategies, traders can harness the power of no margin option trading to achieve their financial goals.